3 US Economic Events with Crypto Implications This Week

Bitcoin trades above $120,000 as investors eye three major US economic events this week—FOMC minutes, Powell’s remarks, and jobless claims—for clues on Fed policy and crypto market direction.

While Bitcoin (BTC) continues to show strength, pushing well above the $120,000 psychological level, US economic events this week present as potential headwinds or prospective tailwinds to determine the next short-term directional bias.

While the influence of US economic data on Bitcoin and crypto had dissipated, it returned in 2025, making these signals critical for investors this week.

US Economic Signals to Watch This Week

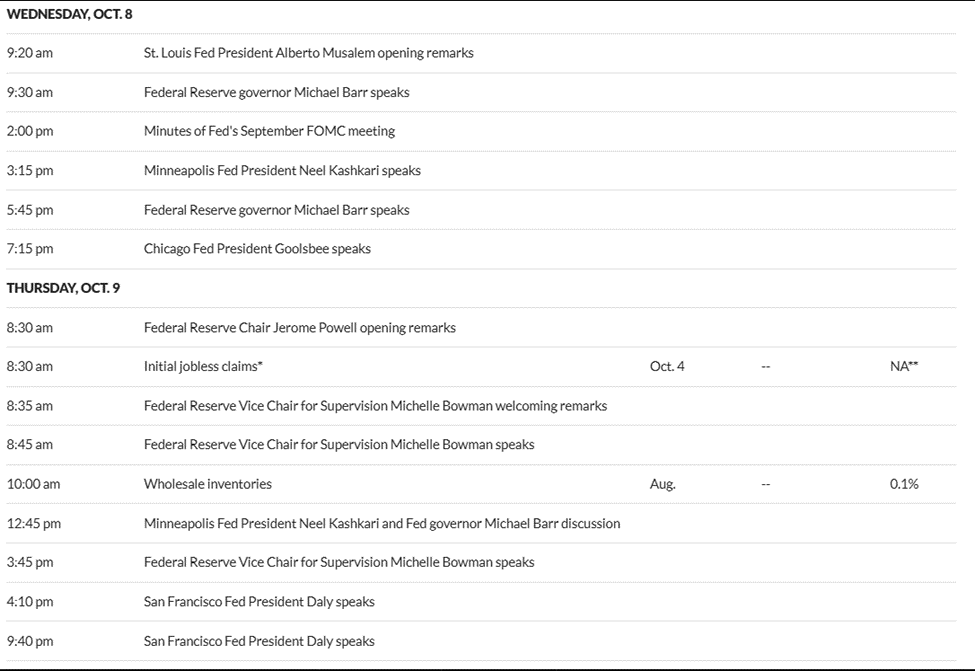

While many US economic events are on the calendar this week, only a few could have a direct or indirect influence on Bitcoin and crypto markets.

US Economic Events This Week. Source:

US Economic Events This Week. Source:

September FOMC Minutes

The minutes for the September FOMC meeting (Federal Open Market Committee) are perhaps the most critical US economic data point this week.

In hindsight, the meeting had featured a new Fed governor, Stephen Miran, which preceded the Fed’s first rate cut in 9 months, lowering the federal funds rate to 4.00–4.25%.

Therefore, the minutes of the Fed’s September FOMC meeting will shed more light on policymakers’ reasoning, adding more weight to Powell’s framing of the rate cut as a risk management decision.

Any indications of more rate cuts downrange would sway the market, potentially positively, with the Bitcoin price likely to extend its gains. In the same way, suggestions of no further rate cuts toward the end of the year could trigger a short-term sell-off.

Nevertheless, some macroeconomists say the event may not move the market as much because it does not include economic projections.

“This week, fundamentally, we have the FOMC minutes on Wednesday, but these do not include economic projections, so they will not impact the markets too much. It is just the written report of what they discussed during the last meeting when we had a rate cut,” wrote xAlex.

Jerome Powell Opening Remarks

A host of Federal Reserve (Fed) speakers are scheduled to speak this week, forming the bulk of US economic events with crypto implications. However, the highlight will be Fed chair Jerome Powell’s speech on Thursday, whose opening remarks could influence the market.

Speaking in Rhode Island on September 23, Powell said policymakers look at overall financial conditions and ask themselves whether their policies affect financial conditions in a way they are trying to achieve.

Powell’s remarks will come on Thursday, October 9, only hours after the FOMC minutes. Traders and investors will parse the speech for possible insight into policymakers’ thinking.

“Fed Chair Jerome Powell’s speech this week and FOMC minutes from September (when rates were cut to start easing) will be scrutinized for clues on the 2025 path: Nine officials eye two more cuts, but seven see none or hikes,” one user observed.

Dovish or hawkish remarks could sway investor sentiment, inspiring Bitcoin volatility depending on what he says.

However, it is worth noting that as the US government shutdown continues, there is considerable uncertainty about whether the economic data will be accurately released.

Initial Jobless Claims

The initial jobless claims, due every Thursday, are also critical this week, especially given the labor market’s growing weight as a Bitcoin macro.

This data point determines the number of US citizens who filed for unemployment insurance for the first time last week.

“Jobless Claims are the early warning system for the economy. First alert: 260k, Recession risk: 300k+ on the 4-week average. Once claims cross these lines, the labor market has historically shifted from healthy to contracting, a key risk for stocks,” economist Kurt S. Altrichter stated.

However, the US government shutdown leaves a lot on the balance, with key US economic events likely to go undated this week.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

As of this writing, Bitcoin was trading for $123,718, down by 1.13% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Essence of Bitcoin and AI

Liberalism gives vitality to Bitcoin; democratization gives it scale. The network effect is the invisible bridge connecting the two, and also proves that freedom grows through participation.

Trump's pressure works! India's five major refineries suspend orders for Russian oil

Due to Western sanctions and US-India trade negotiations, India significantly reduced its purchases of Russian crude oil in December, with its five major core refineries placing no orders.

Masayoshi Son takes action! SoftBank sells all its Nvidia shares, cashing out $5.8 billions to shift towards other AI investments

SoftBank Group has completely sold its Nvidia holdings, cashing out $5.8 billions. Founder Masayoshi Son is shifting the strategic focus, allocating more resources to the artificial intelligence and chip-related sectors.

Research Report|In-Depth Analysis and Market Cap of Allora Network (ALLO)