XRP breakout risk is rising after a 300-day consolidation near the $3.70 all-time high; traders watch $3.01–$3.05 for a breakout trigger, with resistance targets at $3.40 and $3.66 and ETF rulings potentially drawing institutional inflows.

-

XRP consolidates for 300+ days under its prior ATH near $3.70, signaling accumulation.

-

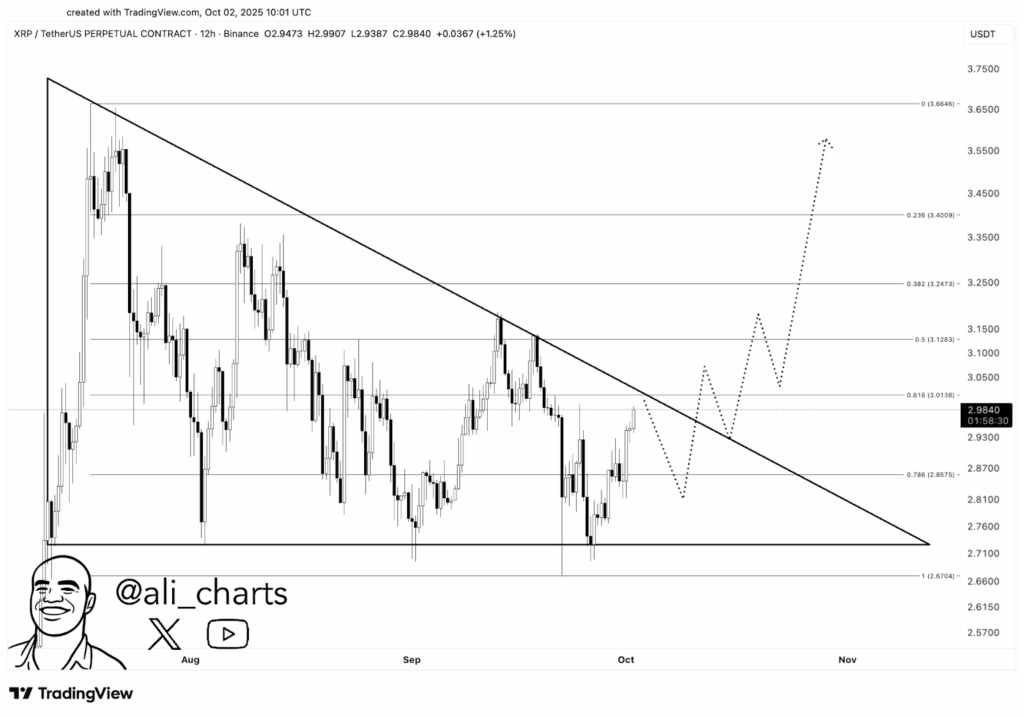

0.618 Fibonacci and descending triangle set key resistance and support levels.

-

SEC ETF decisions and early XRPR fund volume ($38M day one) could drive institutional flows.

XRP breakout: Monitor $3.01–$3.05 trigger, $3.40–$3.66 resistance, and ETF rulings; read analysis and trade levels now.

XRP’s 300-day consolidation near its all-time high signals a potential breakout. Analysts eye $3.40 and $3.66 resistance levels.

- XRP consolidates for 300+ days below its previous ATH around $3.70.

- 0.618 Fibonacci levels near $3 act as key resistance zones.

- Approval of XRP ETFs by the SEC could trigger institutional inflows and liquidity.

Primary keywords: XRP breakout, XRP ETF approval. LSI keywords: XRP consolidation, all-time high, Fibonacci retracement, descending triangle, resistance levels, support zones, institutional inflows.

What is driving the XRP breakout potential?

XRP breakout potential is driven by a prolonged 300-day consolidation just below the $3.70 all-time high combined with technical pressure in a descending triangle. A break above $3.01–$3.05 could accelerate momentum toward $3.40 and $3.66, while SEC ETF rulings may add institutional demand.

How could XRP ETFs affect price action?

Approval of spot XRP ETFs would likely increase institutional inflows and liquidity, raising demand. Early market evidence shows XRPR fund volume reached $38 million on day one, indicating investor appetite. Rejection could spark volatility and short-term downside, but current market positioning prices in a potential positive catalyst.

XRP is holding strong up 1.39% in the last 24 hours and nearly 10% over the past week. With momentum building, traders are eyeing a potential breakout toward $3.70.

Why does the 0.618 Fibonacci level matter?

The 0.618 Fibonacci retracement often marks significant resistance in corrective structures. For XRP, the 0.618 zone aligns near $3, creating a confluence with the descending triangle’s upper trendline. Confluence increases the probability of a clear rejection or, if overcome, a rapid bullish extension.

What technical levels should traders watch?

Key levels to monitor:

- Trigger: $3.01–$3.05 — daily close above could validate a breakout.

- Immediate resistance: $3.13 and $3.25.

- Primary targets: $3.40 and $3.66; extended target $4.20 if momentum is strong.

- Support: $2.75–$2.80 and downside targets $2.86 or $2.67 if invalidated.

Source: galaxyBTC Via X

Source: galaxyBTC Via X

Trading near $3.02 now, XRP is pushing against a major resistance level at $3, highlighted by the important 0.618 Fibonacci retracement. Recent weeks show the price squeezed inside a descending triangle, signaling growing pressure for a big move soon.

How to trade a potential XRP breakout?

Step-based approach:

- Wait for a confirmed daily close above $3.05 before entering long positions.

- Use layered targets at $3.13, $3.25, $3.40 and $3.66; scale out into resistance zones.

- Place protective stops under $2.80–$2.86 to limit downside risk.

Source: Ali Charts Via X

Source: Ali Charts Via X

If XRP breaks out, watch for resistance at $3.13, $3.25, and $3.40, with a target near $3.66. Strong buying could even push it toward $4.20. But if it can’t clear these levels, XRP might fall back to support around $2.86 or $2.67, staying within the descending triangle’s lower edge.

Frequently Asked Questions

Will an XRP ETF approval cause a price surge?

Yes. ETF approval typically increases institutional access and liquidity, which could lift prices. Historical ETF flows in crypto have often produced short-term spikes due to concentrated capital inflows and improved market legitimacy.

When are the SEC rulings expected?

The SEC is expected to rule on several spot XRP ETF applications in mid-to-late October, with a notable decision on Grayscale’s request scheduled by October 18. Market participants are pricing in outcomes ahead of these dates.

Key Takeaways

- Consolidation: XRP has traded near its ATH for 300+ days, signaling accumulation.

- Technical trigger: Daily close above $3.01–$3.05 would validate a breakout setup.

- Regulatory catalyst: SEC ETF rulings could provide institutional inflows and heightened volatility.

Conclusion

In summary, XRP breakout potential rests on a clear technical trigger above $3.01–$3.05 and a favorable regulatory outcome for spot ETFs. Traders should watch resistance zones at $3.40 and $3.66 and manage risk under $2.80. COINOTAG will monitor price action and regulatory updates for possible tradeable catalysts.

| Support | $2.75–$2.80 | Primary accumulation zone |

| Trigger | $3.01–$3.05 | Daily close validates breakout |

| Resistance targets | $3.40 / $3.66 | Profit-taking zones |