ETF Inflows Return: Bitcoin and Ethereum Record $900 Million in Inflows in One Day

Spot Bitcoin ETFs saw a net inflow of over $600M on Thursday, with Ethereum ETFs seeing over $300M. The new capital signals a potential reversal from September's outflows.

Over $600 million flowed into US spot Bitcoin ETFs on Thursday, and Ethereum ETFs also saw over $300 million in inflows.

This trend is a stark reversal from the outflows seen in September. With Bitcoin’s price recovering to the $120,000 level for the first time in a month and a half, many are watching to see if this new ETF capital can fuel a sustained rally.

Bitcoin Breaks $120,000 as Spot ETFs See Renewed Inflows

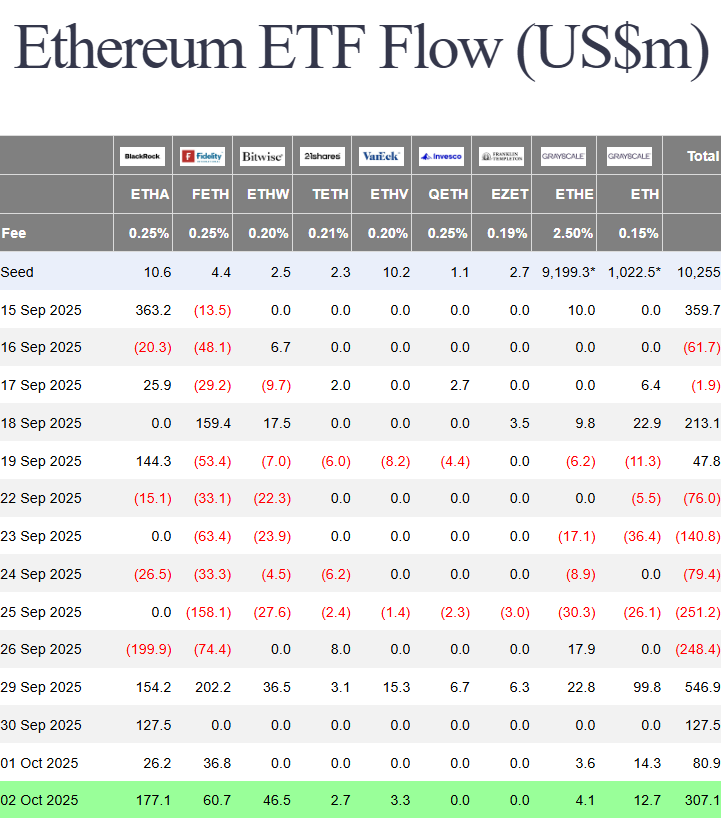

According to data from Farside Investors, US BTC ETFs recorded a net inflow of $627 million on Thursday. BlackRock’s IBIT led the way with $464 million, followed by Fidelity’s FBTC at $89.6 million. ETH ETFs also saw strong inflows, with BlackRock’s ETHA leading with $177 million, followed by Fidelity ($60.7 million) and Bitwise ($46.5 million).

This marks the fourth consecutive day of inflows for Bitcoin spot ETFs and Ethereum spot ETFs.

A Reversal of Fortunes

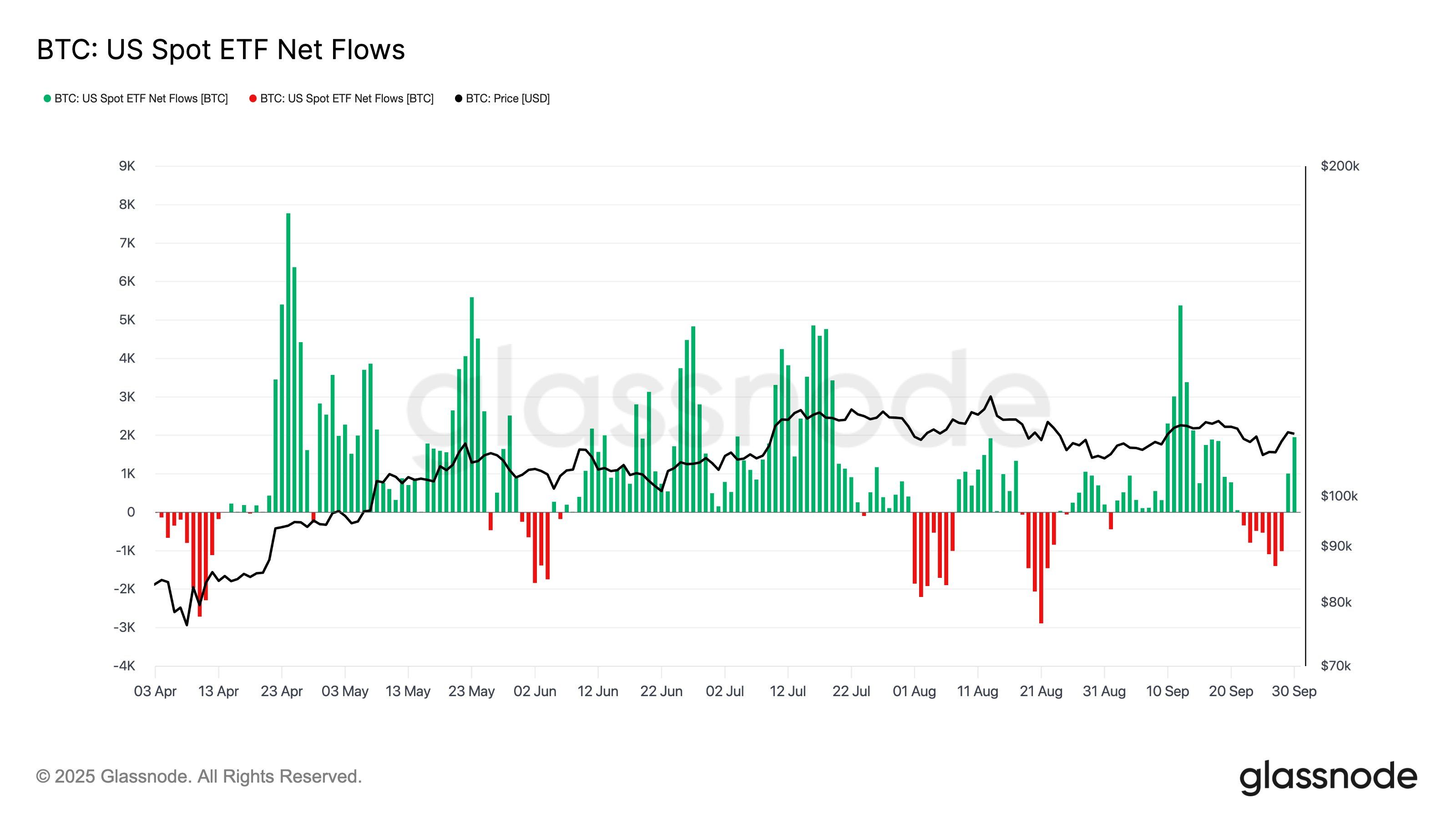

The consecutive inflows have shifted the sentiment in the ETF market. US spot Bitcoin ETFs had previously recorded continuous outflows in the third and fourth weeks of September, with over 16,000 BTC leaving the funds.

However, the trend reversed on September 30 with a net inflow of 3,200 BTC, signaling a potential shift in market sentiment.

BTC: US Spot ETF Net Flows. Source:

Glassnode

BTC: US Spot ETF Net Flows. Source:

Glassnode

For Ethereum spot ETFs, the reversal is still in its early stages. In August, ETH ETFs saw a net inflow of $3.87 billion, which was a key driver behind the asset’s 18.5% monthly price increase. But in September, net inflows plummeted to just $285.74 million, leading to a 5.62% monthly price drop.

ETH ETF Inflow. Source: Farside Investors

ETH ETF Inflow. Source: Farside Investors

Even during the late September crypto rally, Ethereum ETFs underperformed. While they maintained net inflows for three consecutive business days last week, the total inflow was less than $100 million—a far-from-positive figure. But Thursday’s inflow of over $300 million in a single day is a much more hopeful sign.

With the revival of ETF inflows, many are waiting to see if Bitcoin and Ethereum can regain their upward momentum. At the time of writing, Bitcoin’s price is trading at $119,903, and Ethereum’s price is at $4,474.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This year's 30% gains have been completely wiped out, and Bitcoin has fallen into a bear market.

The reversal from the historical highs in October is mainly attributed to fading optimism over US pro-crypto policies, a shift in the macro market toward risk aversion, and the quiet withdrawal of institutional buyers such as ETF investors.

DFINITY founder Dominic: In the Web3 multi-chain era, where is Internet Computer headed?

On-chain, social media, gaming, and the metaverse will all be tokenized.

Explaining the concept of Preconfirmation with Taiko as an example: How to make Ethereum transactions more efficient?

By introducing the concept of preconfirmation, Taiko and many Based Rollup Layer2 projects are building a transaction confirmation system that enables users to confirm transactions more quickly and reliably.

Has SOL Bottomed Out? Multi-dimensional Data Reveals the True Picture of Solana

Despite the ongoing efforts of new chains such as Sui, Aptos, and Sei, they have not posed a substantial threat to Solana. Even though some user traffic has been diverted to application-specific chains, Solana still firmly holds its leading position among general-purpose chains.