Crypto Analytics Firm Unveils Two Factors That Could Trigger ‘Historically Bullish Setup’ for Bitcoin – Here’s the Outlook

Crypto analytics platform Swissblock says two factors could combine to trigger a massive rally for Bitcoin ( BTC ).

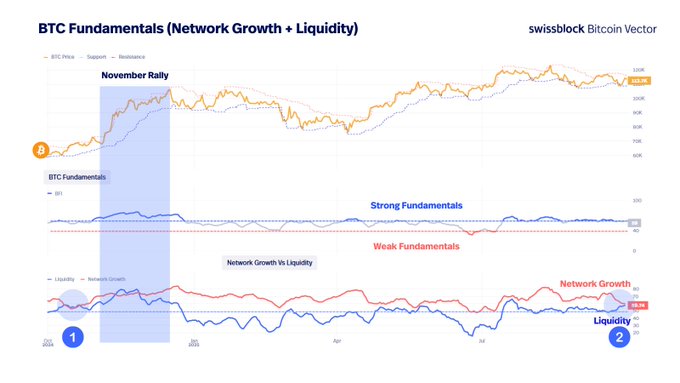

According to Swissblock, an increase in liquidity and the number of Bitcoin users are the ingredients necessary for the formation of a “historically bullish setup.”

“Liquidity remains strong. Unlike true bear markets, liquidity is not collapsing.

Network Growth dipped slightly while liquidity held up (2).

The last time this setup occurred? October 2024 (1), right before the big rally into November.”

Source: Swissblock

Source: Swissblock

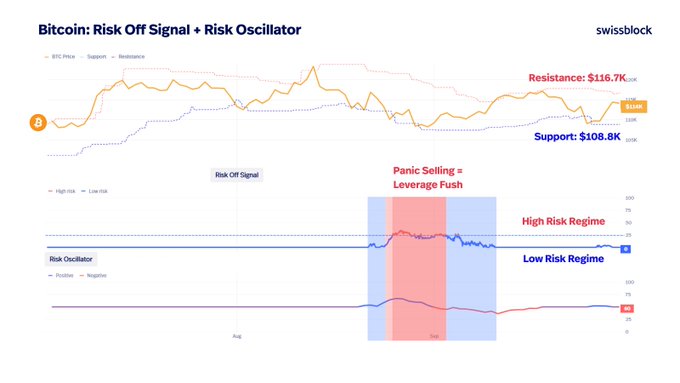

According to Swissblock, Bitcoin is in the “process of finding a bottom,” a phenomenon which has historically been marked by the Aggregated Impulse Signal falling to zero.

The Aggregated Impulse Signal, an indicator calibrated from 0 to 100 that gauges market momentum and selling pressure, is used to identify potential bottoms.

“Markets move in cycles of stress and recovery.

When stress peaks, short-term traders are forced to sell at a loss.

Capitulation stress often mark the end of downside phases, setting the stage for recovery…

…At that exact point, the Impulse Signal collapses to zero.

That’s the moment panic exhausts and new buyers step in.

Since early 2024, this reset has only happened 3 times.

Each one marked a cycle bottom.

Each one was followed by a sustained recovery.

We are approaching that setup again.”

Swissblock further says that Bitcoin experienced the “sharpest wave of panic selling” this cycle from late August to early September.

“That flush cleared excess leverage and reset the market back to cost basis.

This is how bottoms are built.”

Source: Swissblock

Source: Swissblock

Bitcoin is trading at $116,592 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Charter Dispute Highlights Oversight Shortcomings in Digital Banking

- ICBA opposes Sony Bank's U.S. trust charter bid, warning its stablecoin venture could bypass traditional banking safeguards and regulatory frameworks. - Critics argue Connectia's dollar-pegged stablecoins mimic deposits without CRA/FDIC compliance, creating an uneven playing field for insured banks. - Over 30 crypto firms including Coinbase seek similar charters, sparking regulatory debates about innovation risks versus financial stability. - JPMorgan upgrades stablecoin stocks while ICBA highlights OCC'

Hyperliquid News Today: How DeFi's Growth and Bridgewater's New Direction Indicate a Changing Market

- DeFi platforms Lighter, Hyperliquid, and Aster dominated Perp DEX trading volumes in November 2025, with Lighter leading at $73.77B 7-day volume. - Lighter's 650,000 TPS throughput and planned token generation event (TGE) with 25-30% community airdrop drive speculation about its valuation. - Bridgewater Associates reshaped its Q3 2025 portfolio, boosting stakes in Netflix (+896.6%), Verizon (+860%), and digital assets while exiting "Magnificent 7" tech stocks. - Ray Dalio warned of an "AI bubble" amid Br

Bridgewater's Q3 holdings revealed; it reduced its stake in Nvidia.