Chainlink Enables Tokenized Asset Transactions via SWIFT Integration

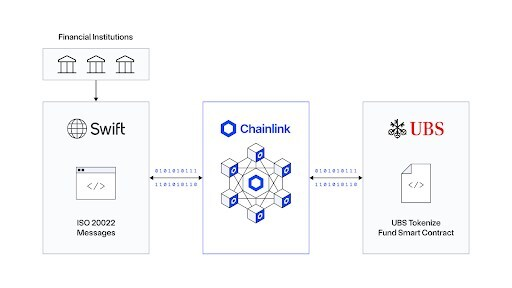

Chainlink has introduced a new system that allows banks and financial institutions to conduct digital asset operations directly from their existing infrastructure. This solution links traditional SWIFT messaging with the Chainlink Runtime Environment (CRE), enabling firms to interact with blockchain networks without changing their internal workflows.

In brief

- Chainlink announced a new framework that enables tokenized asset transactions to be executed on-chain through SWIFT messaging.

- Building on prior initiatives like Project Guardian, the framework demonstrates that tokenized workflows can be executed efficiently, securely, and transparently.

Seamless Tokenized Asset Transactions via Chainlink

Chainlink , the blockchain oracle provider, revealed that the system was tested in a pilot with UBS Tokenise, the bank’s internal platform for tokenized assets.

According to the report, “Subscriptions and redemptions for a tokenized fund smart contract from UBS were triggered using ISO 20022 messages through CRE and Swift infrastructure. CRE received the Swift messages, which then triggered subscription and redemption workflows in the Chainlink Digital Transfer Agent (DTA) technical standard.”

The pilot builds on Chainlink’s earlier work in Singapore’s Project Guardian in 2024, where it explored tokenized asset operations. The UBS test demonstrates that tokenized fund subscriptions and redemptions can be managed on-chain while cash settlements occur off-chain via SWIFT. This approach allows institutions to benefit from blockchain capabilities without altering how payments are processed through traditional banking channels.

Chainlink links SWIFT messages to UBS tokenized fund contracts.

Chainlink links SWIFT messages to UBS tokenized fund contracts.

Blockchain-Powered Solutions for the $100 Trillion Fund Industry

Chainlink presents the system as a “ plug-and-play solution “, positioned to play a key role in the $100+ trillion global fund industry. As stated in the report, “Institutions can leverage the speed, efficiency, composability, and risk management benefits of blockchain technology that are only fully realized when tokenized fund workflows are fully onchain.”

This collaboration builds on the ongoing partnership between Chainlink and SWIFT, which began in 2023 to explore ways for institutions to access multiple blockchain networks through a unified gateway.

Chainlink and SWIFT Modernise Corporate Events with Blockchain

Beyond tokenized funds, Chainlink is collaborating with 24 financial institutions to modernise corporate event management. The company ran a trial with SWIFT, DTCC, Euroclear, and six other institutions, using blockchain technology and artificial intelligence to collect and verify corporate event data in multiple languages, improving both accuracy and efficiency in processing.

SWIFT has also been involved in broader blockchain initiatives in the past, including Project Agorá in 2024, which examined how tokenized commercial bank deposits could coexist with wholesale central bank digital currencies. These efforts highlight SWIFT’s experience in integrating blockchain technology into financial systems while maintaining regulatory compliance.

Alongside this, SWIFT is developing a blockchain -powered ledger for cross-border payments in collaboration with Consensys, with testing by major banks. The project is intended to advance on-chain financial infrastructure that can operate seamlessly across systems while remaining fully aligned with regulatory and compliance standards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s back above $94K: Is the BTC bull run back on?

With retail investors leaving, what will drive the next bull market?

Bitcoin has recently plummeted by 28.57%, leading to market panic and a liquidity crunch. However, long-term structural positives are converging, including expectations of Federal Reserve rate cuts and SEC regulatory reforms. The market currently faces a contradiction between short-term pressures and long-term benefits. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Tether's "son" STABLE crashes? Plunges 60% on first day, whale front-running and no CEX listing spark trust panic

The Stable public blockchain has launched its mainnet. As a project associated with Tether, it has attracted significant attention but performed poorly in the market, with its price plummeting by 60% and facing a crisis of confidence. It is also confronted with fierce competition and challenges related to its tokenomics. Summary generated by Mars AI. The accuracy and completeness of the content are still being iteratively updated.