ZEC Soars to 3-Year High, Eyes $90 Next as Demand Spikes

Zcash is on a breakout run, with surging demand and social dominance pushing ZEC to a 38-month high and setting the stage for further gains.

Privacy-focused cryptocurrency ZEC is today’s top gainer, climbing 17% in the past 24 hours as broader market activity shows signs of gradual recovery. The rally has propelled ZEC to a 38-month high, marking its strongest performance in more than three years.

With momentum building, on-chain and technical indicators suggest that the token could soon test the $90 threshold.

ZEC Climbs to 38-Month High

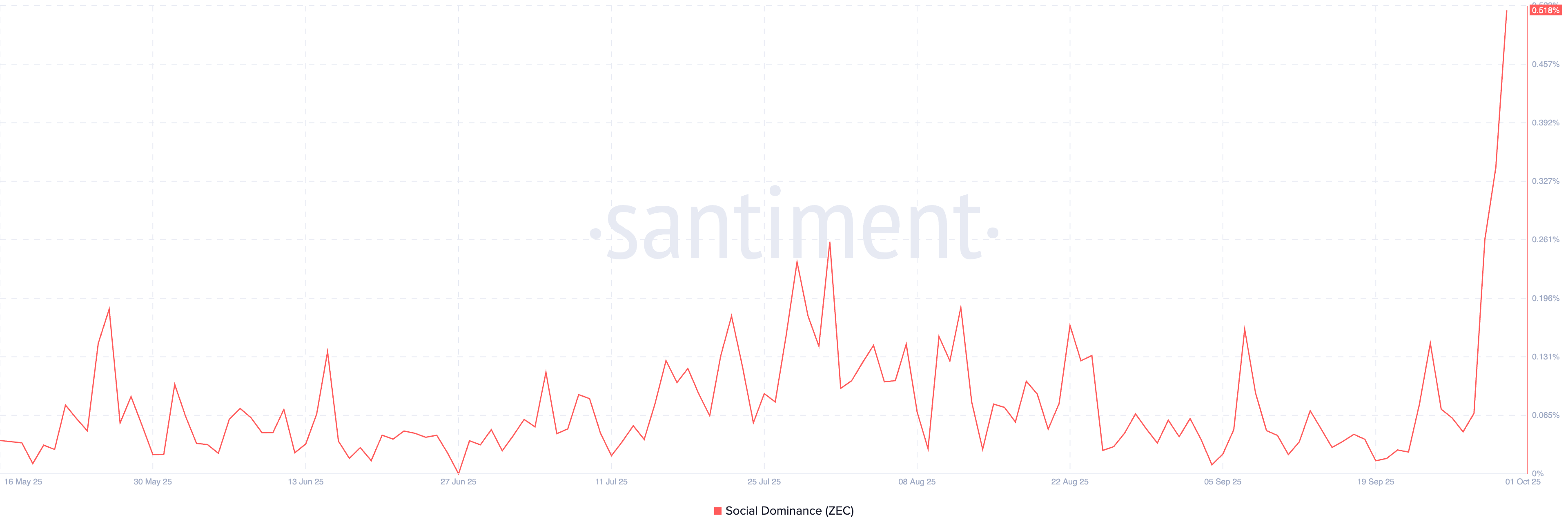

ZEC’s price has surged 47% in the past week. These double-digit gains have coincided with a sharp rise in its social dominance, indicating that conversations around the altcoin are expanding across crypto communities.

At press time, ZEC’s social dominance sits at a three-year high of 0.51%, climbing by 458% in the past three days alone.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

ZEC Social Dominance. Source:

Santiment

ZEC Social Dominance. Source:

Santiment

An asset’s social dominance tracks how often it is mentioned across social platforms and news outlets relative to the rest of the market. When its value falls, it signals that the asset is losing attention and engagement from the community, which may affect its price.

On the other hand, when an asset’s social dominance climbs with its price, it means heightened retail attention and speculative interest. Historically, such heightened chatter and visibility have translated into short-term price boosts. This may, in turn, propel ZEC’s price further.

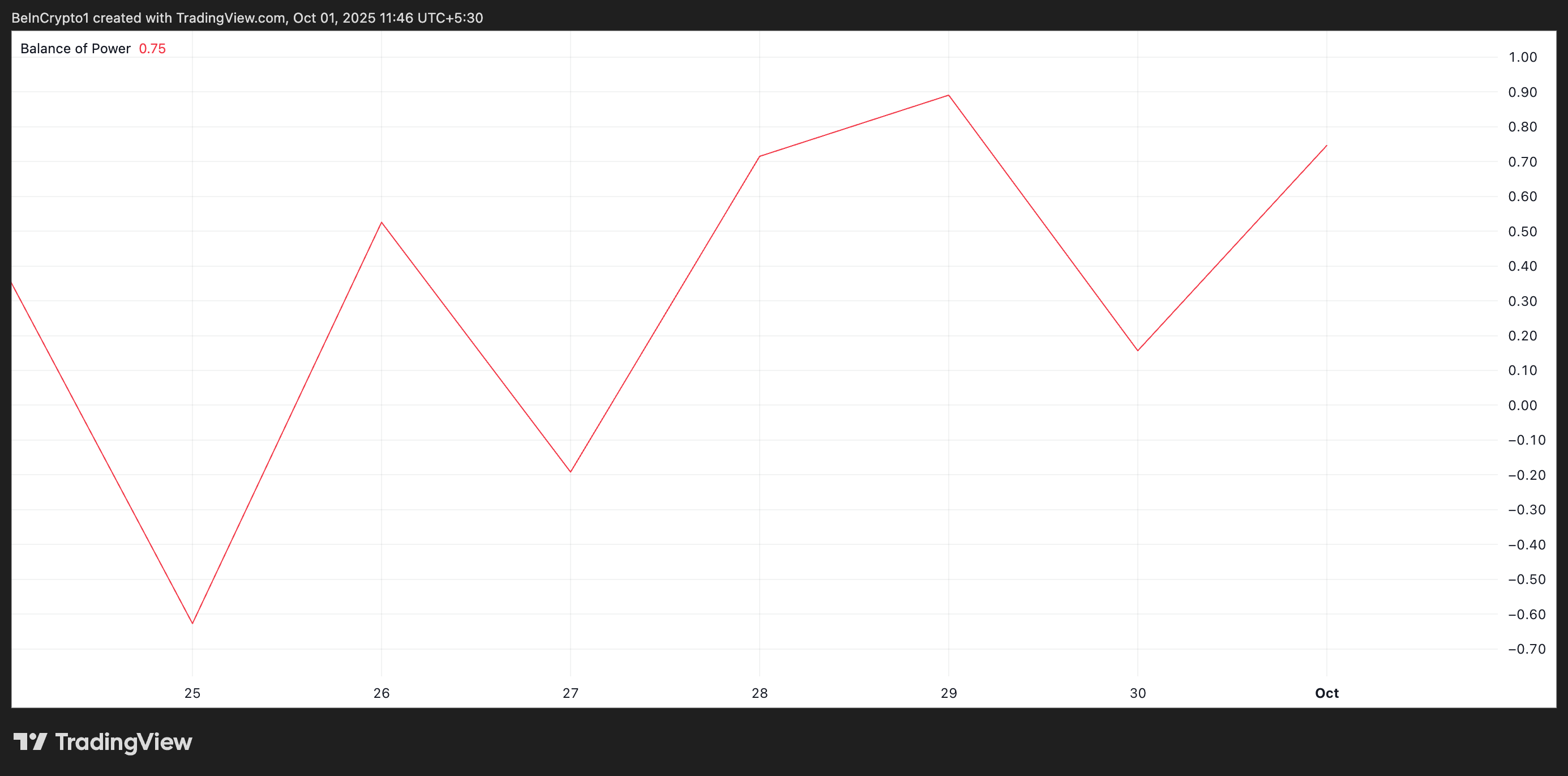

Moreover, readings from ZEC’s Balance of Power (BoP) on the daily chart support this outlook. As of this writing, the momentum is positive (0.75) and continues to climb, confirming stronger spot demand.

ZEC BoP. Source:

TradingView

ZEC BoP. Source:

TradingView

The BoP indicator measures the strength of buying versus selling pressure in the market. When its value is positive, buyers are gradually exerting more control over price action and shifting momentum firmly into bullish territory. This increases the likelihood of a sustained rally for ZEC.

Speculative Buzz Signals Short-Term Price Momentum

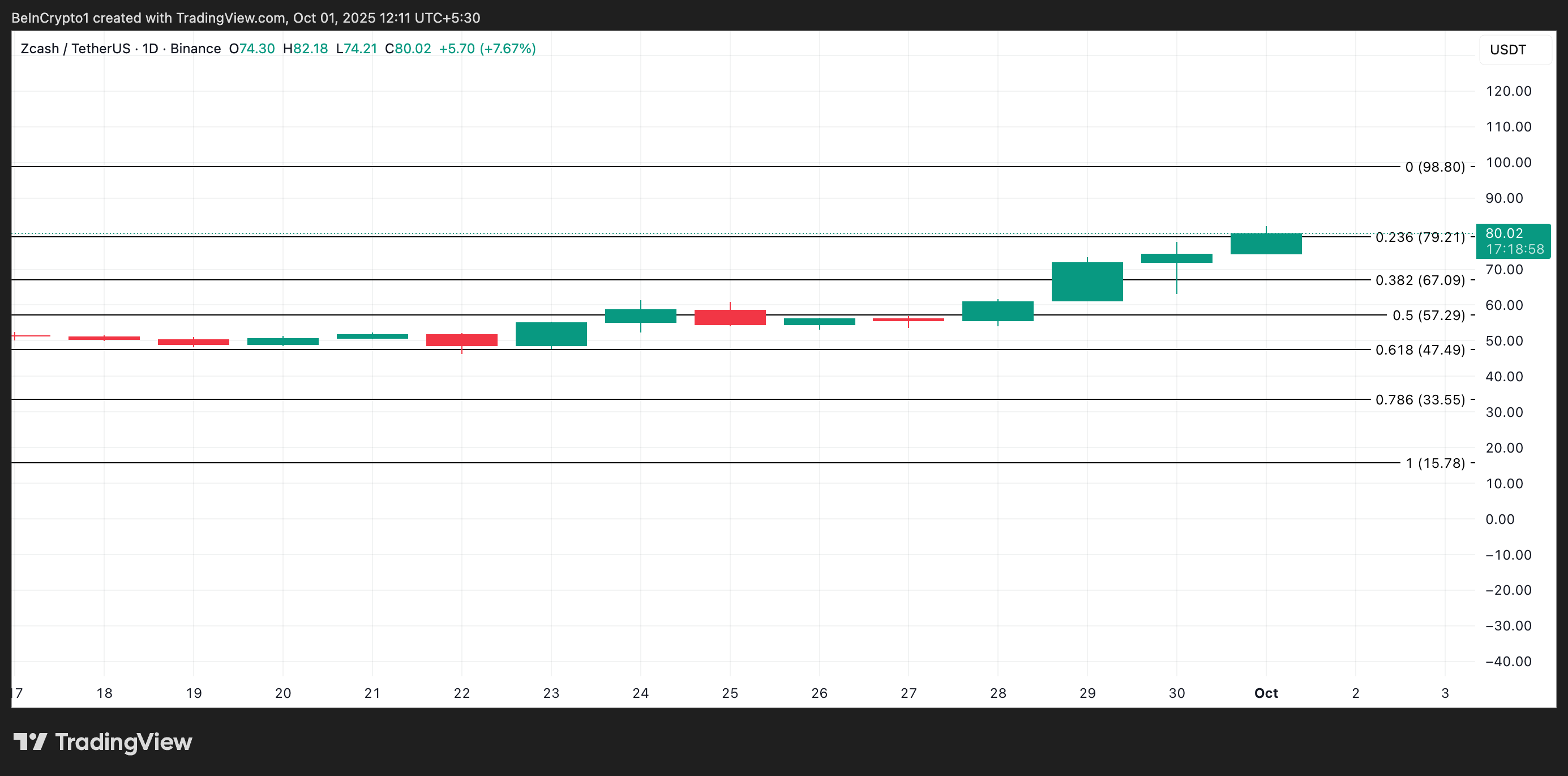

At press time, ZEC trades near the key support floor at $79.21. If demand persists and this price level strengthens, it could drive the token’s price toward $98.80.

ZEC Price Analysis. Source:

TradingView

ZEC Price Analysis. Source:

TradingView

On the other hand, if profit-taking commences, ZEC could lose recent gains, break below the support floor at $79.21, and fall toward $67.09.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Essence of Bitcoin and AI

Liberalism gives vitality to Bitcoin; democratization gives it scale. The network effect is the invisible bridge connecting the two, and also proves that freedom grows through participation.

Trump's pressure works! India's five major refineries suspend orders for Russian oil

Due to Western sanctions and US-India trade negotiations, India significantly reduced its purchases of Russian crude oil in December, with its five major core refineries placing no orders.

Masayoshi Son takes action! SoftBank sells all its Nvidia shares, cashing out $5.8 billions to shift towards other AI investments

SoftBank Group has completely sold its Nvidia holdings, cashing out $5.8 billions. Founder Masayoshi Son is shifting the strategic focus, allocating more resources to the artificial intelligence and chip-related sectors.

Research Report|In-Depth Analysis and Market Cap of Allora Network (ALLO)