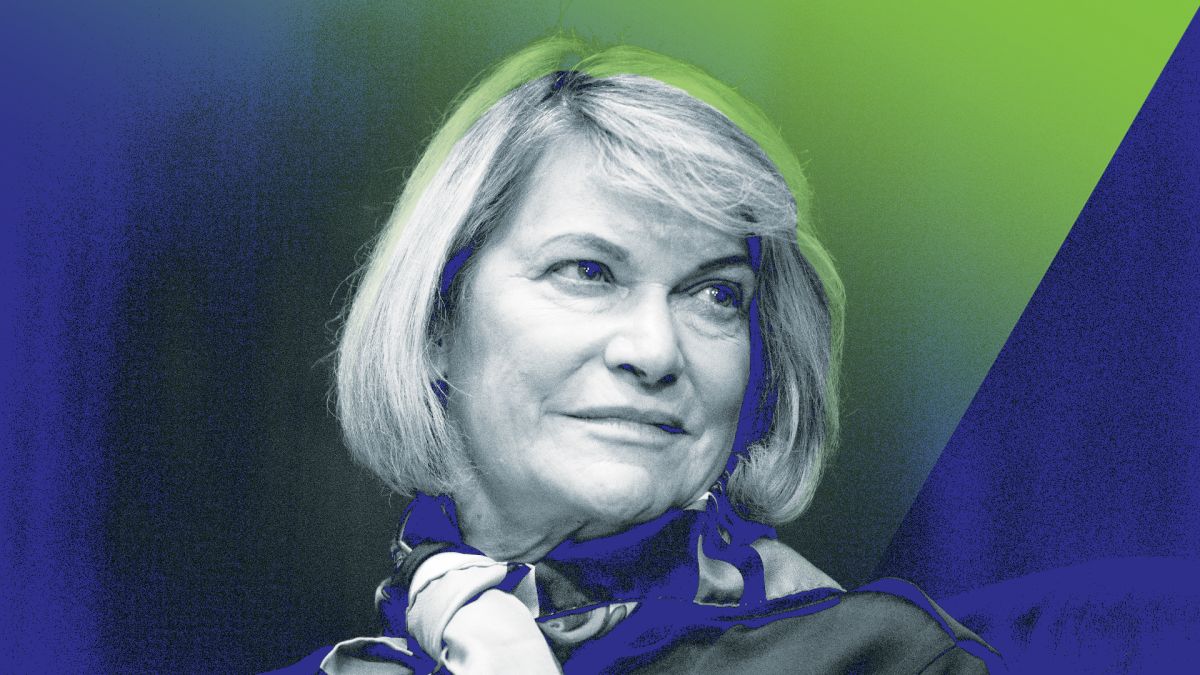

Sen. Lummis says progress is underway on crypto tax rules in the Senate

Quick Take Speaking Tuesday at BTC in D.C., Sen. Cynthia Lummis said that the committee, which focuses on taxes, is working to incorporate ideas she has previously posed. In July, Lummis introduced legislation to modernize the tax treatment of digital assets, which includes a de minimis provision to exclude gains or losses from crypto transactions that are under $300 from being taxed.

Senators on the Senate Finance Committee are making headway on legislation to define how digital assets should be taxed, according to Sen. Cynthia Lummis, a vocal advocate for cryptocurrencies.

Speaking Tuesday at BTC in D.C. in Washington, D.C., the crypto-friendly Wyoming Republican said that the committee, which focuses on taxes, is working to incorporate ideas she has previously posed.

"As I understand it, the draft that the Senate Finance Committee is working on includes 10 things, our nine and one other," Lummis said. "So I think we're making progress on that."

In July, Lummis introduced legislation to modernize the tax treatment of digital assets, which includes a de minimis provision to exclude gains or losses from crypto transactions that are under $300 from being taxed and declares that digital asset lending is not a taxable event, among other measures.

Lummis previously sought to get those provisions, which had support from numerous crypto advocates, into President Donald Trump's larger reconciliation bill called the One Big Beautiful Bill Act, but that ultimately did not happen. Crypto advocacy groups have been pushing for changes in how crypto is taxed, particularly focused on a de minimis exemption .

On Tuesday, Lummis said she has been working with Republican and Democratic members of the Senate Finance Committee on understanding the importance of a crypto tax bill.

"We're working with members of the Senate Finance Committee now to help usher that forward in both parties." Lummis added that Sens. Ron Wyden, D-Ore., has been a "great partner."

Upcoming hearing

The Senate Finance Committee is also slated to hold a hearing on Wednesday titled "Examining the Taxation of Digital Assets." Witnesses scheduled to testify include Jason Somensatto, director of policy at Coin Center, and Andrea S. Kramer, founding member of ASKramer Law.

The hearing comes as lawmakers face the threat of an upcoming government shutdown , which could go into effect if Congress can't agree on funding before Oct. 1.

If there is a government shutdown, the hearing on digital asset taxes in the Senate Finance Committee will continue as planned, a spokesperson for the Senate Finance Committee confirmed to The Block.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

With retail investors leaving, what will drive the next bull market?

Bitcoin has recently plummeted by 28.57%, leading to market panic and a liquidity crunch. However, long-term structural positives are converging, including expectations of Federal Reserve rate cuts and SEC regulatory reforms. The market currently faces a contradiction between short-term pressures and long-term benefits. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Tether's "son" STABLE crashes? Plunges 60% on first day, whale front-running and no CEX listing spark trust panic

The Stable public blockchain has launched its mainnet. As a project associated with Tether, it has attracted significant attention but performed poorly in the market, with its price plummeting by 60% and facing a crisis of confidence. It is also confronted with fierce competition and challenges related to its tokenomics. Summary generated by Mars AI. The accuracy and completeness of the content are still being iteratively updated.

Hassett: The Fed has ample room to cut interest rates significantly.

From "Crime Cycle" to Value Reversion: Four Major Opportunities for the Crypto Market in 2026

We are undergoing a “purification” that the market needs, which will make the crypto ecosystem better than ever before, potentially improving it tenfold.