TRX price shows sustained bullish structure after SunSwap transactions topped 30,000 and exchange outflows reached $4.79M, supporting accumulation. Futures Taker CVD also favors buyers, so a confirmed break above $0.37 could trigger a rally toward $0.40 while trendline support holds.

-

SunSwap transactions>30,000 in September — strong network demand

-

Exchange outflows of $4.79M reduced selling pressure and supported price stability

-

Futures Taker CVD shows taker-buy dominance; resistance cluster at $0.3526–$0.37

TRX price shows bullish signals after SunSwap usage surged and exchange outflows rose; watch $0.37 breakout for a move to $0.40 — read the analysis and key levels.

What boosted TRON network activity in September?

SunSwap’s Total Transaction Count surged above 30,000 in September, the highest level this year, indicating elevated stablecoin settlement and remittance use on TRON. This front-loaded network growth supports TRX price fundamentals by increasing on-chain demand and reducing the reliance on exchanges.

Which on-chain and derivatives metrics matter for TRX price?

Exchange outflows totaling $4.79 million on September 29 highlighted net withdrawals from liquid venues, signaling accumulation. Futures Taker CVD registered taker-buy dominance, which often precedes spot strength when combined with lower exchange inventories. Sources: TradingView (price chart), CoinGlass (netflows), CryptoQuant (taker CVD).

Can TRX price sustain strength above its ascending trendline?

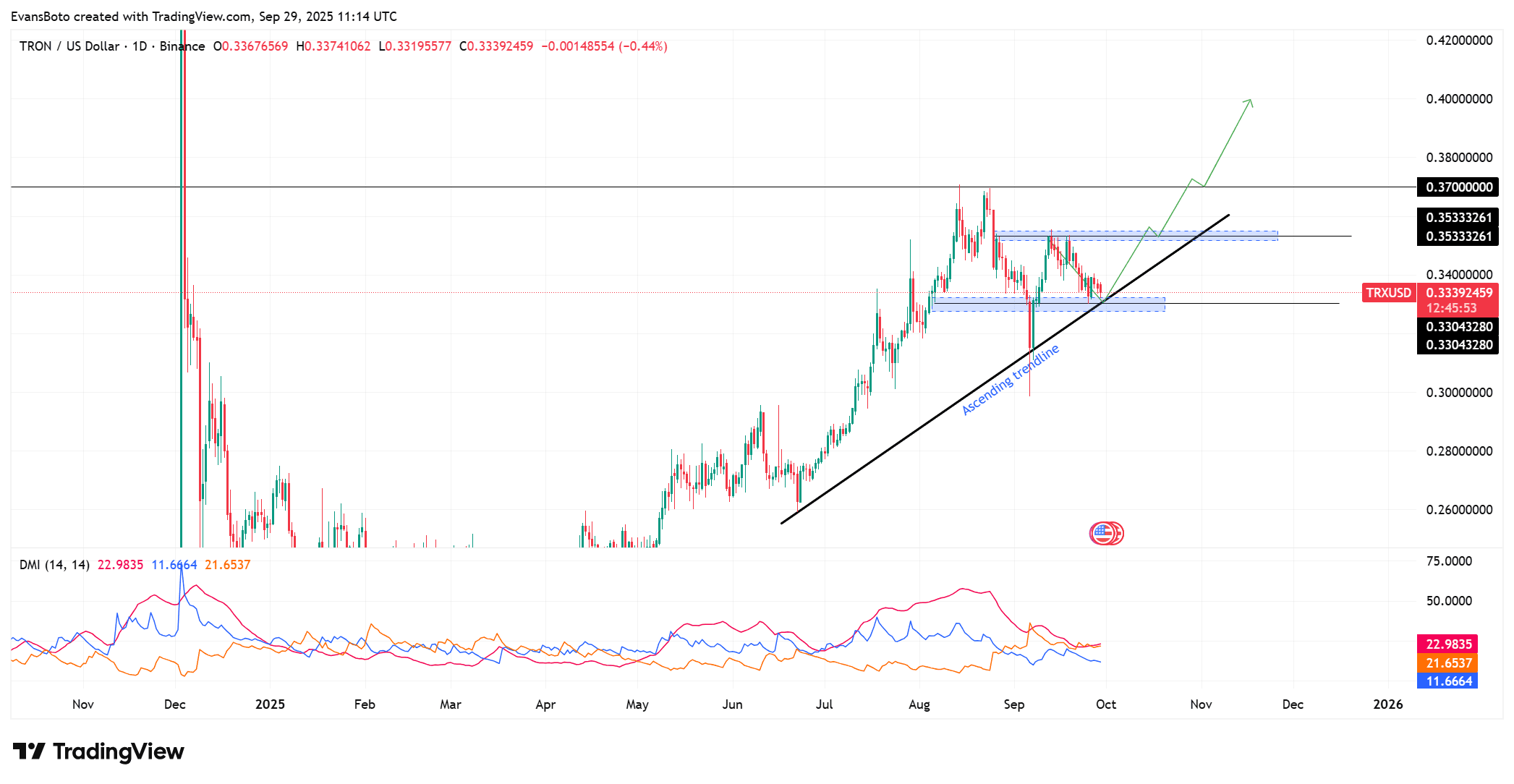

At press time, TRX traded near $0.33 and remained above the ascending trendline support, which has acted as a reliable pivot during pullbacks. The DMI indicator showed mixed signals with a bearish component, suggesting a possible retest of trendline support before continuation.

Key resistance levels to monitor are $0.3526 and $0.3700. A decisive close above $0.37 would validate a new bullish leg targeting $0.40, while a break below the trendline would put $0.30–$0.31 in focus.

SunSwap transactional strength reinforced TRON’s role in stablecoin settlement, with daily transaction volumes consistently above 15,000. This consistent usage underpins the narrative that TRON is attracting real demand beyond speculative flows.

Source: TradingView (price chart)

How do exchange outflows affect TRX supply dynamics?

Spot netflows showed consistent outflows in September; on September 29, outflows totaled about $4.79 million. Withdrawal of coins from exchanges typically reduces available supply and can reduce sell-side liquidity, supporting prices when demand persists.

Sustained outflows paired with steady on-chain activity indicate higher conviction among holders and lower probability of large-scale liquidations from exchange wallets.

Source: CoinGlass (exchange netflows)

Futures positioning: What does taker CVD tell us?

Futures Taker CVD recorded net taker-buy dominance over recent sessions, implying that market participants executed more aggressive buys (market orders) than sells. When taker buys dominate, leveraged traders often anticipate higher spot prices.

This derivatives signal aligned with SunSwap transaction growth and exchange outflows, creating a cluster of bullish indicators that raise the probability of a sustained move if price holds above trendline support.

Source: CryptoQuant (Futures Taker CVD)

Can TRX break above $0.37 for a new rally?

TRX showed the setup to challenge $0.37 as network activity, exchange outflows, and derivatives positioning aligned bullishly. Holding the ascending trendline remains the primary condition for continuation.

A confirmed breakout above $0.37 would elevate $0.40 as the next near-term target. Conversely, failure to sustain trendline support would increase downside risk toward $0.30.

| SunSwap Total Transactions | >30,000 (September) | Higher on-chain settlement demand |

| Exchange Outflows (29 Sep) | $4.79M | Reduced sell-side liquidity |

| Futures Taker CVD | Taker-buy dominance | Derivatives leaning bullish |

| Resistance / Targets | $0.3526 / $0.37 / $0.40 | Break and hold above $0.37 needed for rally |

Frequently Asked Questions

How do SunSwap transactions affect TRX price?

Higher SunSwap transactions indicate increased use of TRON for stablecoin settlement and remittances. This raises on-chain demand for TRX and supports medium-term fundamentals by reducing the proportion of speculative flows versus utility-driven activity.

What should traders watch for a confirmed breakout?

Traders should watch for a daily close above $0.37 with sustained volume, continued exchange outflows, and persistent taker-buy dominance in futures. These combined signals increase the probability of a rally toward $0.40.

Key Takeaways

- Network demand rose: SunSwap transactions topped 30,000 in September, signaling genuine on-chain usage.

- Supply tightened: Exchange outflows of $4.79M reduced available sell liquidity and supported accumulation.

- Derivatives reinforced bias: Futures Taker CVD showed taker-buy dominance, aligning with on-chain and exchange signals.

Conclusion

TRX price is supported by improved on-chain activity, notable exchange outflows, and bullish futures positioning. Holding the ascending trendline and clearing $0.37 are the key conditions for a fresh rally toward $0.40. Monitor these metrics and trade with risk controls as conditions evolve.