Crypto treasury companies are corporate entities holding significant cryptocurrency reserves that must balance risk, debt and liquidity to survive market cycles. Prudent treasury management — debt terming, blue‑chip allocations and revenue-backed strategies — determines which firms endure and which face forced sell-offs.

-

Prudent debt structuring reduces bankruptcy risk:

-

Allocate to supply‑capped, blue‑chip digital assets rather than high‑volatility altcoins.

-

Companies with operating revenue are better positioned to sustain crypto accumulation during downturns.

Crypto treasury companies need debt discipline and blue‑chip allocations to survive bear markets — learn actionable treasury management strategies and next steps. Read now.

What are crypto treasury companies and why do they matter?

Crypto treasury companies are firms that hold a material portion of corporate balance sheets in digital assets. They matter because institutional-sized holdings can amplify market moves, influence liquidity, and create systemic selling pressure if mismanaged.

Investor psychology has not changed in the ensuing 25 years since the dotcom-era bust that took down the US stock market in the early 2000s.

The crypto treasury narrative, a defining feature of the current cycle, mirrors late‑1990s dotcom investor psychology. Ray Youssef, founder of a peer‑to‑peer lending platform, notes that exuberant capital flows and institutional involvement can fuel overinvestment and eventual market stress.

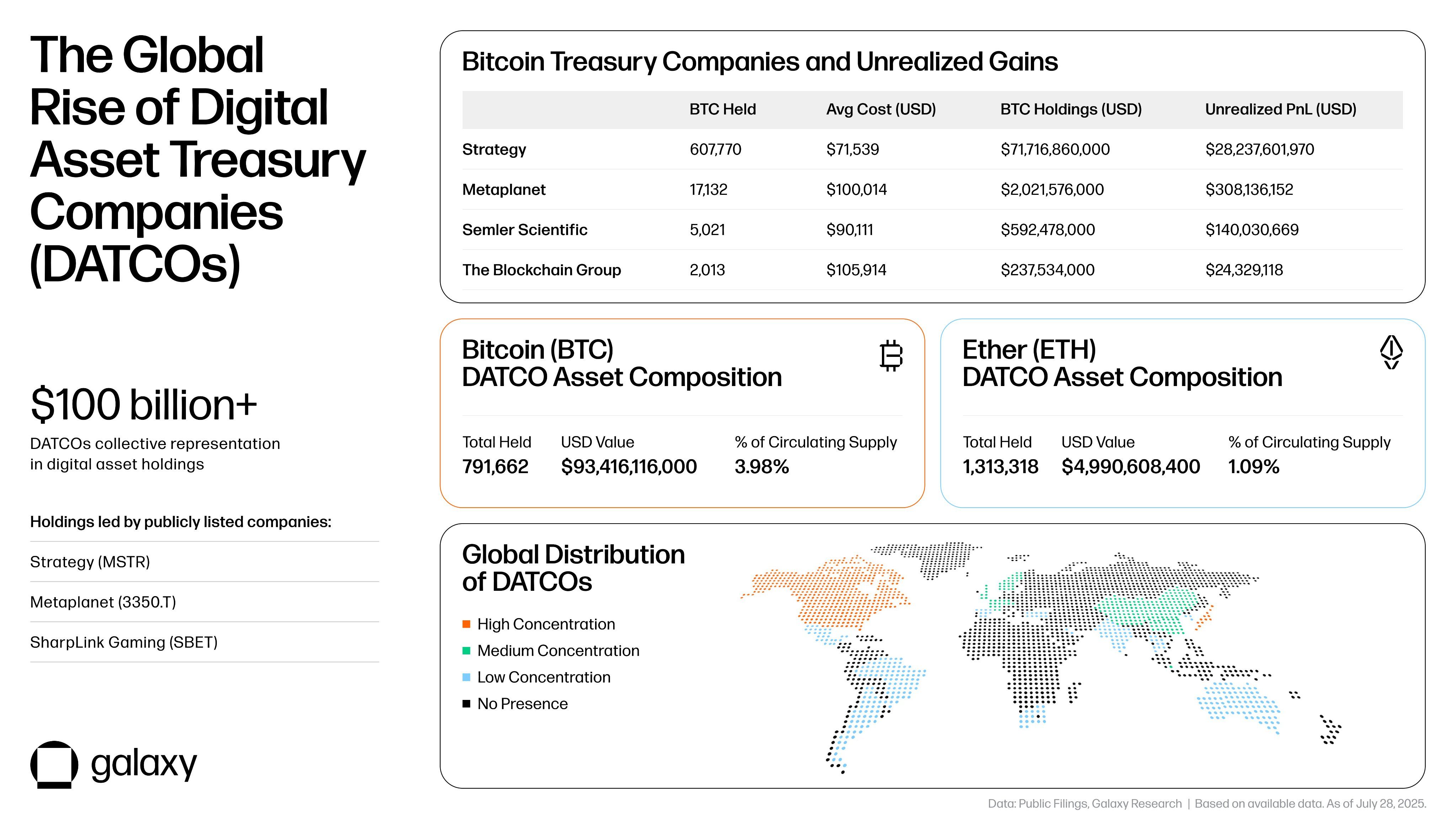

An overview of digital asset treasury sector. Source: Galaxy

How can crypto treasury companies mitigate downturns?

Companies that practice responsible treasury and risk management can reduce downside risk and position themselves to buy at discounts during bear markets. Key measures include debt management, asset selection, and preserving operating cash flow.

What debt strategies reduce bankruptcy risk?

Terming out debt and avoiding short‑dated leverage are central. If Bitcoin cycles average four years, firms should stagger debt maturities beyond expected troughs to avoid forced sales when prices are depressed.

- Structure long‑dated debt tranches (5+ years) to avoid paying during low points.

- Prefer equity raises over debt issuance when possible to limit creditor claims.

- Limit leverage and maintain liquidity buffers in fiat or stable assets.

Which assets should treasuries hold?

Allocate to supply‑capped and market‑leading digital assets that historically recover between cycles. Avoid concentration in high‑beta altcoins that can fall 80–90% and fail to recover.

| Blue‑chip BTC/ETH allocation | Higher resilience, proven recovery | Lower short‑term upside vs small caps |

| High‑beta altcoin accumulation | Large short‑term returns if winners emerge | High chance of severe permanent loss |

| Revenue‑backed purchases | Sustainable accumulation without dilution | Requires operating business and cash flow |

How does having operating revenue affect survival?

Companies with operating revenue can fund crypto purchases without relying solely on capital markets. This reduces dependence on equity dilution or debt and lowers the risk of forced asset sales during market stress.

A breakdown of digital assets adopted by corporations for treasury purposes. Source: Galaxy

Industry commentary highlights that many corporate treasury plays lack sustainable business models and may be forced to liquidate holdings, while a smaller cohort with prudent finance policies will survive and continue accumulating at discounts during bear markets.

Related: Crypto markets are down, but corporate proxies are doing far worse

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

Frequently Asked Questions

Will most crypto treasury companies fail in the next bear market?

Not all will fail, but many that relied on short‑term leverage or speculative altcoin positions without revenue backing face elevated risk. Firms with conservative finance policies and diversified blue‑chip allocations have better survival odds.

How long should companies term out debt when buying crypto?

Match debt maturities to expected market cycles—if Bitcoin exhibits ~4‑year cycles, consider 5‑year or longer maturities to avoid repaying during price troughs.

Key Takeaways

- Debt discipline matters: Term out short‑dated liabilities to reduce forced selling risk.

- Asset selection is critical: Prioritize supply‑capped, market‑leading digital assets over high‑risk altcoins.

- Revenue backing boosts resilience: Operating businesses can fund accumulation without dilution or excessive borrowing.

Conclusion

Crypto treasury companies influence market dynamics and face meaningful liquidation risk if finance and risk policies are weak. Emphasizing debt terming, disciplined allocations to blue‑chip digital assets, and leveraging operating revenue can distinguish survivors from companies forced to liquidate. Stakeholders should monitor treasury disclosures and maturity schedules closely as markets evolve.