Ethereum is forming a bullish symmetrical triangle while exchange reserves drop to multi-year lows, creating a potential supply-shock breakout toward $5,000–$6,000; key support sits near $4,150 and institutional inflows are increasing ahead of the Fusaka upgrade.

-

ETH triangle breakout could target $5,000–$6,000 on strong volume

-

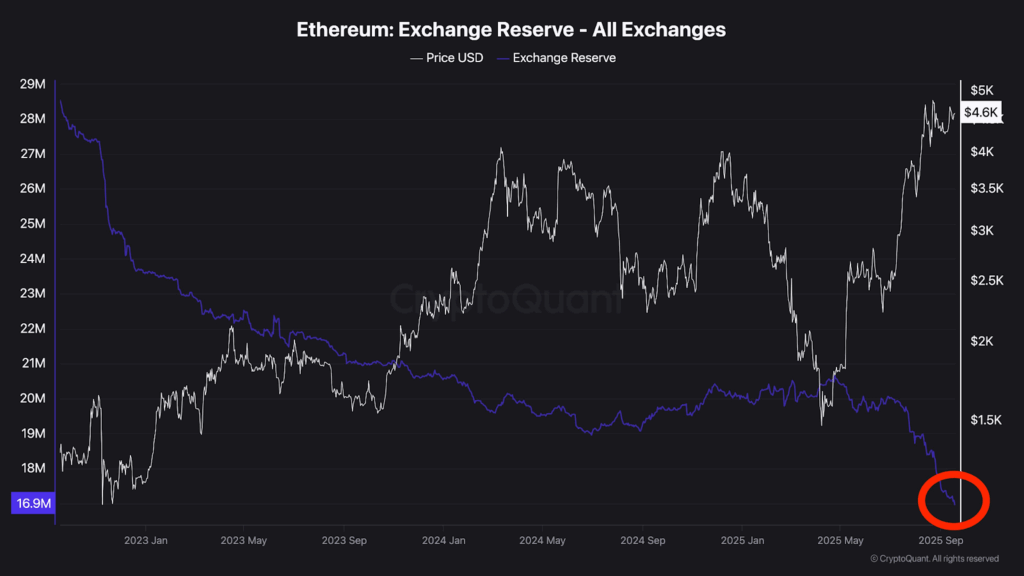

Exchange reserves at 16.9M ETH signal reduced sell-side liquidity and rising scarcity.

-

Institutions report $213.1M ETF inflows yesterday, with Fidelity accounting for $159.4M.

Ethereum breakout: ETH forming a bullish triangle amid 16.9M exchange reserves — monitor $4,150 support and Fusaka upgrade; read analysis and key takeaways.

Ethereum gears up for a major breakout as a bullish triangle forms. With exchange reserves plunging, a supply shock rally could be imminent.

What is the technical setup behind the Ethereum breakout thesis?

Ethereum is consolidating in a symmetrical triangle after a sustained uptrend, a pattern that often precedes continuation moves. Measured-move targets place a breakout in the $5,000–$6,000 range if upper resistance is taken with expanding volume.

How significant are exchange reserve declines for ETH price?

Exchange reserves have dropped to 16.9 million ETH, a multi-year low. Lower on-exchange balances reduce immediate sell liquidity and increase the likelihood of upward price pressure when demand resumes. Historical supply shocks on exchanges have correlated with accelerated rallies in ETH.

$ETH

$5000 comes fast after we break out from this triangle — Galaxy (Twitter content quoted as plain text). September 19, 2025

The daily chart shows higher lows and lower highs compressing price into a tight range. A breach above triangle resistance with volume expansion would validate the bullish continuation. Conversely, a breakdown below the $4,150 support level would invalidate the setup and increase downside risk.

Measured move projection calculations place a conservative target at $5,000 and an extended target near $6,000 if momentum persists. Traders should watch volume, on-chain outflows to cold storage, and staking inflows for confirmation.

Why are institutions and ETFs relevant to the current ETH momentum?

Institutional flows notably influence market liquidity and investor sentiment. Recent ETF inflows totaled $213.1 million on the latest reporting day, with Fidelity responsible for $159.4 million of that total. Large, consistent inflows reduce circulating supply available to spot sellers and can amplify price moves during technical breakouts.

The Fusaka upgrade, scheduled for December 3, 2025, adds a near-term catalyst. Fusaka aims to increase throughput without compromising security, and preparatory events (testnets, audits) are driving attention and capital allocation now.

Source: Merljin The Trader Via X

Source: Merljin The Trader Via X

When could Fusaka and subsequent upgrades affect ETH demand?

Fusaka is scheduled for December 3, 2025, with testnet rollouts and security audits through October–November. Successful deployment may increase staking and on-chain utility, leading to longer-term demand growth ahead of the Glamsterdam update expected in 2026.

Frequently Asked Questions

Will Ethereum reach $5,000 after a triangle breakout?

A confirmed breakout above triangle resistance with rising volume could push ETH toward $5,000; measured-move targets and institutional inflows support this scenario, while a failure below $4,150 would negate it.

How do falling exchange reserves impact ETH price?

Falling exchange reserves reduce immediate sell-side liquidity. When large volumes exit exchanges to cold storage or staking, scarcity increases and historical precedents show higher probability of strong upward moves.

Is institutional buying driving the current ETH rally?

Yes. Recent ETF inflows (reported at $213.1M on the latest day) and large allocations by firms like Fidelity (reported at $159.4M) are compressing available supply and underpinning bullish sentiment.

Key Takeaways

- Technical setup: Symmetrical triangle suggests a potential continuation toward $5,000–$6,000.

- Supply dynamics: Exchange reserves at 16.9M ETH indicate reduced sell liquidity and rising scarcity.

- Institutional catalyst: Significant ETF inflows and the upcoming Fusaka upgrade strengthen the bullish case.

Conclusion

The combination of a bullish triangular consolidation, shrinking exchange reserves, and growing institutional inflows builds a constructive case for an Ethereum breakout. Monitor $4,150 support, breakout volume, and Fusaka upgrade progress for confirmation. For active traders, set risk management rules and watch on-chain metrics closely.