WLFI proposes "100% liquidity fee buyback and burn"

According to ChainCatcher, on September 19, World Liberty Financial previously released a proposal requiring that all fees generated from the protocol-owned liquidity (POL) of WLFI be used for open market buybacks of WLFI and permanently burned. This proposal has now received support from 99.84% of voters.

The official statement noted that if this proposal passes, WLFI will use this as the foundation for a continuous buyback and burn strategy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hourglass: Stable pre-deposit phase 2 KYC verification extended until November 13, 7:59

BNY Mellon: Stablecoins and Tokenized Cash Could Reach $3.6 Trillion by 2030

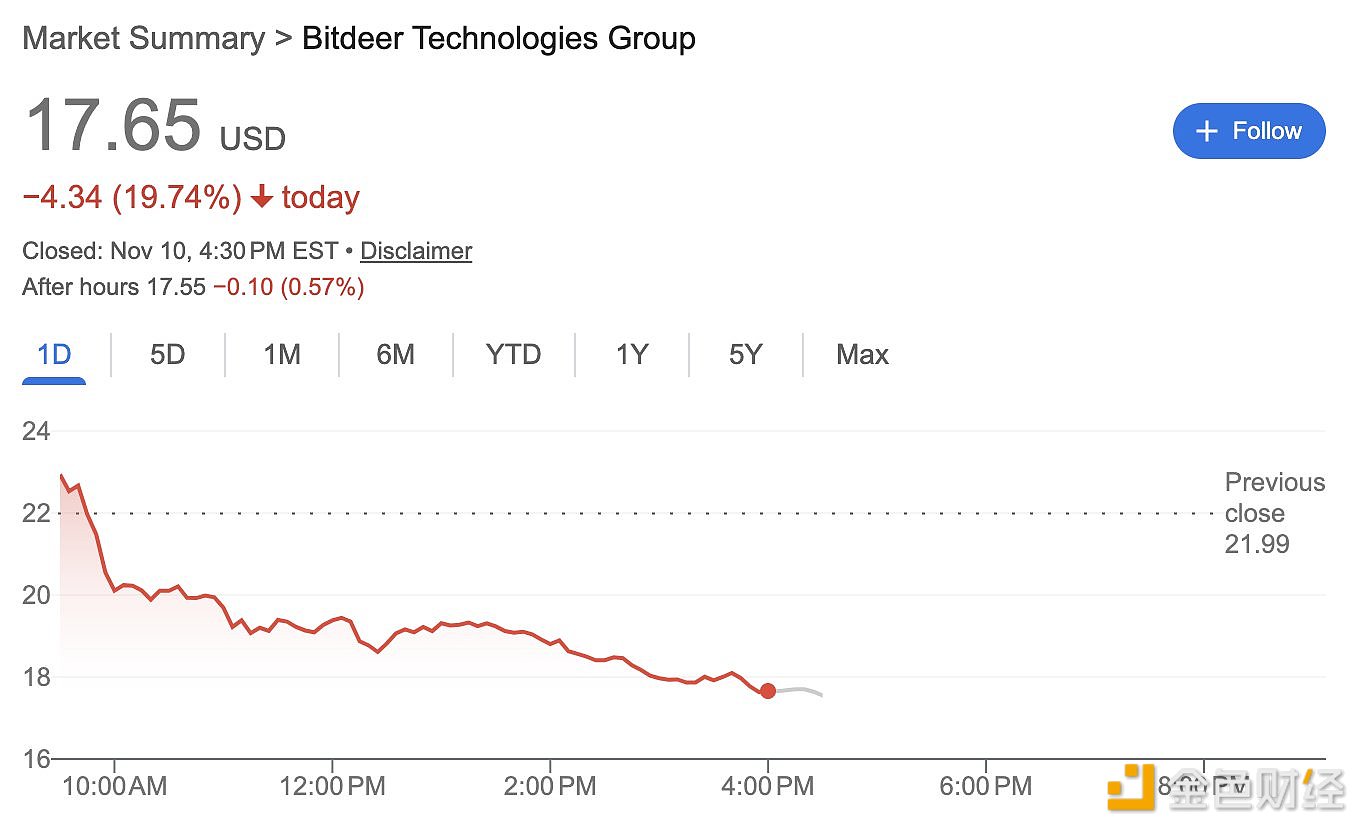

Bitdeer posts a net loss of $266 million in Q3, stock price plunges 20%