Solana Price Rally Faces Critical Risk as All Holder Groups Turn Sellers

Solana price has jumped 37% in a month, but selling pressure and chart signals warn of risks. Holder groups are trimming supply, profits remain high, and technical patterns hint the rally may not last.

The Solana price has been on a strong run this past month, gaining about 37%. But beneath the rally, warning signs are starting to show.

Key holder groups are quietly reducing supply, while chart signals hint that the move higher may not be as solid as it looks. Whether Solana pushes past resistance or slips into correction now hangs in the balance on a few critical levels.

Holders Take Profits While Hidden Selling Pressure Builds

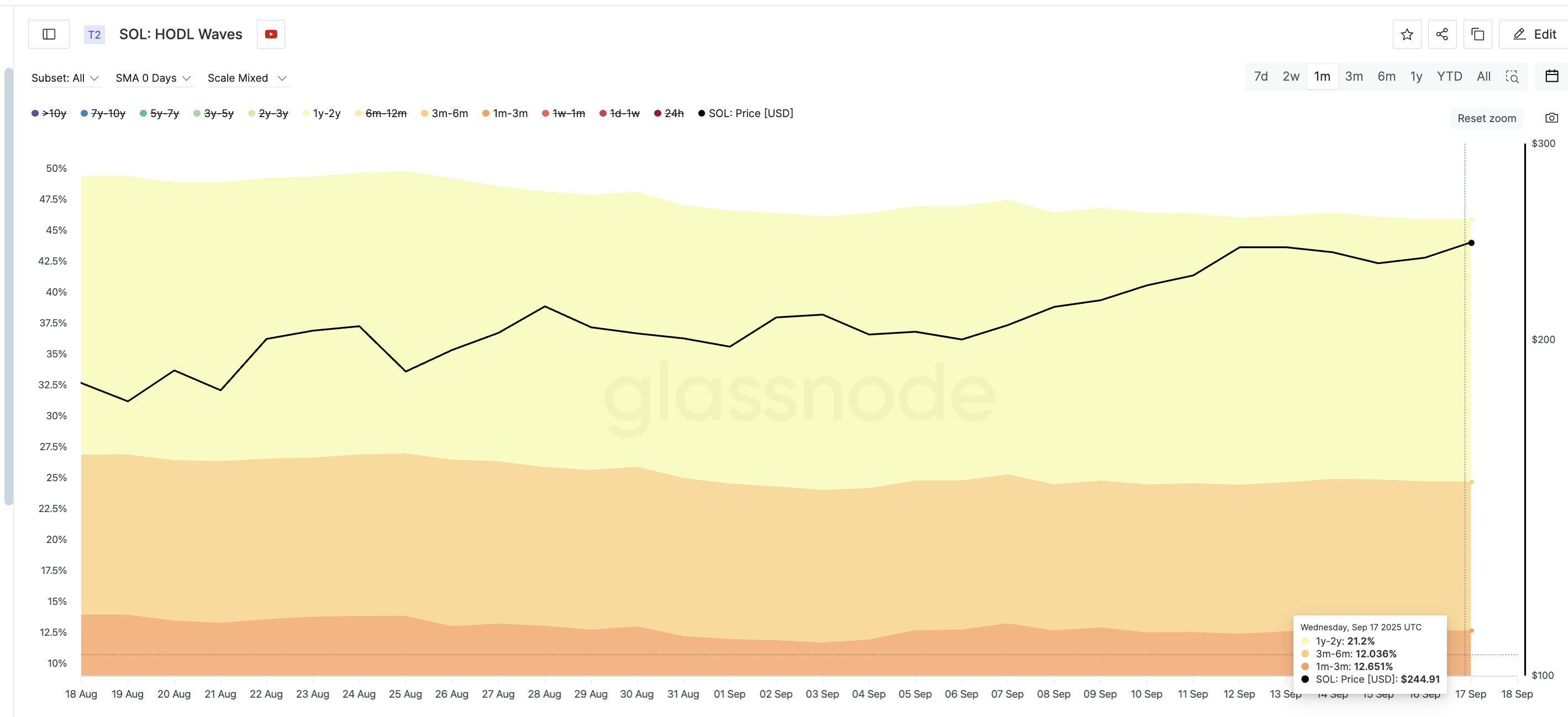

One way to track selling or holding behavior is through HODL Waves, which show how much of the supply is held by different age groups of wallets. If the percentage of coins held by a group falls, it usually means that the group is selling.

In Solana’s case, almost every key group has trimmed its holdings in the past month. The 1-3 month cohort dropped from 13.93% of supply on August 18 to 12.65% now. The 3-6 month group went from 12.92% to 12.03%. Even the long-term 1-2 year holders reduced from 22.51% to 21.20%.

Solana Sellers Grow Stronger:

Glassnode

Solana Sellers Grow Stronger:

Glassnode

The selling is not surprising after a 37% rally.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

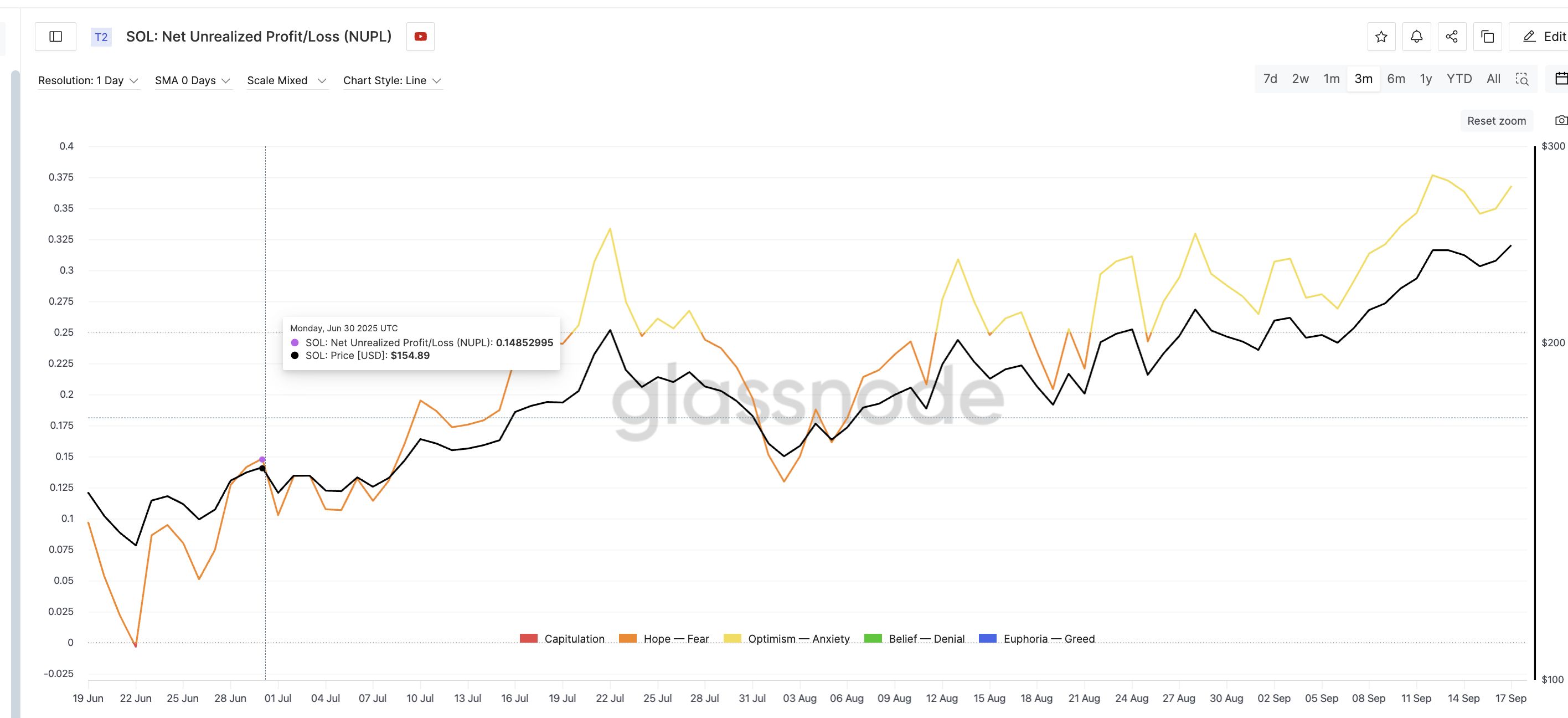

But what is unusual is that NUPL, or Net Unrealized Profit and Loss, remains high. NUPL tracks how many wallets are sitting on paper profits. When it is high, it means many holders are still in profit and could take gains.

On September 12, when NUPL reached a three-month peak of 0.37, the Solana price corrected by over 3%.

Solana Traders Sitting On Profit Despite Selling:

Glassnode

Solana Traders Sitting On Profit Despite Selling:

Glassnode

This also takes us back to July 22, when NUPL hit 0.33. That peak lined up with a much steeper 22.9% drop in Solana’s price, from $205 to $158.

Right now, NUPL is near 0.36 — close to those same danger levels.

Together, these signals suggest that while different holder groups have already sold, plenty of profit remains in the system. If selling pressure picks up again, weak hands may be quick to cash out.

Key Levels Decide Whether Solana Price Rally Extends Or Corrects

On the daily chart, Solana’s breakout from an ascending channel still points to a target near $284. But the immediate test lies at $249. A daily close above this resistance would keep bulls in control.

Solana Daily Price Chart:

TradingView

Solana Daily Price Chart:

TradingView

The bigger risk comes from the two-day chart. Here, Solana is trading inside a rising wedge, a setup that often hints at a correction.

Solana Price Analysis:

TradingView

Solana Price Analysis:

TradingView

At the same time, the Relative Strength Index (RSI) shows momentum fading — prices have made higher highs, but RSI has made lower highs. This “bearish divergence” is often an early sign that a rally is running out of steam.

If the Solana price breaks above $249 on a two-day close, the bearish setup could be invalidated.

But if it fails, the price may drift in a range and face pressure at $227. A deeper break below that could push Solana toward $202 and even lower.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IOTA partners with top global institutions to build Africa’s “digital trade superhighway”: a new $70 billion market is about to explode

Africa is advancing trade digitalization through the ADAPT initiative, integrating payment, data, and identity systems with the goal of connecting all African countries by 2035. This aims to improve trade efficiency and unlock tens of billions of dollars in economic value. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated.

Panic selling is all wrong? Bernstein: The real bull market structure is more stable, stronger, and less likely to collapse

Bitcoin has recently experienced a significant 25% pullback. Bernstein believes this was caused by market panic over the four-year halving cycle. However, the fundamentals have changed: institutional funds such as spot ETF are absorbing the selling pressure, and the structure of long-term holdings is more stable. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved.

Young Bitcoin holders panic sell 148K BTC as analysts call for sub-$90K BTC bottom

Rare Bitcoin futures signal could catch traders off-guard: Is a bottom forming?