Ethereum Tests Support: Holder Conviction Sets Stage for a Rebound to $4,775

Ethereum price slipped below $4,500, but nearly $8 billion in maturing ETH supply signals strong investor conviction. If ETH reclaims support, a rally toward $4,775 and new highs could follow.

Ethereum has seen a 4% decline in recent days, pulling the altcoin king just under $4,500.

While this short-term dip may concern some traders, the long-term outlook remains bullish as strong fundamentals and investor behavior suggest resilience ahead.

Ethereum Supply Is Maturing

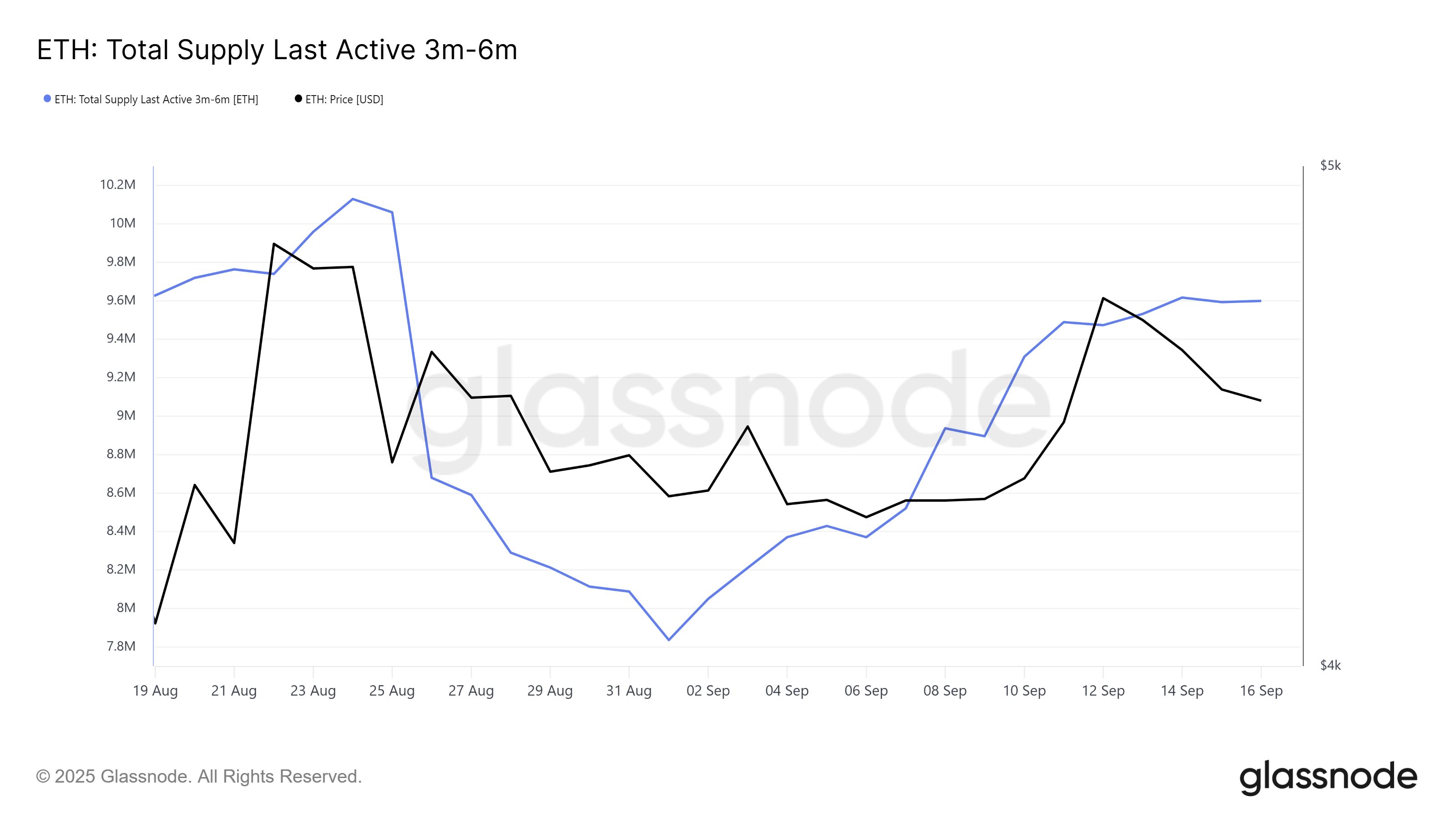

Ethereum supply has matured significantly, reinforcing investor confidence in the asset’s long-term strength. Since the beginning of the month, the 3-6 month-old supply has grown by 1.76 million ETH, now valued at nearly $8 billion. This indicates that holders refrained from liquidating even during market volatility.

Such conviction suggests that investors anticipate higher prices and are willing to ride out short-term declines. By keeping ETH locked, these holders are reducing the circulating supply, which can create favorable conditions for upward price momentum when demand returns. This behavior is a bullish foundation for Ethereum’s growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

Ethereum Supply Last Active 3-6 Months Ago. Source:

Glassnode

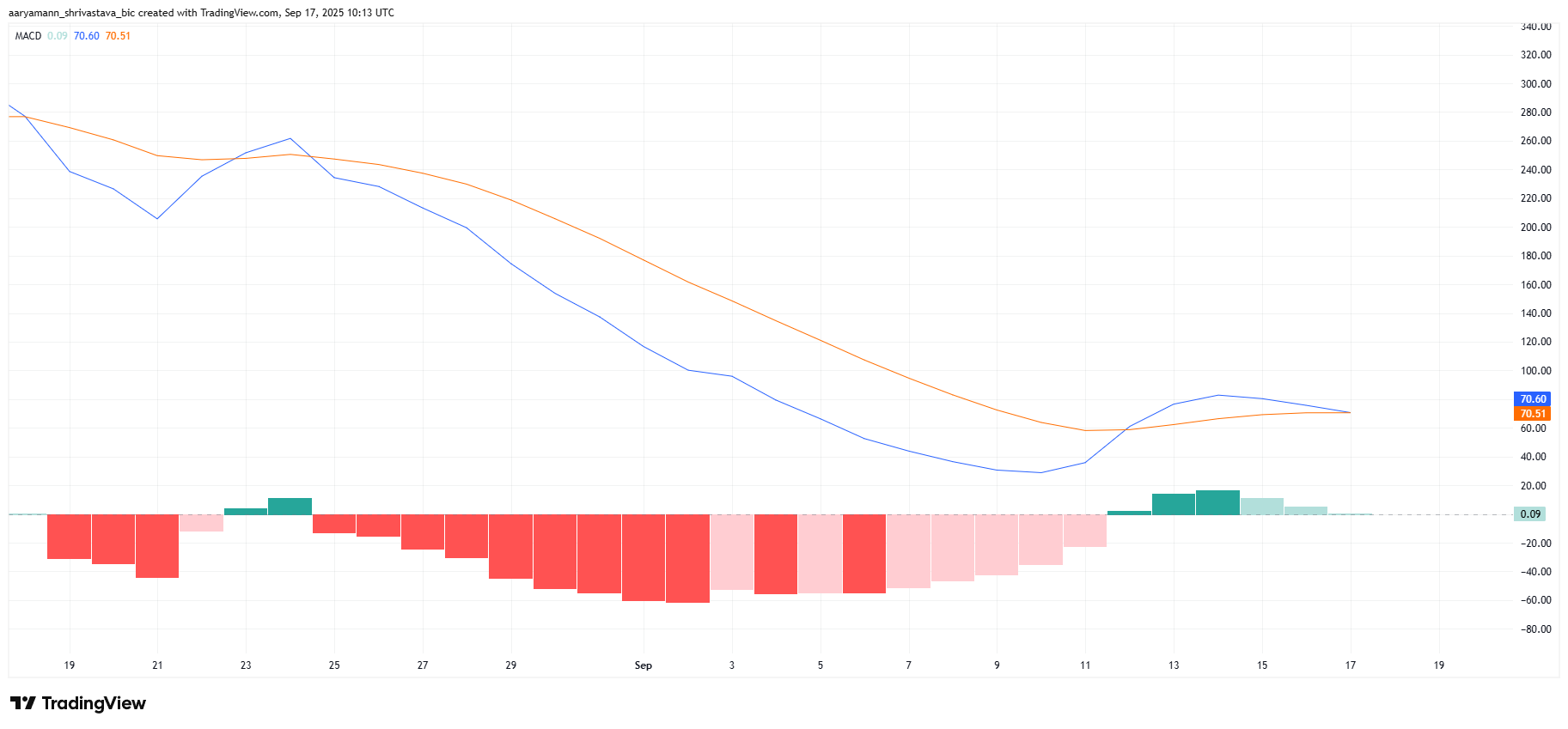

On the technical side, Ethereum’s momentum appears mixed in the near term. The Moving Average Convergence Divergence (MACD) indicator is nearing a bearish crossover, signaling the possibility of short-lived downside pressure. This aligns with ETH’s recent price slip below the $4,500 level.

However, the broader market cues remain constructive. Even if the MACD confirms a bearish crossover, investor sentiment and maturing supply could support a quick recovery. Such dynamics highlight that any decline would likely be temporary, with ETH primed for a strong rebound soon after.

ETH MACD. Source:

TradingView

ETH MACD. Source:

TradingView

ETH Price Could Bounce Back

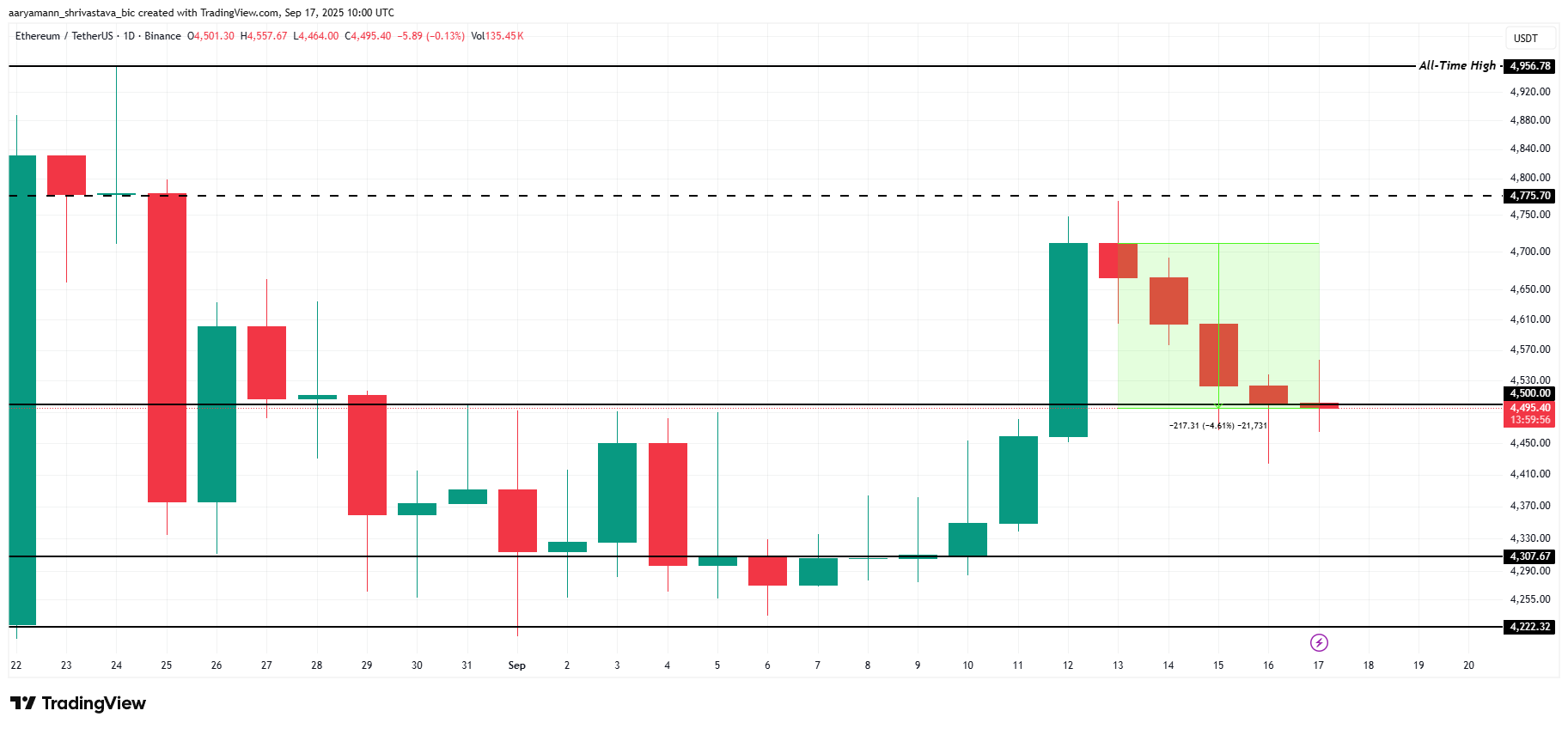

Ethereum is currently trading at $4,495, just below the $4,500 support line. It has not yet closed below $4,500, so the support is still valid.

The maturing supply and bullish long-term outlook indicate that Ethereum could bounce from the support. With fewer coins entering circulation, the altcoin has structural support for renewed upward momentum to $4,775 despite short-term volatility.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if the price closes below the support, ETH may slip toward $4,307, invalidating the bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster announces a $10 million trading competition, combined with Stage 4 airdrop and Rocket Launch incentives, driving multi-layered growth in platform depth and liquidity.

After achieving strong performance in Stage 3, Stage 4 (Harvest) airdrop plan was launched, and the “Double Harvest” trading competition with a total reward of 10 million USD will be introduced on November 17.

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.