At 02:00 AM (GMT+8) on September 18, 2025, the Federal Reserve will announce its interest rate decision, marking the first official shift towards easing since the end of 2024. Market consensus points to a 25 basis point rate cut, lowering the benchmark rate from the 4.25%-4.5% range to 4%-4.25%. Powell’s press conference at 2:30 (GMT+8) will be the touchstone for interpreting the path of easing. The cold fact is: expectations have been fully priced in, and any deviation could trigger a “buy the rumor, sell the news” chain reaction.

The Dual Pressure of Weak Labor and Inflation

Trump has once again publicly criticized Powell recently: “The Fed should act beyond expectations.” If Trump’s tariff policies return to the White House, import costs may rise, further amplifying inflationary pressure. Market participants worry that such political noise could interfere with the Fed’s independence.

Bitcoin is currently holding steady at the $116,000 mark, with trading volume surging 20% compared to last week. As “digital gold,” BTC is highly sensitive to interest rates: a low-rate environment stimulates risk appetite, shifting capital from US Treasuries to high-yield assets. However, historical data shows that FOMC meetings are often periods of peak volatility—after the first rate cut in December 2024, BTC once soared 15%, only to retrace 8% in a “sell the news” move. Tonight, leveraged traders need to be especially cautious: the risk of high-leverage liquidation looms, and even a hint of hawkishness could trigger a chain collapse.

Since the beginning of this year, the US economy has shown signs of a “soft landing”: the unemployment rate has slightly risen to 4.3%, and CPI remains well above the 2% target range. The market predicts a 25 basis point rate cut is almost certain, with the focus shifting to Powell’s remarks: will he emphasize “economic resilience” and “inflation risks,” or send a more dovish signal?

Three Scenarios: From Euphoria to Collapse, a Tale of Two Extremes

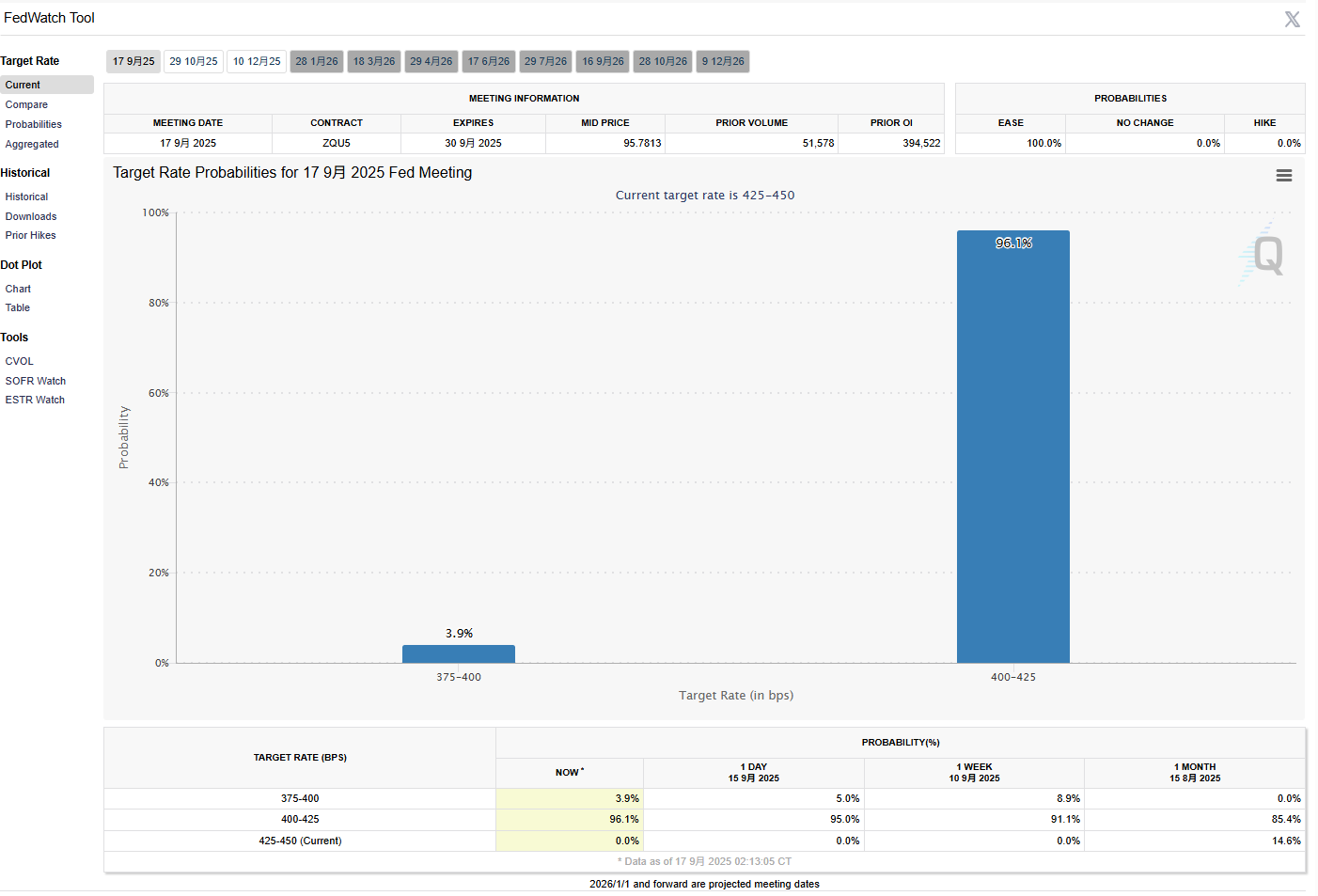

The CME FedWatch tool shows that a 25 basis point rate cut is almost a certainty, but there is still a 5% tail risk of an unexpected 50 basis point cut. Three scenario forecasts:

- Scenario 1: Unexpected Easing (50 basis point rate cut)

If Powell bluntly states that “labor market risks are rising” and hints at consecutive rate cuts, this would be a “carnival night” for the crypto market. BTC could break through resistance and head straight for the $120,000 mark—but don’t celebrate too soon: unexpected moves often come with a “liquidity illusion.” If capital flows in and inflation rebounds, the Fed may be forced to slam on the brakes, leading to a bigger correction.

- Scenario 2: In Line with Expectations (25 basis point rate cut)

The most likely outcome: a moderate rate cut, with the dot plot showing two adjustments within the year. The dollar continues to weaken, and the crypto market “steadily advances”—BTC may fluctuate upward in the $115,000-$117,000 range, while ETH benefits from the stablecoin ETF application wave. If Bitwise’s “Stablecoin and Tokenized ETF” is approved, it will accelerate institutional capital inflows.

- Scenario 3: No Rate Change or Unexpected Hawkishness

Black swan event: Powell emphasizes “inflation risks remain, economic resilience is strong,” signaling a cautious path. This would be a “cold shock,” with the crypto market bearing the brunt: BTC could fall below the $110,000 support, triggering a wave of leveraged liquidations. Trump’s remarks become a double-edged sword at this moment: if the Fed withstands the pressure, the market will see it as a “victory for independence,” but short-term pain is inevitable.

Join our community to discuss and grow stronger together!