Research Report | Lombard Token Project Overview &BARD Market Cap Analysis

I. Project Overview

-

LBTC: A liquid staking token with cross-chain support.

-

Lombard Vaults: Custodial vaults operated by leading risk management institutions.

-

DeFi Marketplace: Lending, trading, and other DeFi services available across multiple blockchains.

-

Lombard SDK: Enables developers to embed native BTC deposits and yields directly into any chain, protocol, or wallet.

-

Staking: Direct staking through Babylon’s four finality providers, operated by Galaxy, Kiln, P2P, and Figment.

II. Project Highlights

-

Unlocking Bitcoin Value Enhancing Liquidity Lombard focuses on unlocking the liquidity of Bitcoin and other mainstream assets. It allows holders to obtain liquid funds by staking their assets without selling the underlying assets, fundamentally improving liquidity challenges and expanding the use of Bitcoin in the DeFi ecosystem.

-

Innovative Staking Overcollateralized Lending Mechanism The platform supports users staking Bitcoin or other supported assets to borrow stablecoins (e.g., USDT, USDC). With an overcollateralization design, it effectively manages lending risks, ensuring protocol security and robust protection of user assets.

-

Decentralized Architecture Multi-Layered Security Built on Ethereum and other smart contract platforms, Lombard adopts an automated lending architecture and supports cross-chain interactions for Bitcoin and other non-Ethereum assets. To mitigate single-point risks, it incorporates multisig wallets, third-party security audits, and an insurance fund for comprehensive risk management.

-

LBARD Token Multi-Dimensional Value LBARD is the native token of the Lombard platform, serving as the medium for fee payments, protocol governance, and incentive distribution. Holders can participate in governance voting and gain ecosystem utilities and rewards through token staking, fostering platform activity and sustainable development.

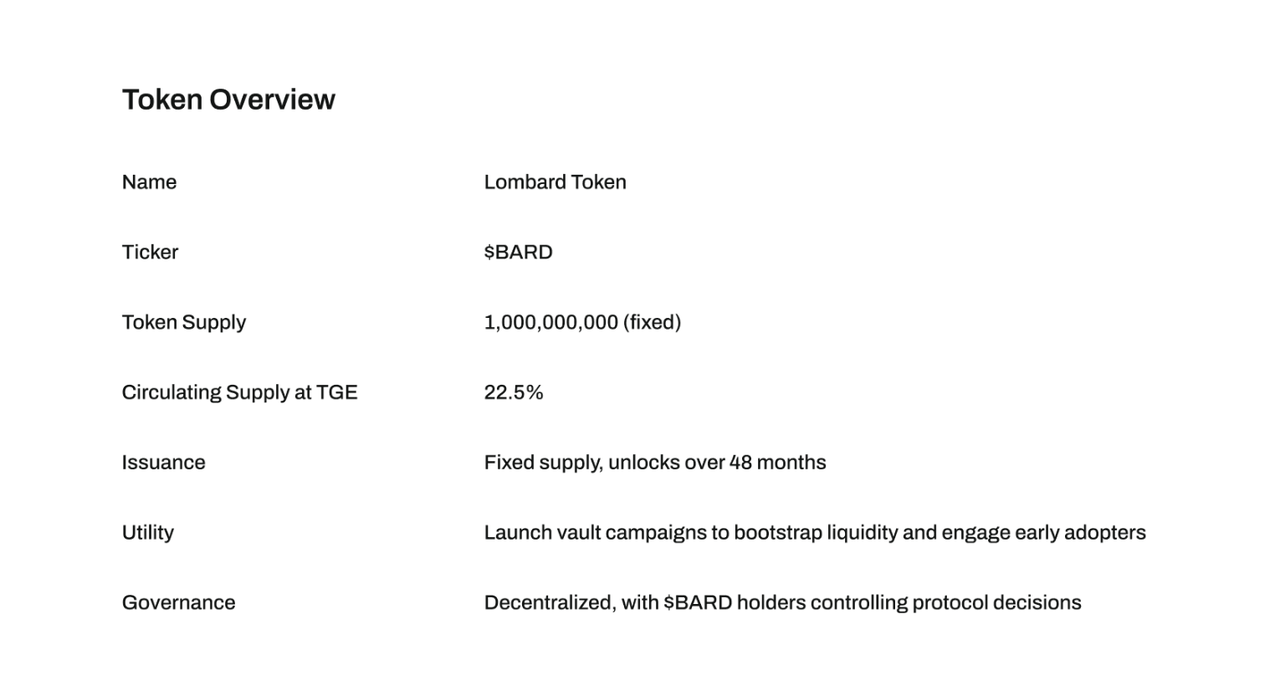

III. Tokenomics

-

Total Supply: Fixed at 1 billion $BARD.

-

TGE Distribution: 22.5% (225 million tokens) will be released into circulation at the Token Generation Event as rewards for early users and participants.

-

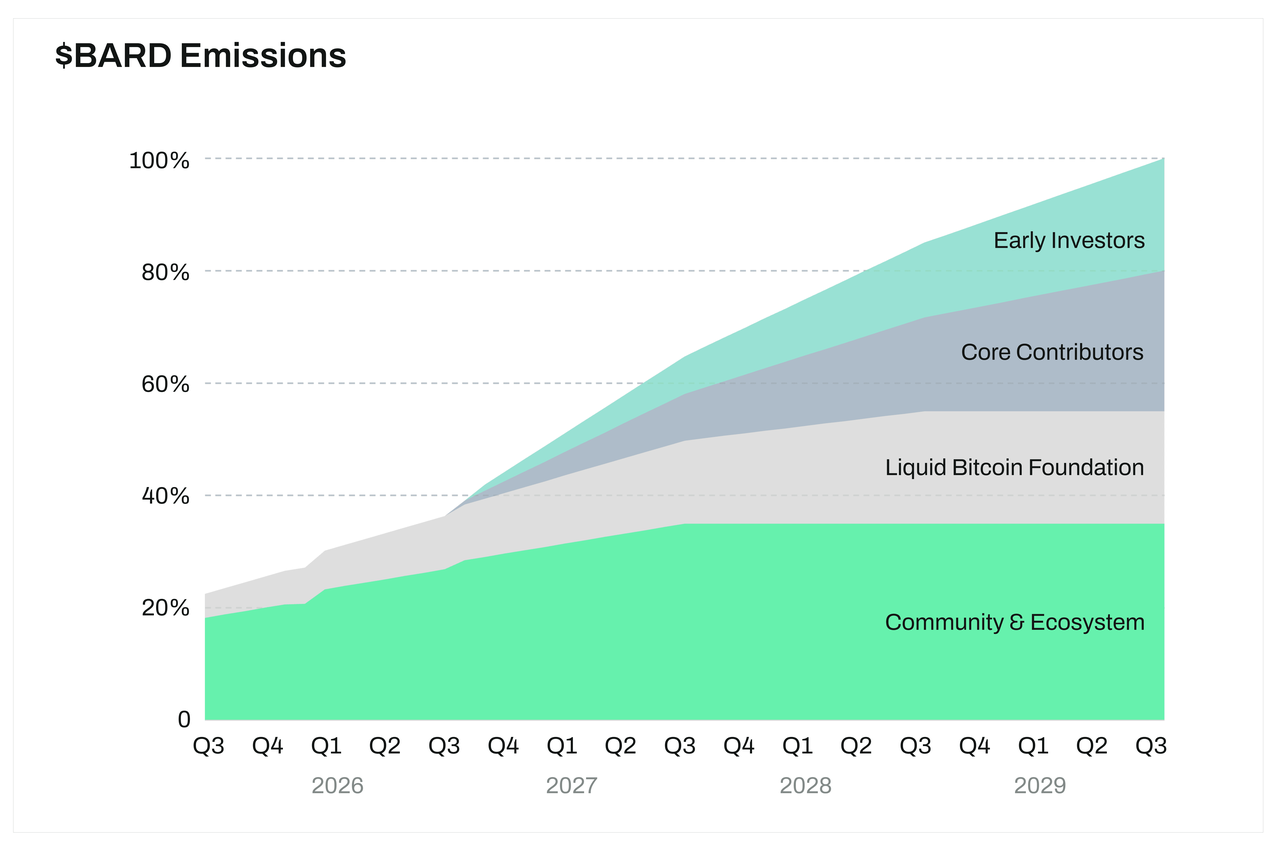

Vesting: The remaining supply will be gradually unlocked over 48 months after TGE to ensure long-term sustainability.

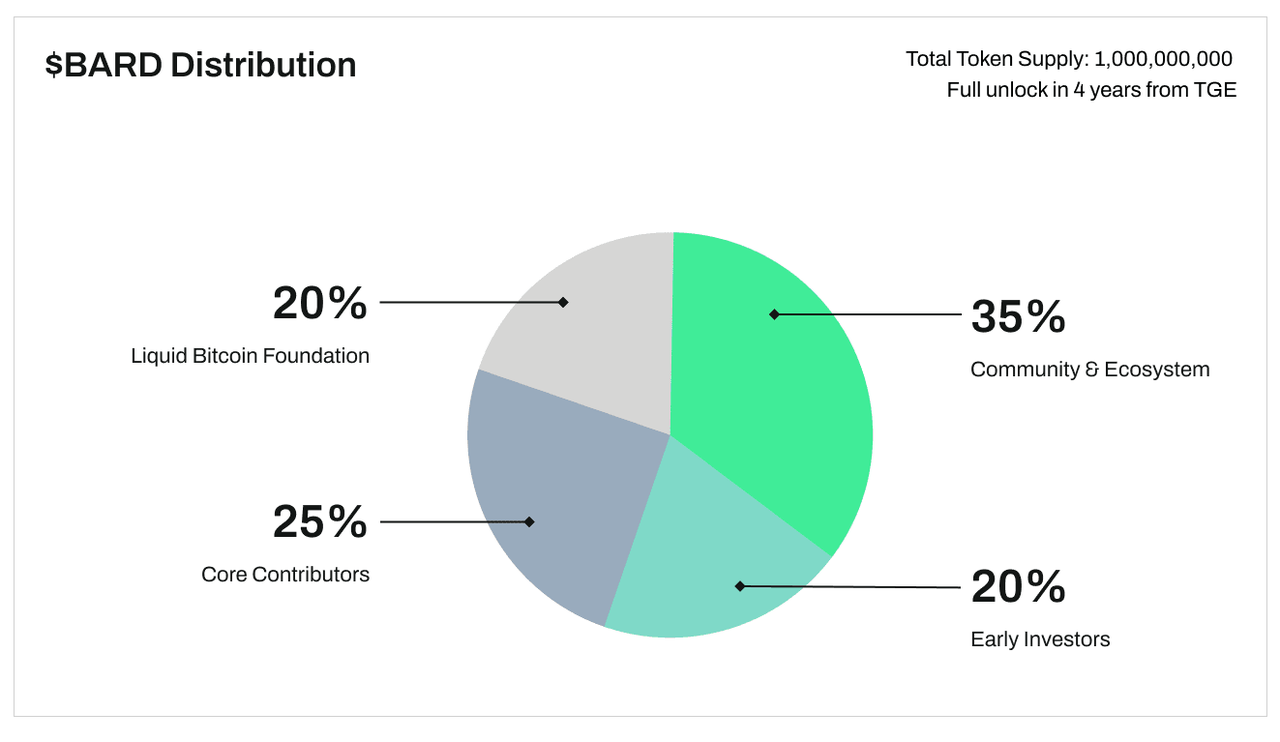

Token Distribution

-

35% allocated to Community Ecosystem, including:

-

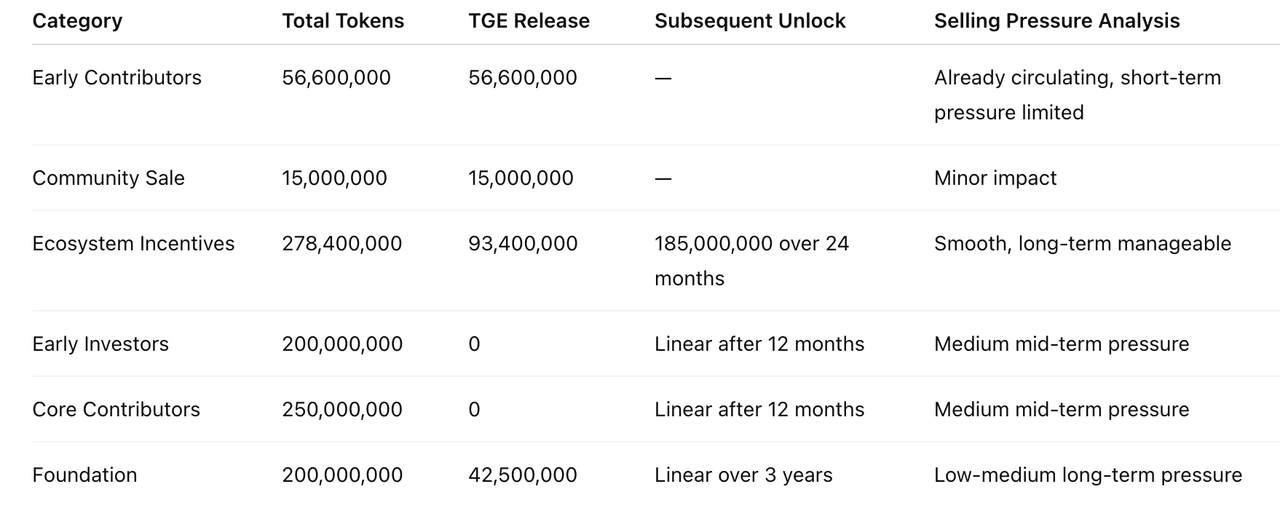

Early Contributors: 56,600,000 tokens, including 55,000,000 for airdrops (vested in two phases) and 1,600,000 for Kaito Leaderboard rewards, accounting for 5.66% of total supply.

-

Community Sale: 15,000,000 tokens, fully unlocked at TGE, 1.5% of total supply.

-

Ecosystem Activation Development: 278,400,000 tokens, of which 93,400,000 are for user incentives (immediately unlocked), and 185,000,000 are for long-term ecosystem development (linearly unlocked over 24 months), totaling 27.84% of total supply.

-

-

20% allocated to Early Investors: 48-month lockup, linear unlock starting after 12 months.

-

25% allocated to Core Contributors: 48-month lockup, linear unlock starting after 12 months.

-

20% allocated to the Liquid Bitcoin Foundation (LBF): 21.25% (42,500,000) unlocked at TGE; remaining 78.75% (157,500,000) linearly released over 3 years.

Token Utility

BARD is the key token for participating in the Lombard ecosystem, designed to serve four core purposes:

-

Governance

BARD forms the backbone of Lombard’s governance layer, enabling the community to actively participate in protocol decision-making. Holders vote on critical matters, including the composition of the validator set, fee structures, product roadmaps, and the allocation of ecosystem funds through the Liquid Bitcoin Foundation (LBF). -

Security

BARD plays an essential role in securing Lombard’s core infrastructure. At launch, holders can stake $BARD to safeguard LBTC cross-chain transfers, which are built on Chainlink CCIP and Symbiotic infrastructure. This provides a decentralized security layer for the protocol that can scale as adoption grows. -

Ecosystem Development

BARD acts as a catalyst for Lombard’s network effects, channeling resources to accelerate adoption and expand protocol influence. Through the Liquid Bitcoin Foundation (LBF), $BARD holders can fund ecosystem grants, build commercial partnerships, and support cutting-edge RD. These efforts not only ensure the scalability and continuous evolution of Lombard’s infrastructure but also unlock trillions of dollars in economic opportunities, strengthening Bitcoin’s role at the core of on-chain finance. -

Protocol Utility

From day one, $BARD gives holders access to and participation in Lombard’s growing suite of products—with priority access, preferential terms, and enhanced features. Over time, its utility will expand through governance-driven innovation, ensuring that $BARD remains at the heart of Lombard’s infrastructure and product ecosystem.

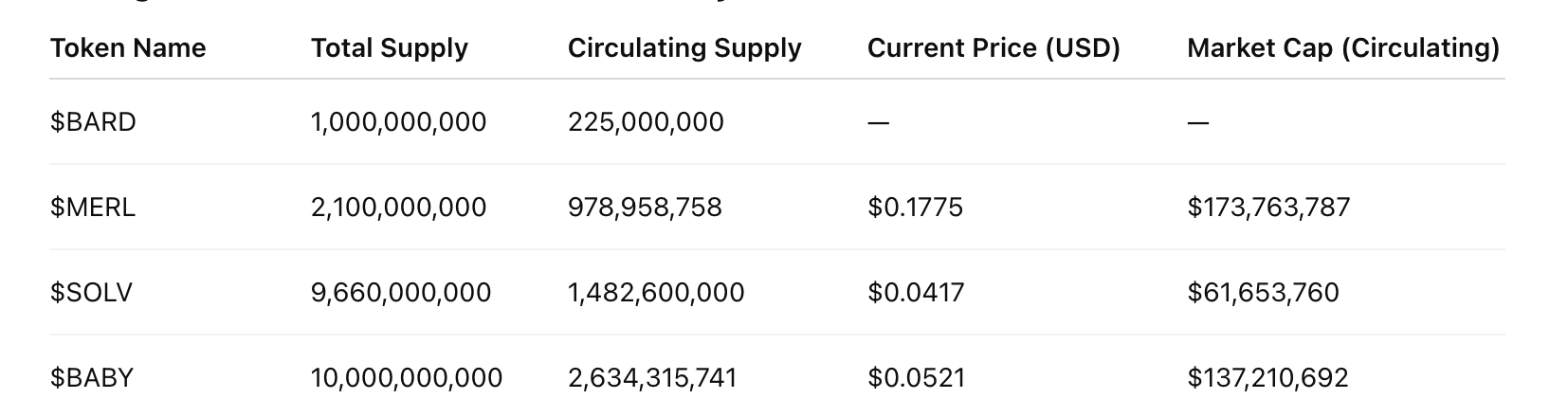

IV. Market Valuation Outlook

Lombard Token, as an emerging DeFi platform project, is initially expected to focus on mainstream financial applications such as lending, staking, and liquidity support. Currently, it is still in the early stages and has not yet been widely tracked by major crypto data platforms. Assuming a circulating supply of 1.2 billion tokens, the circulating market cap is approximately $12 million (at the current price of $0.01). On a fully diluted basis, the market cap would be around $9.5 million. With further adoption progress and increasing market recognition, Lombard Token has strong potential to compete and innovate, positioning itself as a significant player in the DeFi sector.

Comparative Valuation

Based on the market performance of similar tokens within the Bitcoin ecosystem, the current circulating supply of $BARD is 225 million tokens. Its fair value range is estimated between $0.27 and $0.77 per token, corresponding to a circulating market cap of approximately $110 million to $225 million. At the median valuation, $BARD could be priced around $0.61 per token, implying a circulating market cap of about $157.5 million.

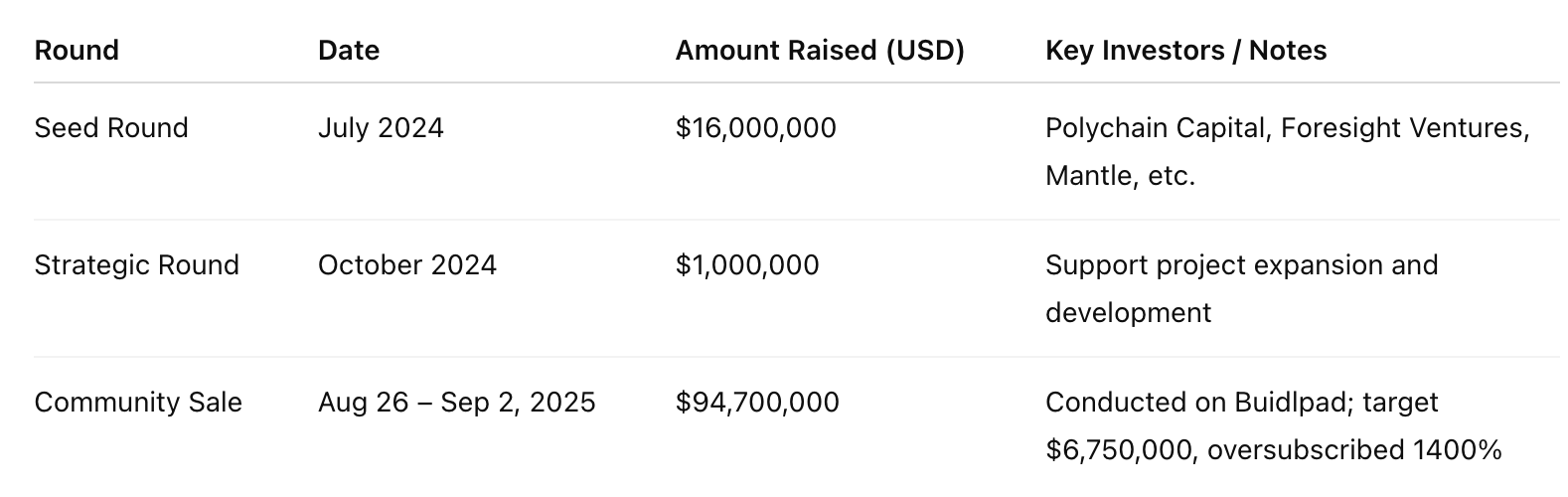

V. Team and Funding Information

-

Jacob Phillips: Co-founder, previously held leadership roles in multiple blockchain projects, responsible for strategic planning and product direction.

-

Olivia Thet: Engineering Director, previously technical lead in several DeFi projects.

-

Matthew Donovan: Head of Business Development, formerly held senior roles in traditional finance, responsible for partnership expansion and market strategy.

-

Charlotte Dodds: Head of Marketing, with extensive experience in blockchain project marketing, specializing in community building and brand promotion.

-

Seed Round (July 2024): Raised $16,000,000, with key investors including Polychain Capital, Foresight Ventures, Mantle, etc.

-

Strategic Round (October 2024): Raised $1,000,000 to further support project expansion and development.

-

Community Sale (August 26 – September 2, 2025): Conducted via the Buidlpad platform, with a target of $6,750,000; the actual subscription amount reached $94,700,000, achieving an oversubscription rate of 1400%.

VI. Potential Risk Disclosures

-

Short-term selling pressure (TGE period): Mainly from early contributors and community sale (~7% of total supply), limited impact.

-

Mid-term selling pressure (after 12 months): Early investors and core contributors start unlocking (~9M tokens/month), may cause price fluctuations if market absorption is insufficient.

-

Long-term pressure (2–3 years): Ecosystem incentives and foundation tokens release linearly; pressure is relatively stable and can be absorbed by ecosystem growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ReChange: NFT-driven engine on the TBC public chain, making every transaction flow like a stream

ReChange enables NFTs to "circulate endlessly."

In this bull market, even those who stand still will be eliminated: only "capital rotation" can survive the entire cycle.

Summary of the 7 deadly mistakes in the crypto market: 99% of traders keep repeating them