ARK Invest’s Bullish holdings near $130M with latest $8.2M scoop

The Cathie Wood-led ARK Invest has bought more than 160,000 shares in the crypto exchange Bullish in the asset manager’s latest scoop of crypto-related stocks.

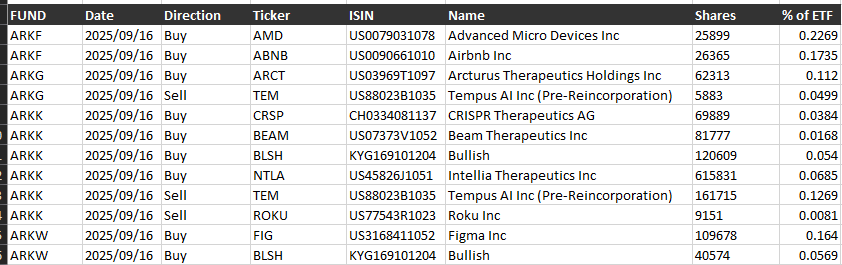

In a filing on Tuesday, the company revealed it bought around $8.21 million worth of Bullish shares across two of its funds, the ARK Innovation ETF (ARKK) and the ARK Next Generation Internet ETF (ARKW), with the funds buying up 120,609 shares and 40,574 shares, respectively.

The firm now holds over $129 million worth of Bullish stock across ARKK, ARKW, and its ARK Fintech Innovation ETF (ARKF).

ARK Invest bought more than 160,000 shares in Bullish across ARKK and ARKW. Source: ARK Invest.

ARK Invest bought more than 160,000 shares in Bullish across ARKK and ARKW. Source: ARK Invest.

ARK has backed Bullish since its debut on the New York Stock Exchange last month, when it acquired 2.53 million shares , worth $172 million at the time.

ARK’s latest buy aims to rebuild Bullish position

The investment firm bought $7.5 million shares in Bullish earlier this month , and had acquired $21 million worth of Bullish stock on Aug. 20.

Despite the recent buys, Ark’s total Bullish holdings across all three of its ETFs currently stand at 2.52 million shares, indicating that the firm has booked some partial profits and is now reacquiring the stock after it fell heavily since its debut.

Bullish stock declines post-IPO

Shares in Bullish (BLSH) soared on its listing day, as the stock touched an intraday high of $118, registering a gain of 218% from its IPO price of $37 .

However, since its debut on Aug. 13, the stock has shed most of its gains and closed trading on Tuesday flat at $51.36, down nearly 57% from its all-time high, according to Google Finance.

The firm reported its revenue dropped 0.2% year-over-year as of the quarter ending March, while its operating income was down 270% during the same period.

Bullish is set to release its second-quarter results on Thursday, its first since its debut.

Analysts are mixed on the exchange, with some neutral, while others are optimistic that it can outperform.

Last week, Jefferies initiated a “hold” rating on Bullish, while JP Morgan and Bernstein assigned a “neutral” rating, according to Yahoo Finance.

Conversely, Cantor Fitzgerald had an “overweight” rating, meaning it thinks Bullish will outperform.

Ark has been accumulating other crypto-related stocks in recent months.

It acquired $4.4 million in BitMine on Sept. 9, which increased its total stack to 6.7 million BitMine shares worth $284 million .

The firm also bought shares of Jack Dorsey-backed financial services company Block, and held $193 million worth of Block shares on Aug. 12.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?

Crypto: Fundraising Explodes by +150% in One Year