XRP treasury firm VivoPower says its latest buy will effectively be at 65% discount via mining swaps

Quick Take VivoPower said its mining arm, Caret Digital, will expand its fleet with “bulk” discounts and swap mined tokens into XRP. The company said this strategy will give it XRP exposure at an effective 65% discount.

VivoPower International (ticker VVPR) said Tuesday its mining arm Caret Digital will expand operations and swap mined tokens into XRP, a move it claims will give the company exposure at an effective 65% discount.

The company did not specify how much XRP it expects to acquire or which mined tokens will be exchanged. Caret Digital currently mines Bitcoin, Litecoin, and Dogecoin, according to its website . XRP is trading over $3, up 1.7% in the past 24 hours, with a market capitalization of about $182 billion, according to The Block’s XRP price page.

VivoPower first unveiled its XRP treasury strategy in May, backed by a $121 million private placement led by His Royal Highness Prince Abdulaziz bin Turki bin Talal Al Saud, chairman of Eleventh Holding Company in Saudi Arabia. Adam Traidman, a former Ripple board member, also participated and joined VivoPower’s advisory board as chairman.

In June, the company said it would use BitGo as its exclusive custodian and over-the-counter trading partner to acquire XRP. Around the same time, it partnered with Layer 1 blockchain developer Flare , which is backed by Ripple Labs, to generate yield on its holdings. VivoPower said the yield program would begin with a $100 million capital allocation with plans to reinvest income directly into its XRP reserves.

Last month, VivoPower announced additional plans to acquire $100 million of privately held Ripple Labs shares through "definitive" agreements with current shareholders, subject to final approval from Ripple’s executive management. VivoPower said that deal would give it exposure equivalent to 211 million XRP at an implied $0.47 per token — an 86% discount to market prices at the time.

VivoPower says its XRP treasury strategy is dual-pronged: combining token swaps from mining activities with Ripple equity purchases to lower average acquisition costs while building deeper exposure to the XRP ecosystem.

In recent weeks, the company has also expanded into other parts of the XRP ecosystem. Its electric vehicle unit Tembo will accept Ripple’s RLUSD stablecoin for payments, and it partnered with Doppler Finance to deploy $30 million of XRP into institutional yield programs, with proceeds reinvested into reserves.

VivoPower’s shares were down about 0.5% Tuesday at $5, giving the company a market capitalization of roughly $50 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

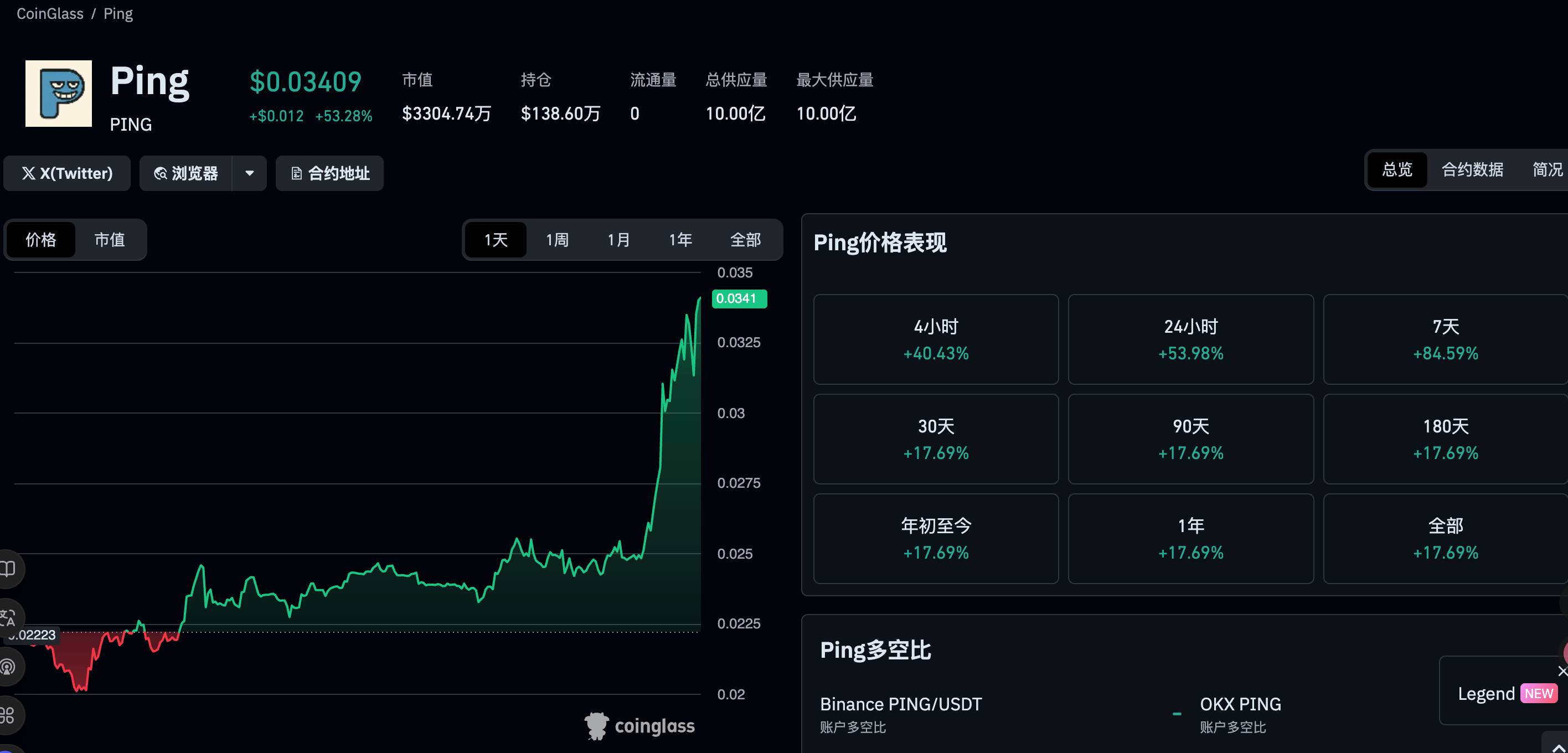

$PING rebounds 50%, a quick look at the $PING-based launchpad project c402.market

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

Crypto Capitalism, Crypto in the AI Era

A one-person media company, ushering in the era of everyone as a Founder.

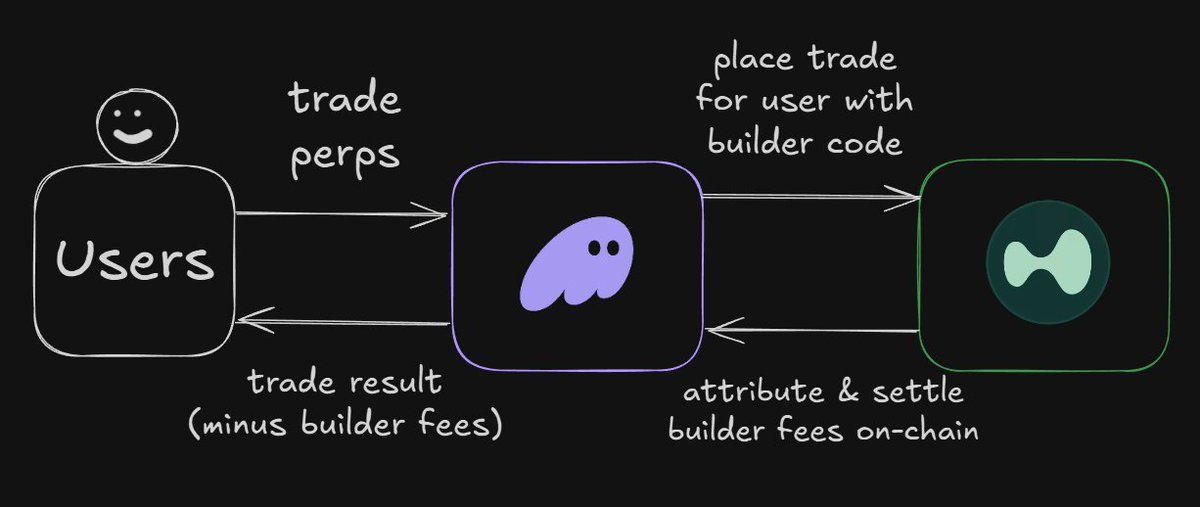

Interpretation of the ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid’s Developer Wealth Creation Myth?

The platform serves as a foundation, enabling thousands of applications to be built and profit.

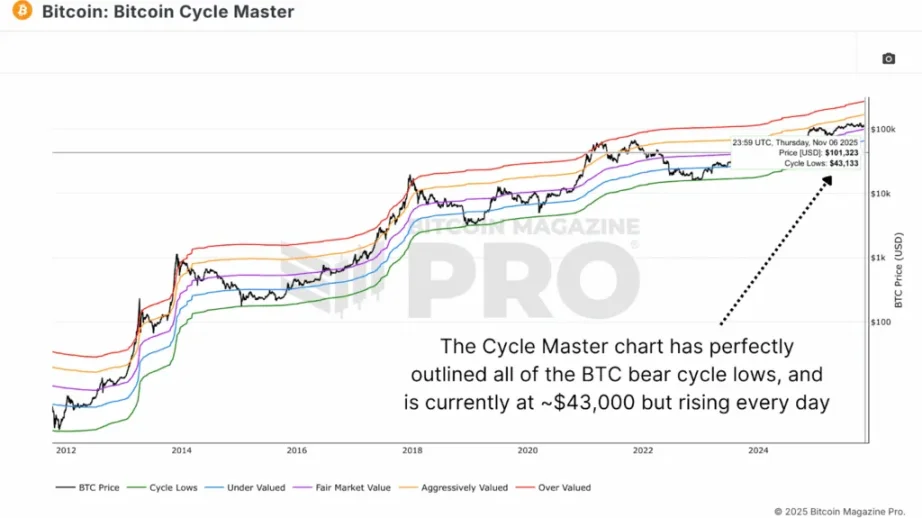

Data shows that the bear market bottom will form in the $55,000–$70,000 range.

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.