Seven Days, Seven DAOs: Proposal for Governance and Market Flows

From Scroll’s governance suspension to Hyperliquid’s USDH battle and Ronin’s Ethereum migration, this week’s DAO proposals could reshape liquidity, incentives, and investor sentiment across DeFi.

Seven major DAO proposals emerged during a turbulent week, including Scroll’s governance shift and the USDH ticker dispute on Hyperliquid. Strategic moves from Ronin and dYdX also contributed to the significant proposals.

These decisions impact their respective ecosystems and could directly affect investors.

DAOs Heat This Week

Over the past seven days, key proposals and debates across major DAOs have painted a volatile picture of on-chain governance. From a Layer-2 (L2) project suspending its DAO operations to crucial votes deciding the future of stablecoins and buyback trends being considered by multiple protocols, the DAO market is hotter than ever.

One of the most shocking announcements came from Scroll, which revealed it would suspend its DAO and change to a more centralized model. This move raises significant questions about the balance between development speed and the philosophy of decentralization. In an era where L2 networks are fiercely competitive, Scroll’s “taking the reins” could allow faster upgrades — but also stir community concerns over transparency and user participation.

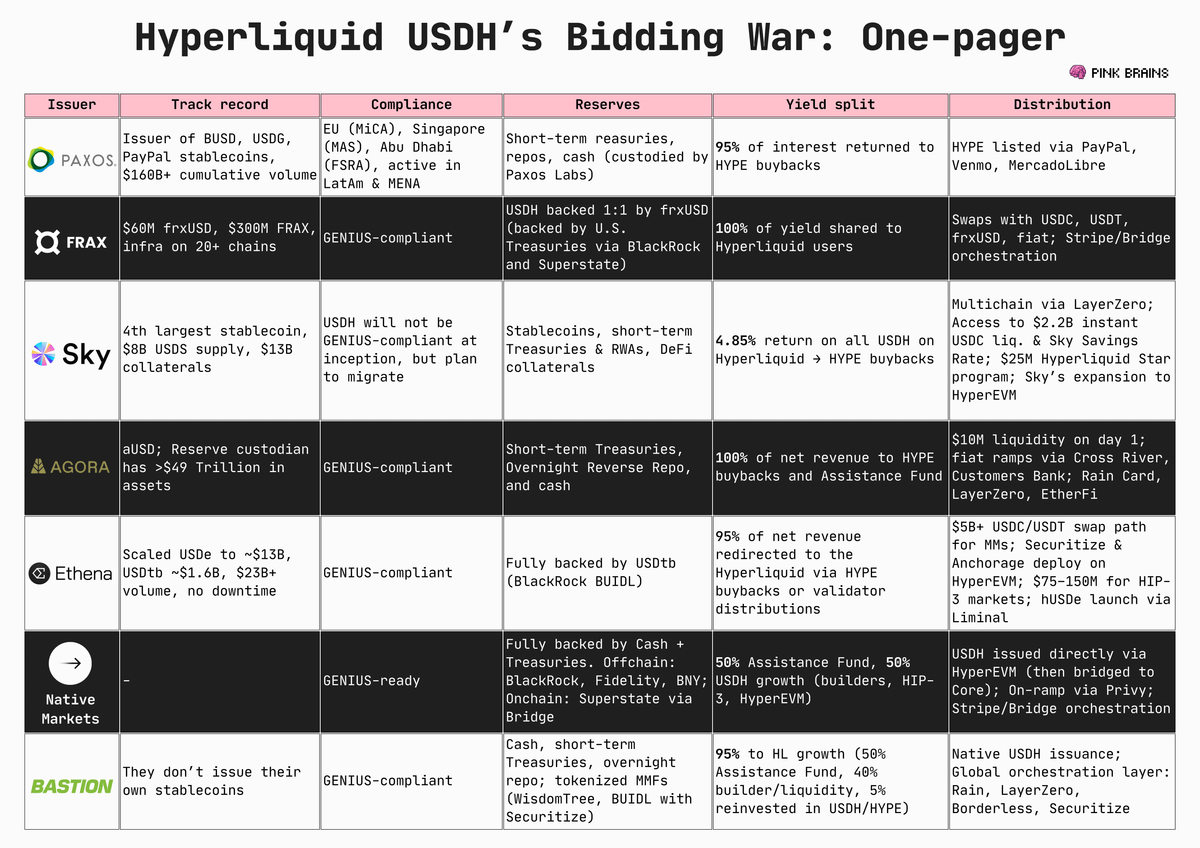

The second central focal point is the validator vote on Hyperliquid (HYPE) to determine ownership of the USDH ticker — one of the platform’s most liquid stablecoins. If control ends up in the hands of a specific group, it could directly impact stablecoin development strategies and trading fees. This battle may reshape capital flows on Hyperliquid and influence the broader DeFi ecosystem.

USDH ticker war. Source:

USDH ticker war. Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Instil Bio Halts Main Drug Development Program

Market Makers See a $0.38–$0.43 Opening for BlockDAG While Ethereum & XRP Hold Firm

Electronic Arts Earnings Outlook: Key Points to Watch