Chainlink price prediction: LINK is showing on-chain accumulation and a bullish technical setup; a confirmed breakout from the symmetrical triangle could target $31–$40 in the short term, with extended targets near $45 if momentum and exchange outflows continue.

-

Major catalysts: ETF filing, SBI partnership, and strong exchange outflows.

-

Technical setup: symmetrical triangle breakout, Fibonacci extensions at $36.33 and $45.07.

-

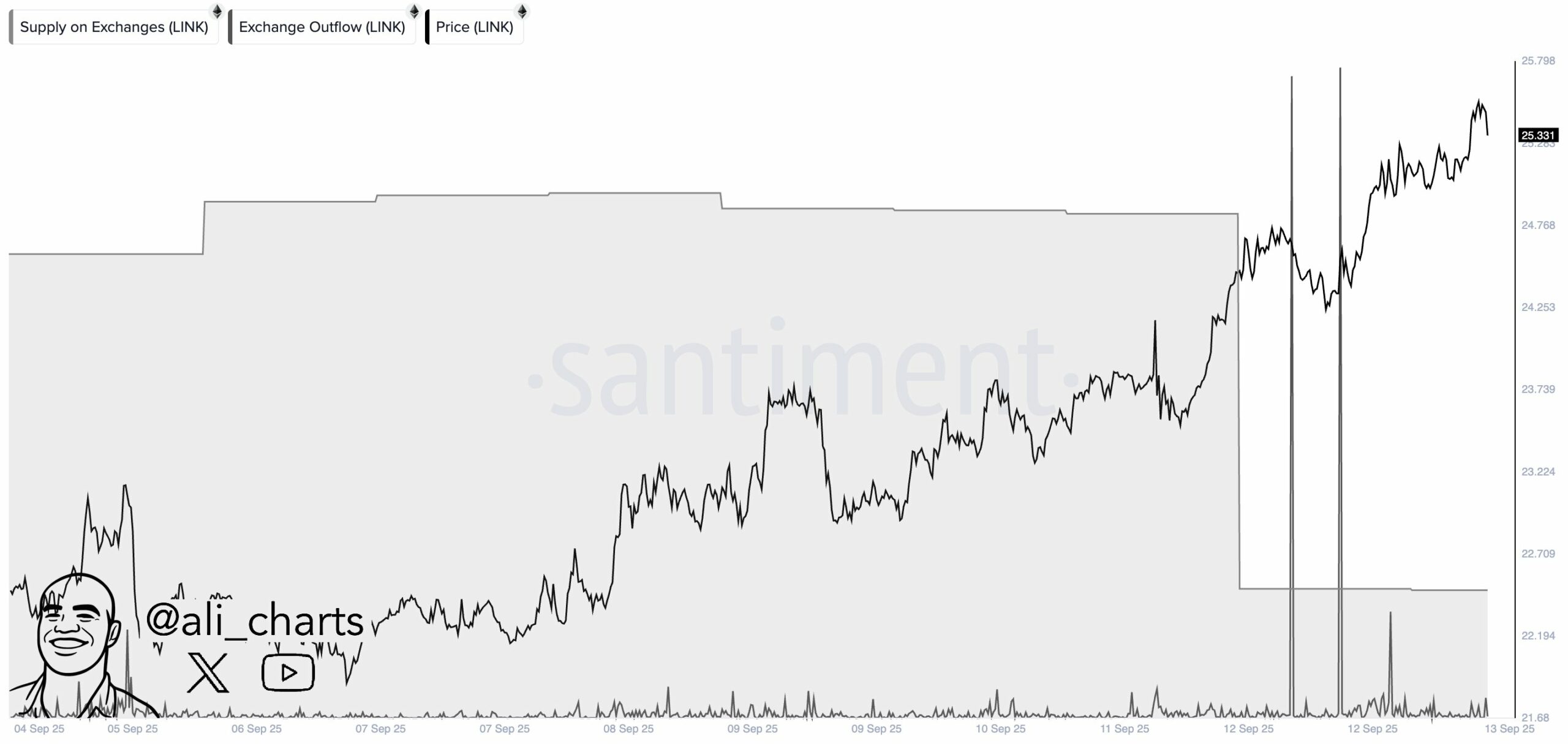

On-chain data: 5.34 million LINK withdrawn from exchanges in 24 hours, signalling accumulation.

Chainlink price prediction: LINK shows accumulation and breakout potential toward $31–$45; read technical targets and trade considerations now.

What is the Chainlink price prediction?

Chainlink price prediction points to near-term targets between $31 and $40 if buyers defend key support and a triangle breakout occurs. Technicals and on-chain withdrawals support a bullish stance, while failure to hold $23.4 would increase downside risk.

How could Chainlink reach $40 and beyond?

Bullish momentum for LINK is being driven by institutional catalysts and sustained accumulation. The recent Bitwise Chainlink ETF filing and a partnership mention involving SBI Holdings increased demand signals.

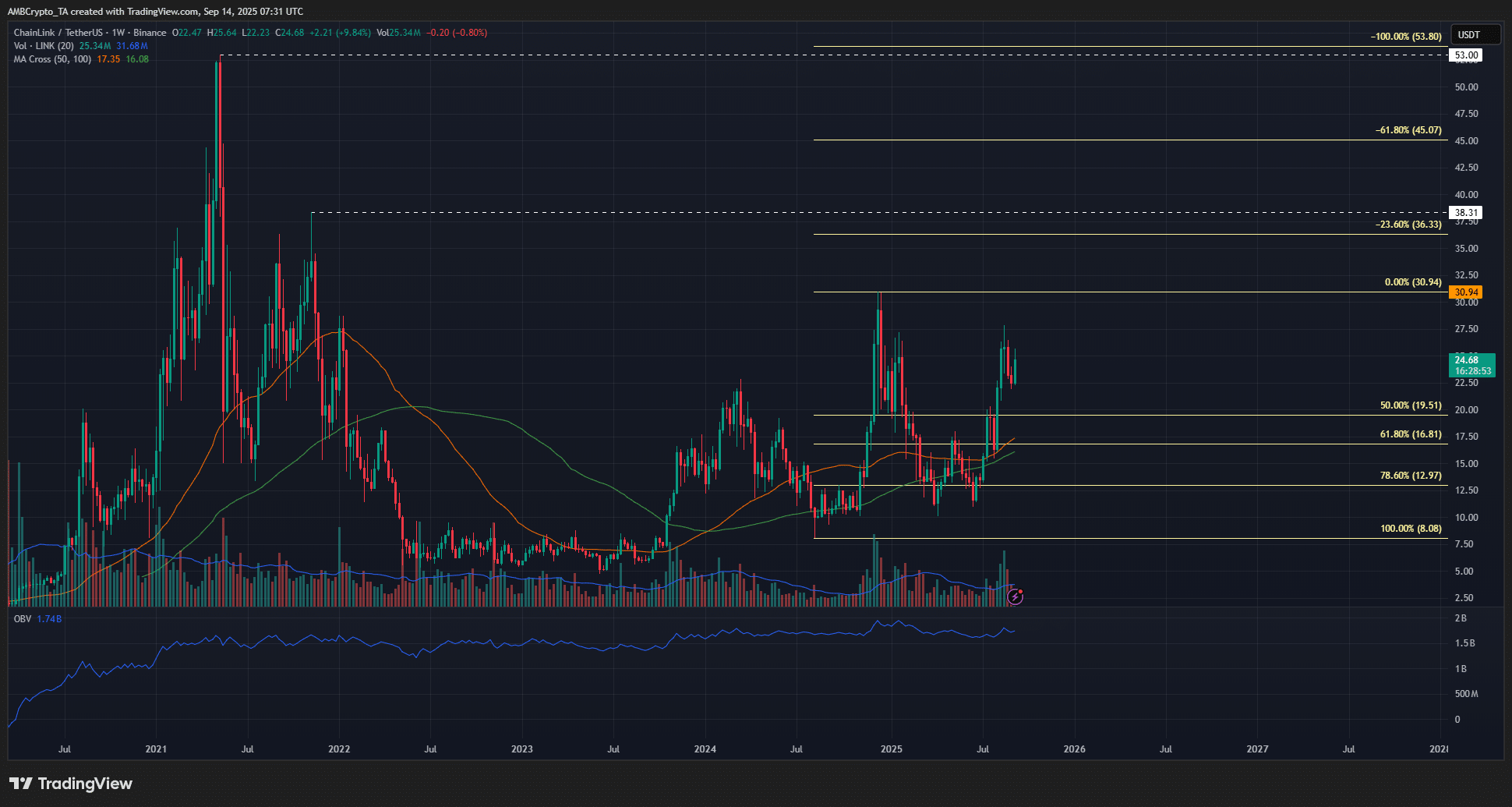

Technically, a symmetrical triangle on weekly charts projects a measured move that supports $31 and $40 targets. Fibonacci extensions from the 2024 rally (from $8.08 to $30.94) indicate extension levels at $36.33 (23.6%) and $45.07 (61.8%).

The analyst view: a technical analyst noted a potential parabolic target near $102 on a large breakout, but nearer-term objectives are $31 and $40 based on current structure. On-chain data shows 5.34 million LINK withdrawn from exchanges in 24 hours—an accumulation signal consistent with rising buying pressure.

Source: Ali Charts

Why do on-chain flows matter for LINK?

Large withdrawals from exchanges reduce available sell liquidity and often precede price increases when demand persists. In LINK’s case, a 24-hour outflow of 5.34 million tokens aligns with accumulation by long-term holders.

Exchange outflows, when combined with ETF-related demand narratives and institutional partnerships, can amplify price moves because they tighten supply while creating new buying pressure.

Source: Ali Charts

How does technical analysis support the targets?

Weekly structure: since mid-2023 LINK has shown bullish structure after breaking above $8. The 2024 rally to $30.94 is the basis for the Fibonacci extension targets at $36.33 and $45.07.

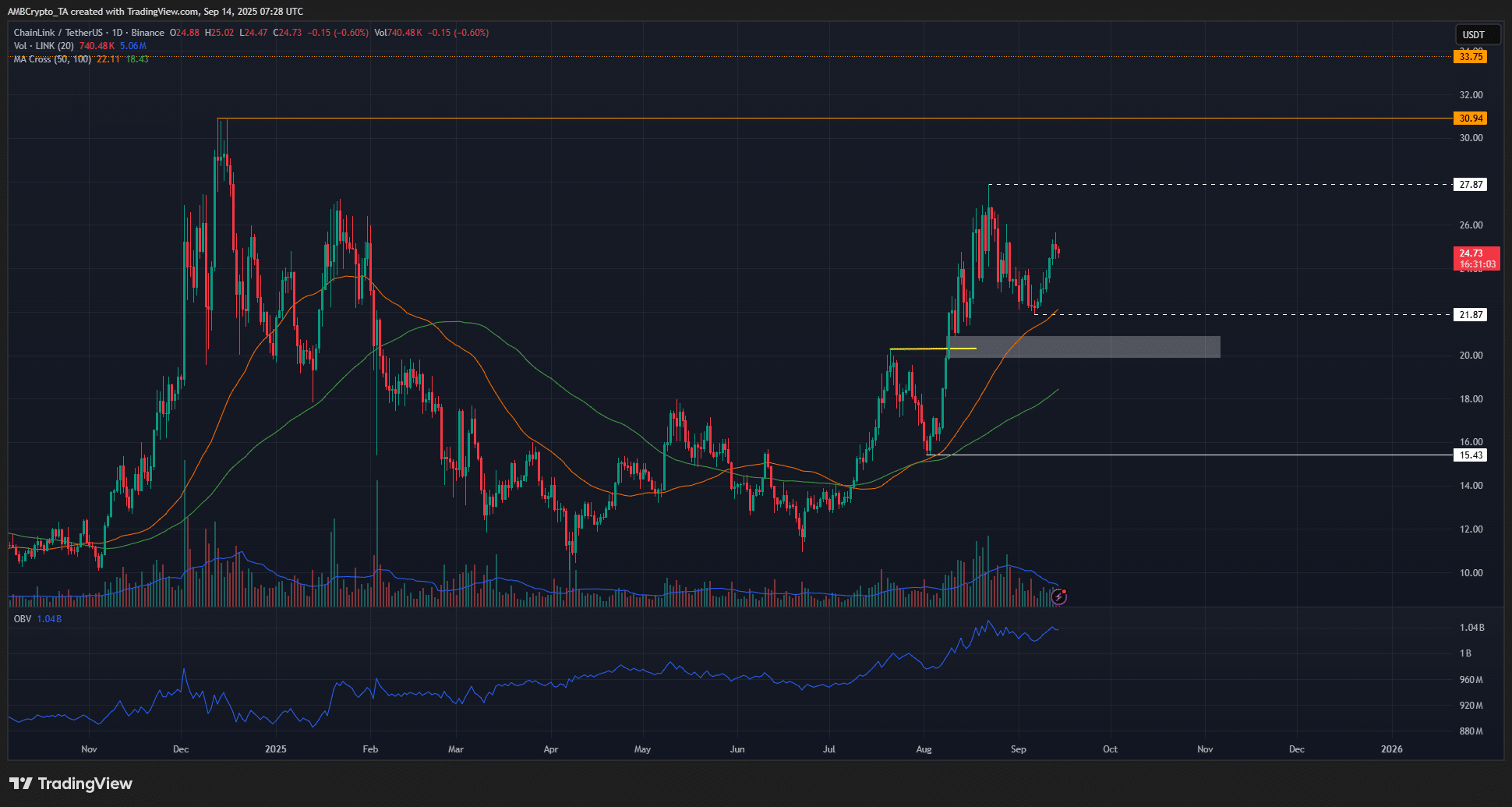

Daily structure: the 1-day chart highlights key swing points at $15.43 and $27.87, with $21.87 as a minor low. Moving averages and OBV supported buyer strength in 2024 before a temporary 2025 pullback.

Source: LINK/USDT on TradingView

Source: LINK/USDT on TradingView

Frequently Asked Questions

Will Chainlink reach $40 this year?

Short-term momentum and accumulation support a potential move to $40, but Chainlink must hold $23.4 and confirm a triangle breakout. Monitor on-chain flows and weekly closes for confirmation.

What are the key support and resistance levels for LINK?

Key support: $23.4 (near-term). Key swings to watch: $21.87 (minor low), $15.43 (deeper support). Resistance targets: $31, $36.33, $40, and $45.07 (Fibonacci extensions).

Key Takeaways

- Bullish catalysts: ETF filing and institutional interest improved demand dynamics.

- On-chain accumulation: 5.34M LINK withdrawn from exchanges in 24 hours, reducing sell-side liquidity.

- Technical targets: $31–$40 near term; $36.33 and $45.07 as higher Fibonacci extension targets. Defend $23.4 to keep the uptrend intact.

Conclusion

Chainlink price prediction combines on-chain accumulation, institutional narratives, and a bullish technical pattern that supports near-term targets between $31 and $40. Traders should watch the $23.4 support and exchange flows; continued withdrawals and a confirmed triangle breakout would strengthen the case for higher extensions.