Key Notes

- Chainlink price hit $25 on Sept 13, notching 15% weekly gains.

- Polymarket confirmed live Chainlink oracle integration on Polygon mainnet.

- Open interest slipped despite a 7% jump in trading volumes.

Chainlink price grazed the $25 mark on Saturday, Sept 13, stretching weekly timeframe gains to 15%. The surge comes as Polymarket officially adopted Chainlink’s feed for the settlement of price-related wagers. Both entities confirmed the operational partnership in a Friday press release , stating the integration is live on the Polygon mainnet.

According to the statement, the upgrade enables the creation of secure, real-time prediction markets across hundreds of crypto trading pairs. It also introduces the potential for Chainlink to settle markets involving subjective questions, reducing reliance on social voting mechanisms and easing resolution risk.

“Polymarket’s decision to integrate Chainlink’s proven oracle infrastructure is a pivotal milestone that greatly enhances how prediction markets are created and settled. When market outcomes are resolved by high-quality data and tamper-proof computation from oracle networks, prediction markets evolve into reliable, real-time signals the world can trust.” Sergey Nazarov, Co-Founder of Chainlink.

By adopting Chainlink data streams , the integration allows for low-latency, verifiable price reports and automated on-chain settlement. This provides Polymarket with near-instantaneous resolution capabilities, particularly in cases involving deterministic outcomes, such as Bitcoin or Ethereum price predictions .

The LINK price action reflected initial enthusiasm around this news on Friday, before momentum flash overheating signals.

Coinglass’ derivatives data reinforces this narrative as Chainlink open interest held at $1.7 billion, down 0.02% intraday, even as trading volumes climbed 7.3%. This suggests the majority of the intraday speculative activity was from traders trimming down LINK futures positions, as market sentiment approaches euphoric peaks.

LINK Price Forecast: Can Bulls Sustain Momentum Above $25?

From a technical perspective, the daily Chainlink price chart shows a 15.9% rally over six sessions, bouncing from the $22 support level, to intraday peaks around $25 on Saturday.

The 5-day and 8-day SMAs have crossed back above the 13-day, forming a Golden Cross signal at $24. RSI sits at 65, below overbought territory, indicating room for more upside.

Chainlink (LINK) Technical Price Forecast | TradingView, LINKUSDT 24H Chart, Sept 13, 2025

If LINK price closes decisively above $25, the next key target lies near $28, where the 42% breakout in reactions to data partnership with the US Government halted in August.

On the downside, failure to hold above $24 could invite a retest of the $23.30 support area. A breakdown below that would nullify the active Golden cross upside catalyst, potentially sending LINK towards the next psychological support level at $20.

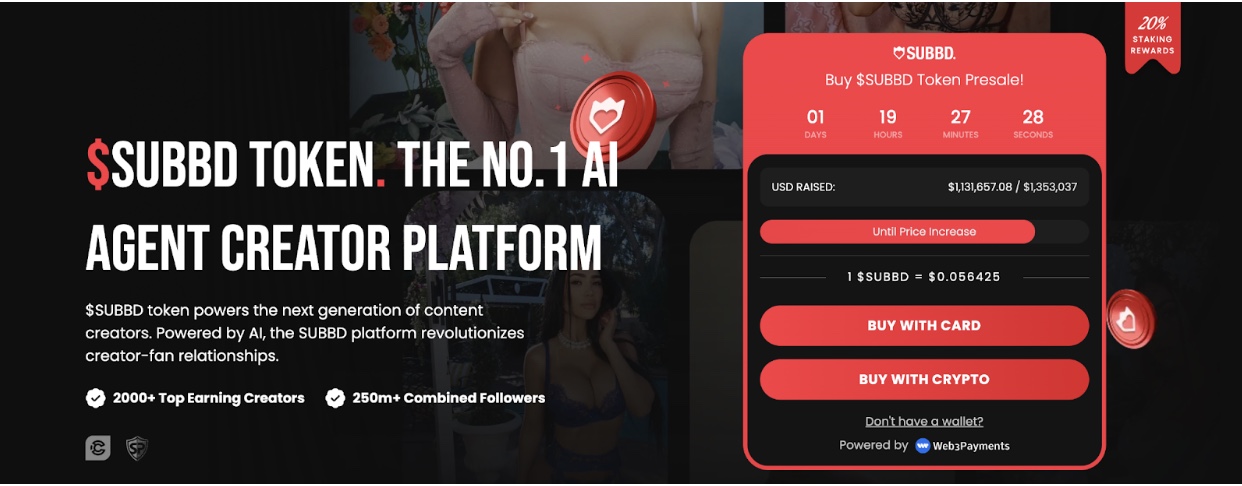

SUBBD项目最新进展引发市场关注

随着Chainlink受益于近期的机构合作,早期项目如SUBBD($SUBBD)凭借其创新的实用功能也在获得关注。

SUBBD将创作者与粉丝的互动和现实应用场景结合,使粉丝能够与创作者进行互动,并利用AI驱动的内容个性化服务。

SUBBD 相关图片