Galaxy CEO: The Crypto Market is Entering the "Solana Season"

Galaxy Digital CEO stated that significant institutional funds are flowing in, and Forward Industries has completed a $1.65 billion financing round to build the world's largest Solana reserve strategy.

Galaxy Digital CEO stated that institutional funds are flowing in significantly, and Forward Industries has completed a $1.65 billion financing round to build the world’s largest Solana reserve strategy. The regulatory environment has improved markedly, with SEC Chairman Atkins supporting on-chain operations and stating that most crypto tokens are not securities. Experts predict that with ETF approval and corporate purchases, Solana will experience a rally similar to that of bitcoin and ethereum.

Written by: Dong Jing

Source: Wallstreetcn

The cryptocurrency market is ushering in a new turning point. Driven by the accelerated inflow of institutional funds and a significant shift in regulatory policy, the “alternative coin” Solana is receiving increasing market attention.

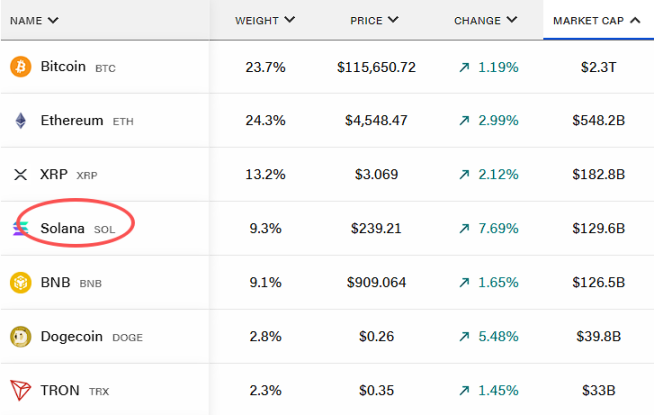

On September 12, according to media reports, Galaxy Digital CEO Mike Novogratz said that the cryptocurrency market is entering what he calls the “Solana season,” with both market momentum and regulatory signals tilting toward this blockchain. SOL’s market cap has surpassed $126 billion, hitting a new all-time high, and has now overtaken BNB to become the fifth largest cryptocurrency by market capitalization.

In an interview with CNBC on September 11 local time, Novogratz stated that asset management companies focusing on alternative coins (altcoins) are injecting new vitality and capital into this sector.

He specifically mentioned Forward Industries’ recent $1.65 billion financing round, led by Galaxy Digital, Jump Crypto, and Multicoin Capital, aimed at building the world’s largest Solana asset reserve strategy.

Meanwhile, the regulatory environment is undergoing significant changes. U.S. Securities and Exchange Commission Chairman Paul Atkins recently stated that the agency is working to “modernize securities rules and regulations so that our markets can move on-chain.” Novogratz described this stance as a “fundamental shift” from previous policies and sees it as a signal for accelerated institutional adoption.

These developments indicate that Solana is receiving dual support from both regulators and capital markets, laying the foundation for it to occupy a more advantageous position in blockchain competition.

Large-scale Institutional Capital Inflows into the Solana Ecosystem

According to reports, Forward Industries’ $1.65 billion financing represents a significant expression of institutional confidence in the Solana ecosystem.

This capital will be used to build the world’s largest Solana reserve strategy, demonstrating professional investment institutions’ recognition of the long-term value of this blockchain platform.

Novogratz pointed out that crypto asset management companies focusing on alternative coins are becoming new drivers of the market. These companies not only bring in capital, but more importantly, inject new vitality and professional operational models into the entire cryptocurrency ecosystem.

Bitwise Chief Investment Officer Matt Hougan also expressed a similar view, predicting that the “Solana season” is beginning.

Hougan believes that the anticipated ETF approval, subsequent capital inflows, and corporate treasury purchases will drive a rally similar to that of bitcoin and ethereum.

Major Shift in Regulatory Attitude

Recently, U.S. SEC Chairman Atkins has made a series of statements supporting cryptocurrencies, including that entrepreneurs and investors should be able to raise funds on-chain “without facing endless legal uncertainty.”

He also reiterated that “most crypto tokens are not securities” and are not within the SEC’s regulatory scope. Novogratz believes these comments “are pushing things in the right direction.”

In addition, Nasdaq has submitted a rule change application to the SEC, seeking approval to allow tokenized versions of listed stocks and ETFs to trade on the same order books as traditional trading products. If approved, this change could activate a blockchain-based settlement system as early as the third quarter of 2026.

Novogratz stated that blockchain is now fast, secure, reliable, and trustworthy, and with regulatory frameworks in place, it is ready for adoption by Wall Street.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH volatility surges: On-chain liquidity and leverage risks trigger market turbulence

Bitcoin hits 6-month low as AI fears add to risk-off mood: How are pro traders positioned?

Kiyosaki Predicts Massive Money Printing

ETF Canary Launch Has Little Impact On XRP