Finally, a token launch platform that requires mandatory disclosure of selling purposes.

The first step in issuing a token: it is essential to give the token real value.

The first step in issuing a token: it must be endowed with real value.

Written by: Eric, Foresight News

A token issuance platform called Soar, whose X account was registered just two months ago and has fewer than 2,000 followers, has gone viral due to an article that garnered over 350,000 views.

In this article, Soar does not shy away from criticizing the current chaos in the cryptocurrency market, directly pointing out three major issues: tokens being issued without real value, lack of transparency in token sales, and founders having no incentive to focus on long-term value due to low token holdings.

Soar has decided to try to bring some change to the industry with a new token standard, which is currently patent-pending, and a new platform. At present, the project team has only provided some conceptual explanations of the new token standard and stated that further clarification will be given before the official launch. Based on the available information, I will describe Soar’s operating mechanism.

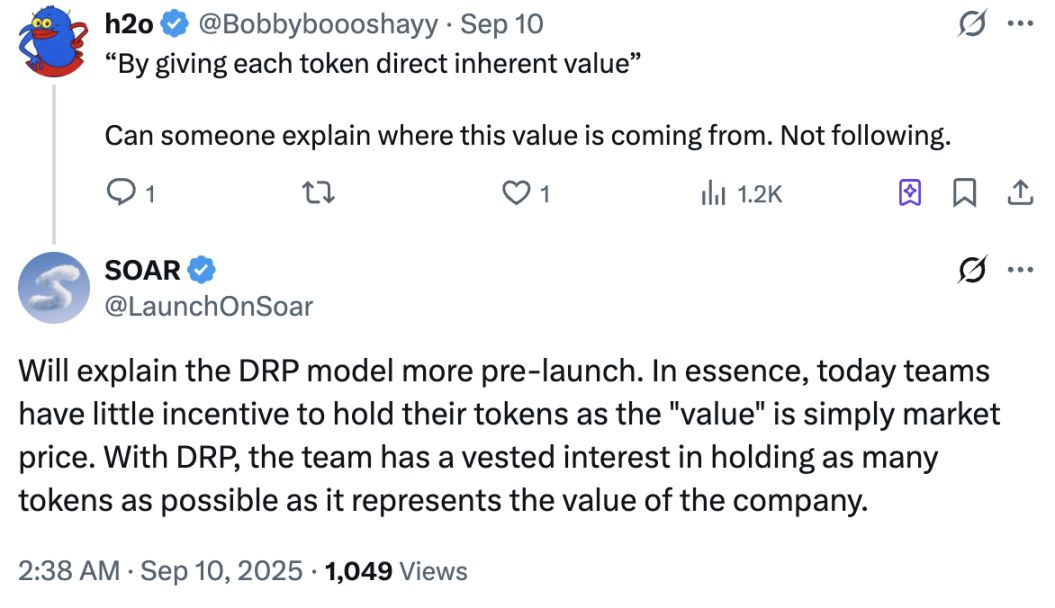

The new token standard launched by Soar is called DRP (Digital Representation of Participation). Regarding the DRP mechanism, Soar has provided a rather obscure explanation:

- Tokens deployed under the DRP standard, both in nature and in fact, will not and never will constitute any form of equity;

- They only represent a specific value relationship: reserved value, or value that should belong elsewhere;

- This relationship is governed by a private contract (“agreement”) between the token deployer (“issuer”) and the entity providing the DRP standard (“provider”);

- Under the DRP standard, the issuer loses a certain amount of value when deploying tokens, but can regain that value at any time by reclaiming the tokens;

- After the initial deployment, the issuer must wait for a period of time before releasing any of its reserved tokens to the market (“holding period”);

- After the holding period ends, whenever the issuer releases previously held tokens, it must clearly disclose to the public the number of tokens to be released and the reason (“disclosure”);

- After any disclosure, the issuer must wait for another period of time before releasing the tokens to the market;

- At any point in time, the agreement will automatically reflect the relative value between the issuer and the provider, and will have specific trigger conditions (“events”). Once triggered, the relevant value will be automatically settled between the two parties;

- The DRP standard also includes many other mechanisms/functions to enhance transparency, strengthen accountability, and create incentive balance between token holders and issuers.

Under this standard, the company acts as the token issuer, and Soar acts as the provider of the DRP standard:

- The company itself holds a certain number of such tokens, which represents the value reserved by the company at any given time;

- The portion of tokens not held by the company at any given time (i.e., held by external parties) corresponds to the value that the company no longer reserves or controls at that time;

- According to the private contract, Soar is entitled to receive, and the company should prioritize payment to Soar of the above-mentioned unreserved value;

- Once a Company Liquidity Event occurs, Soar becomes the recipient of such value and can decide how to dispose of it.

Overall, tokens issued under the DRP standard must have a predetermined “value relationship” at the time of issuance. This value relationship means that the token must represent a specific value, such as company value, and cannot simply be issued as a governance token. Moreover, this value relationship is contractually bound in advance.

However, Soar also states that such tokens will not be equity. I speculate that Soar aims to launch a token that can represent the specific value of an entity but is not subject to traditional equity restrictions, thereby clarifying from the outset what the issued token actually is.

After the token is issued, the issuer must hold it for a period of time before selling its own tokens. Before selling, the issuer must disclose the intention and specific quantity to be sold, and even after disclosure, must wait for another period before the sale can officially take place.

The most difficult part of the DRP mechanism to understand is the so-called value that the token issuer (i.e., the company) needs to pay to Soar when certain conditions are triggered. I believe this mechanism is similar to “privatization delisting” in the stock market, where if a listed company wants to go private, it must buy back publicly issued shares so that the public holding falls below the exchange’s requirements. In Soar’s design, tokens not held by the “company” must be accounted for by the “company” when it plans to liquidate, which largely prevents rug pulls.

Soar clearly states that the DRP design draws on some regulations from traditional securities markets, fundamentally blocking the behavior of arbitrarily issuing tokens, selling them, and then rug pulling. Tokens issued under this standard must represent real value and strictly comply with pre-sale disclosure rules.

Since Soar has not provided additional information, this is all the conclusions we can draw for now. I have always believed that the prerequisite for the next altcoin bull market is to solve the question of “what exactly do altcoins represent.” Currently, the tokens issued by many projects cannot be linked to the actual value of the project, nor does any project clearly explain what its issued tokens represent. These issues are likely the biggest obstacles for investors who favor cryptocurrencies but currently only dare to choose bitcoin.

Although Soar’s mechanism design standards are very strict, whether these standards are implemented through a “gentleman’s agreement” or at the smart contract level, and how to ensure that the “company” will be responsible for tokens in circulation in the event of liquidation, all require more information from the project.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Saylor Dismisses Sell-Off Rumors as Strategy Increases Bitcoin Holdings Amid Market Drop

Coinpedia Digest: This Week’s Crypto News Highlights | 15th November, 2025

Cathie Wood’s ARK Invest Buys Circle, BitMine, and Bullish Shares Amid Market Dip