Ethereum Hit by Rare Mass Slashing as 39 Validators Penalized Over SSV Network Errors

Contents

Toggle- Quick Breakdown

- What Triggered the Slashing

- Slashing Still Uncommon, But Scale Raises Concerns

- Timing Amid Staking Pressure

Quick Breakdown

- 39 validators were slashed due to operator errors tied to SSV Network’s DVT.

- Each validator lost around 0.3 ETH ($1,300), with inactivity leaks worsening the impact.

- The event underscores how human error, not protocol flaws, remains Ethereum’s biggest slashing risk.

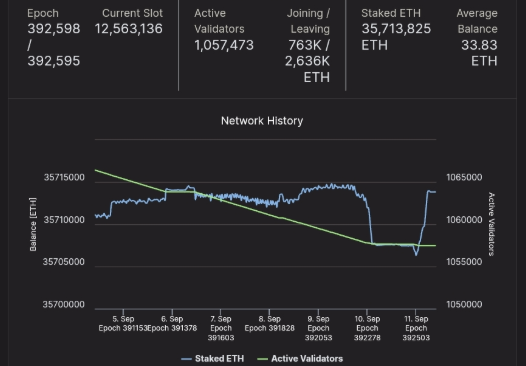

Ethereum has faced a rare mass slashing incident that saw 39 validators penalized on September 10 according to data from blockchain explorer Beaconcha.in, making it one of the biggest coordinated slashing events since the network transitioned to proof-of-stake (PoS) in 2022.

What Triggered the Slashing

The penalties were traced to operational mistakes linked to third-party staking providers utilizing SSV Network’s distributed validator technology (DVT). Ankr reportedly caused slashing during routine maintenance. A migration mishap at Allnodes resulted in duplicate validator setups, compounding the losses.

Source:

Beaconchain

Source:

Beaconchain

Each validator lost about 0.3 ETH (roughly $1,300), with inactivity leaks deepening the financial hit. Crucially, the slashing was not due to protocol-level bugs or malicious intent but rather human error and poor infrastructure handling.

Slashing Still Uncommon, But Scale Raises Concerns

Since the Beacon Chain’s launch in 2020, fewer than 500 of Ethereum’s 1.2 million validators have been slashed. While rare, this latest episode highlights how simple operational missteps can cascade into significant financial damage, even with advanced systems like SSV’s DVT in play.

Timing Amid Staking Pressure

The incident comes at a moment of heightened stress for Ethereum’s staking ecosystem; Over 699,000 ETH entered the exit queue in August, stretching withdrawal delays to as long as 12 days. According to Validator Queue data, more than 2.5 million ETH now await unstaking, the highest level in 18 months, with a 45-day queue currently in place. Meanwhile, Ethereum’s price has been under pressure, though institutional interest remains firm.

Despite the turbulence, Ethereum has added over 50,000 new validators since May 2025, a trend fueled by clearer U.S. regulatory guidelines that are drawing in institutional players. The foundation also launched a “Trillion Dollar Security Initiative” to enhance the security and resilience of the Ethereum blockchain. This program aims to protect the network, which supports a wide range of decentralized finance applications, NFTs, and smart contracts.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial listing] Bitget to list Theoriq (THQ). Grab a share of 3,016,600 THQ

CandyBomb x VSN: Trade VSN, XRP or SOL to share 2,931,200 VSN

New users get a 100 USDT margin gift—Trade to earn up to 1088 USDT!

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— Enjoy up to 10% APR and trade to unlock an additional pool of 50,000 USDT