Meteora TGE Sparks Hype But Raises Allocation Concerns

Meteora’s October MET TGE could mark a breakthrough for Solana DeFi, but risks from concentrated allocations and post-airdrop sell pressure loom large.

Meteora, the leading dynamic liquidity protocol on Solana, has entered a “hot” phase as it announced plans regarding its Token Generation Event (TGE) in October, with MET as the core token.

Meteora’s points system has already attracted hundreds of thousands of wallets. This event will likely create a new wave in the DeFi market alongside the existing system. However, it also carries significant risks from allocation and sell-off pressures. It will be a crucial test of Meteora’s potential breakthrough in Q4 2025.

What is Meteora?

Meteora is a dynamic liquidity protocol within the Solana (SOL) ecosystem. It is widely recognized for its Dynamic Liquidity Market Maker (DLMM) model, which enables optimized capital efficiency and trading fees.

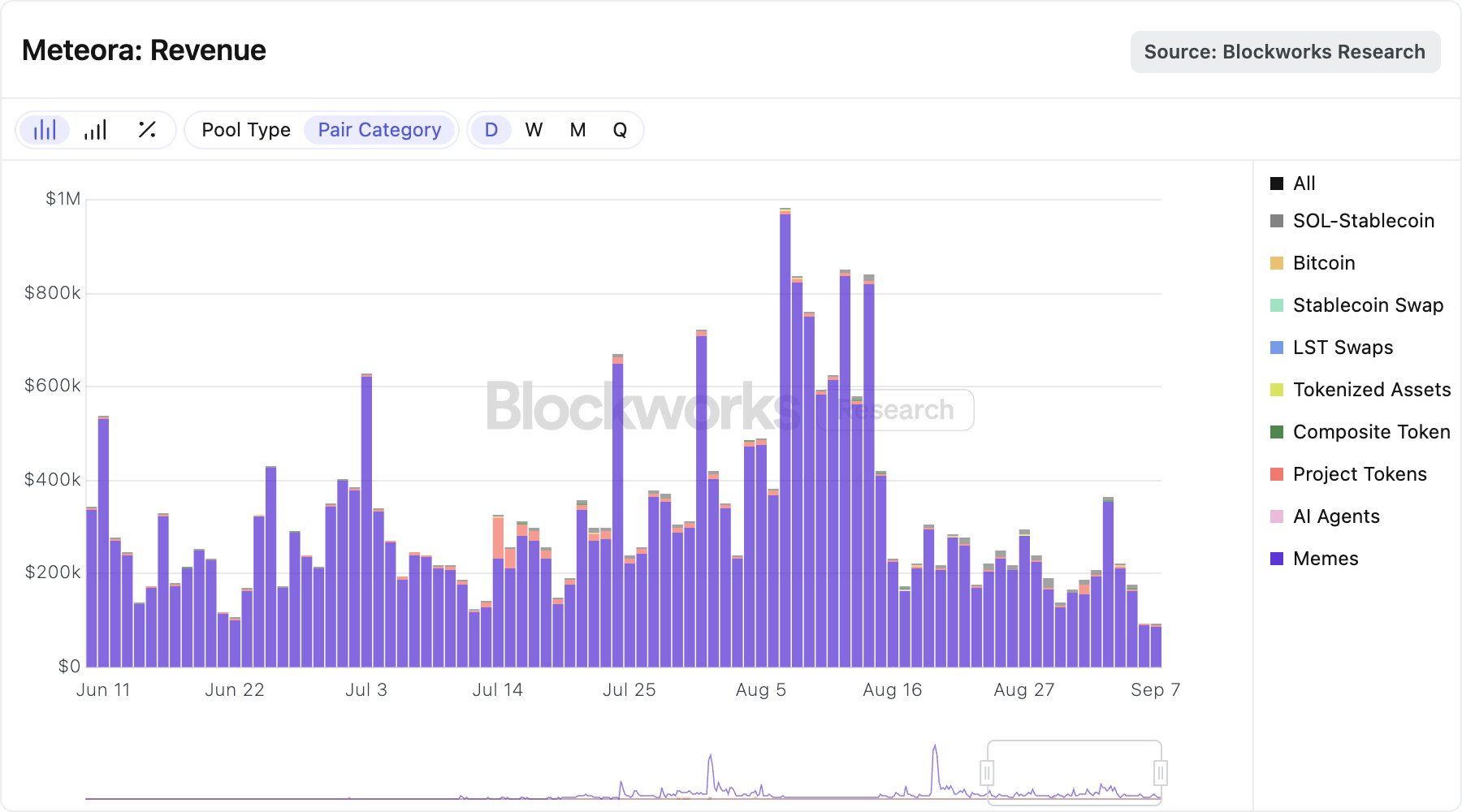

Meteora has made around $10 million in revenue in the past 30 days. Almost all of this revenue is from memecoin trading activity. August was Meteora’s second-best month on record for SOL-Stablecoin volumes with $5.5 billion.

Meteora revenue. Source:

Blockworks

Meteora revenue. Source:

Blockworks

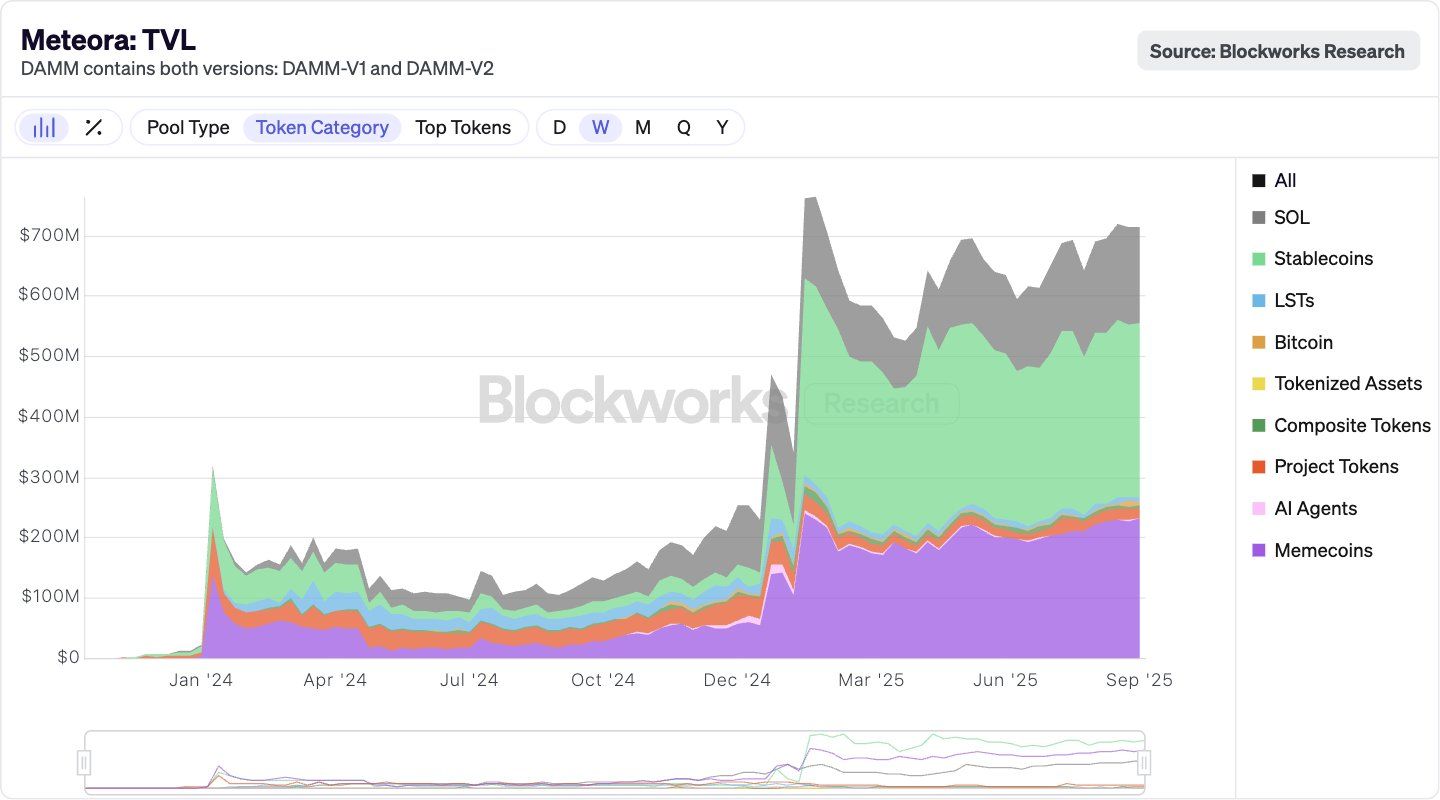

Meteora has over $700 million in TVL, $300 million in stablecoins, and over $150 million in SOL. Jupiter (JUP) is the most popular DEX aggregator (80% of DEX aggregator volume) that Meteora traders use. Retail/permissionless pools earned over $15 billion last month in LP fees, and meme coin pools were the most popular.

Meteora TVL. Source:

Blockworks

Meteora TVL. Source:

Blockworks

MET Token Generation Event

The project has officially confirmed hosting a Token Generation Event (TGE) in October, with MET as the central element. This represents a pivotal moment for Meteora and the broader Solana ecosystem, as MET will become a direct link within the liquidity mechanisms the project is building. How MET is integrated into liquidity pools, staking programs, or incentive structures will significantly impact the token’s intrinsic value and the market’s reaction immediately after TGE.

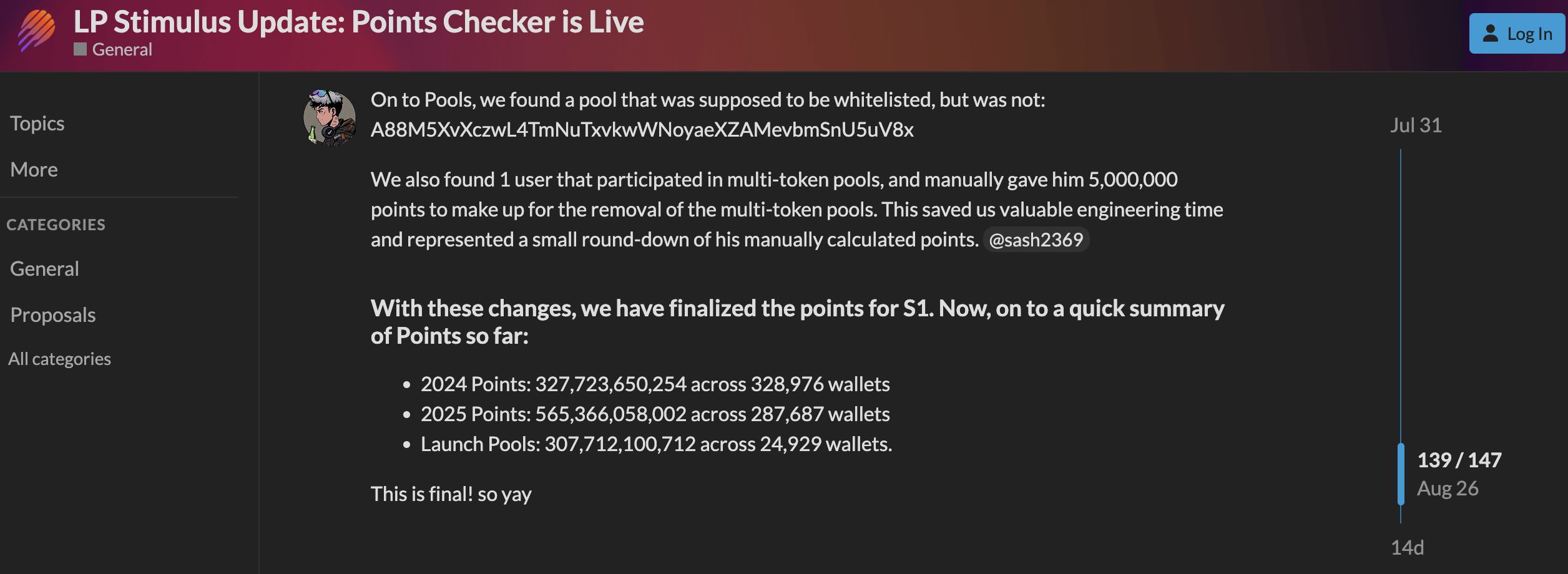

The distribution of MET tokens for Season 1 is based on a points mechanism. The data shows approximately 327.7 billion points (2024) were distributed across 328,976 wallets. Additionally, 565.3 billion points (2025) were distributed across 287,687 wallets. The launch pool distributed 307.7 billion points across 24,929 wallets.

Number of Points allocated in Meteora. Source:

Meteora

Number of Points allocated in Meteora. Source:

Meteora

This allocation highlights a significant imbalance in concentration. While hundreds of thousands of wallets received points from regular activities, only about twenty-five thousand in the launch pool captured a disproportionately large share.

In particular, the “Airdrop Claim” mechanism, which allows users to claim tokens directly from the pool, can accelerate liquidity but may also expose the market to sudden price fluctuations if not adequately controlled. This means higher reward concentration and the risk of significant sell pressure as soon as Meteora’s TGE occurs.

However, MET has not yet officially disclosed the full details of its tokenomics. These missing details include total supply distribution, community allocation, and team vesting schedules. The company also hasn’t revealed DAO vesting or any cliff schedules. Previously, Meteora proposed allocating 25% of the MET token supply to Liquidity Rewards and TGE Reserve.

The October TGE is a decisive milestone for Meteora. It marks MET’s official debut and is a real-world test of the protocol’s dynamic liquidity model. Still, risks of concentrated allocations, potentially unfavorable vesting terms, and post-airdrop sell pressure remain challenges that investors must carefully navigate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OracleX Global Public Beta: Restructuring Prediction Market Incentive Mechanisms with "Proof of Behavior Contribution"

OracleX is a decentralized prediction platform based on the POC protocol. It addresses pain points in the prediction market through a dual-token model and a contribution reward mechanism, aiming to build a collective intelligence decision-making ecosystem. Summary generated by Mars AI The content of this summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Bitcoin is not "digital gold"—it is the global base currency of the AI era

The article refutes the argument that bitcoin will be replaced, highlighting bitcoin's unique value as a protocol layer, including its network effects, immutability, and potential as a global settlement layer. It also explores new opportunities for bitcoin in the AI era. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?