Is the biggest on-chain bull market about to break out? Are you ready?

The article believes that the crypto sector is experiencing the largest on-chain bull market in history. Bitcoin remains bullish in the long term, but its short-term risk-reward ratio is not high. There is a surge in demand for stablecoins, and regulatory policies will become a key catalyst. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

You’ve come at just the right time, catching the biggest on-chain bull market in crypto history. In this article, I’ll break down how, why, and when it’s about to happen, and answer the questions everyone should be asking.

Mainstream Coins and On-Chain

Let’s start with bitcoin—every other cryptocurrency isn’t even worth mentioning. As I write this, bitcoin is trading at $111,000. In terms of short-term positions, the risk-reward ratio here isn’t attractive. Of course, in the long run, the path forward is obvious.

"As a crypto newbie, one of the quickest ways to expose yourself as an outsider is to ask: What’s the reason for bitcoin’s surge today? Its path to a million dollars is destined, and there’s never a need for a reason at any given time." —Degenspartan

During Trump’s presidency, even his sons threw out a $150,000 price target. Reasonable, but honestly: a 1.5-2x return just isn’t enough for me.

This is just the beginning

Current On-Chain Status

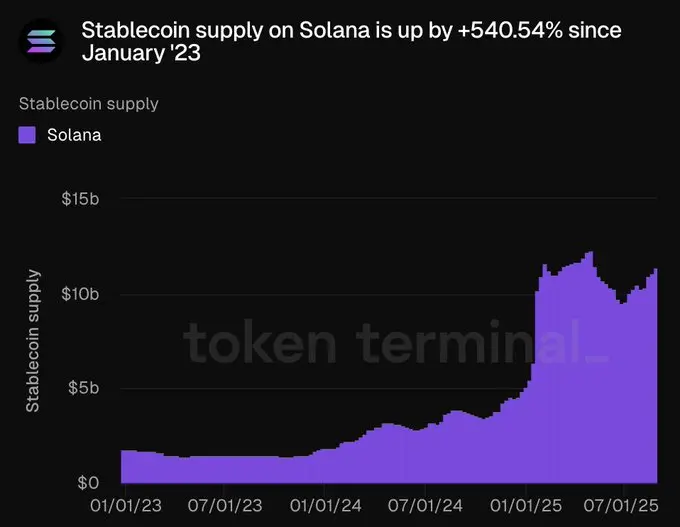

Stablecoin metrics on Ethereum and Solana have both hit all-time highs. This is likely the first wave of crypto treasury capital being deployed on-chain. As mainstream coin prices approach all-time highs, demand for stablecoins is also increasing.

However, the crypto community’s atmosphere feels like the peak of a bear market. Crypto Twitter is filled with meme coin traders who used to be washed-up forex course promoters, and “entrepreneurial” TradFi types running platforms with only 12 users.

Why?

Stablecoins seem to be performing well

Trump Breaks the Cycle

Trump’s presidency broke the traditional four-year halving cycle. Bitcoin is now deeply integrated into Wall Street; you could say BlackRock has taken the lead. The core question now is whether bitcoin will behave like a safe-haven asset (gold) or a leveraged Nasdaq alternative.

The market narrative has been fully priced in, even over-priced. The only thing that truly matters now: liquidity inflows and outflows.

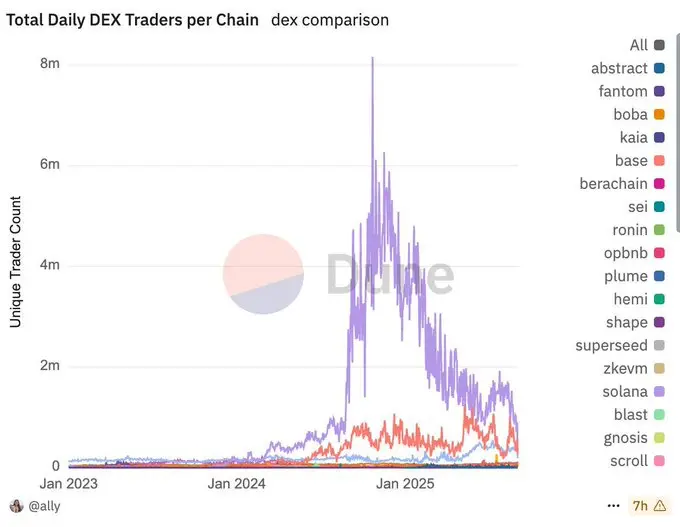

On-chain trading is tougher than ever, and the launch of Trump meme coins marked the peak of the last cycle. Since then, countless meme coins have gone to zero. While the game continues among players, on-chain data doesn’t lie.

Bottom confirmed?

The Meta-Narrative Is Brewing

We’re currently in a narrative vacuum. There’s a lack of liquidity and no clear main storyline. Three major narratives are being tested:

1. Confidence Assets

Meme coins are upgrading to a corporate model, with communities becoming “religious” and shifting toward revenue-generating businesses. The bar has been raised: being funny is no longer enough. The future will be meme coins backed by capital, narrative teams, and existing crypto communities. A true community war is about to begin.

2. Creator Capital Markets

Pumpfun and similar platforms are merging meme culture with streaming. This model is still in its early stages—maybe even too early—and early stages often mean maximum monetization. But if it continues to develop, it could completely change how the creator economy accesses liquidity.

3. DeFi

Loved by quant traders, scoffed at by speculators. As TradFi chases yield, DeFi will see explosive growth, but the real speculative opportunities lie elsewhere. Some projects (like PENDLE) may perform well, but DeFi’s essence is more like infrastructure than speculative mania.

Sorry, bro

The Real Catalyst: Regulation

In the age of AI, the truly important catalysts are those factors the market can’t price in instantly: uncertain timing and emotional behavior. And the biggest catalyst right now? Regulation.

Heard of the Clarity Act?

This U.S. bill will define when digital assets are securities (under SEC jurisdiction) or commodities (under CFTC jurisdiction), establish a maturity framework for blockchains, and create tailored rules for stablecoins and DeFi. The bill passed the House in July 2025 and is now awaiting a Senate vote, expected to be enacted by late 2025 or early 2026.

What does this mean?

Funds—billions, maybe even trillions—will finally have a framework for on-chain deployment. Traditional markets are exhausted. Venture capital needs a new home, and crypto will be the only choice.

So much it’s exploding

On-Chain Meta-Narrative

Forget the word ICM—that brand is already discredited. Let’s call it the on-chain meta-narrative. The tokenization of everything: real estate, AI projects, startups—every project will raise funds on-chain via meme tokens. Fast, decentralized, with minimal restrictions.

The question isn’t if this will happen, but when and at what scale. The convergence of TradFi and crypto is inevitable.

Investment Strategy and Outlook

Mainstream strategies are always changing, and your edge lies in timing, diversification, and strict discipline.

Diversify into strong teams with cultural depth and narrative advantages.

Note: What works today may not work tomorrow.

Keep some liquidity. Without liquidity, you might miss out on the biggest gains.

It’s still early—the bubble hasn’t started yet. High volatility, endless token launches, and capital inflows.

But be careful—most of you are already broke or down on your luck. Don’t blow everything too early; there will be more opportunities than you can handle in the future.

Slow, but never too slow

Finally

Get ready—the wildest on-chain journey of your life is about to begin!

Hold steady, brothers—the funds are deployed!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Whales" Accelerate Bitcoin Sell-Off, But Is It Really a Panic Signal?

Some "whale" wallets are showing regular selling patterns, which may be related to profit-taking rather than panic signals, but the market's ability to absorb these sales has weakened.

Will bitcoin be cracked by quantum computers by 2030?

Quantum computers may break bitcoin within five years. How will the crypto world respond to this existential crisis?

Raking in crypto dividends: How did the family of Trump's Secretary of Commerce earn 2.5 billions dollars a year?

After Howard Lutnick became the Secretary of Commerce in the Trump administration, his family's investment bank, Cantor, is heading toward its most profitable year ever.

BTC price bull market lost? 5 things to know in Bitcoin this week