As the inflation week arrives, anticipation builds around the impact of tariffs on August inflation figures. Following last week’s dismal employment numbers, there is hope for a rise with upcoming inflation data. But what do the forecasts say about the prospects for SOL , VET, and ETH?

SOL and ETH Expectations

SOL Coin has returned to the critical resistance area of $214. After lingering for a long time, Solana $213 moved away from $2023 and oriented towards the resistance instead of the $180 support. If inflation data does not exceed expectations this week, the eagerness for interest rate cuts might reflect favorably on altcoins.

Continuing the day with a 5.4% increase, Solana (SOL) has been distant from the $260 levels for a long time, which could potentially lead to a rally. Despite its underwhelming performance in August, it stands among the frontrunners along with DOGE in the September revival.

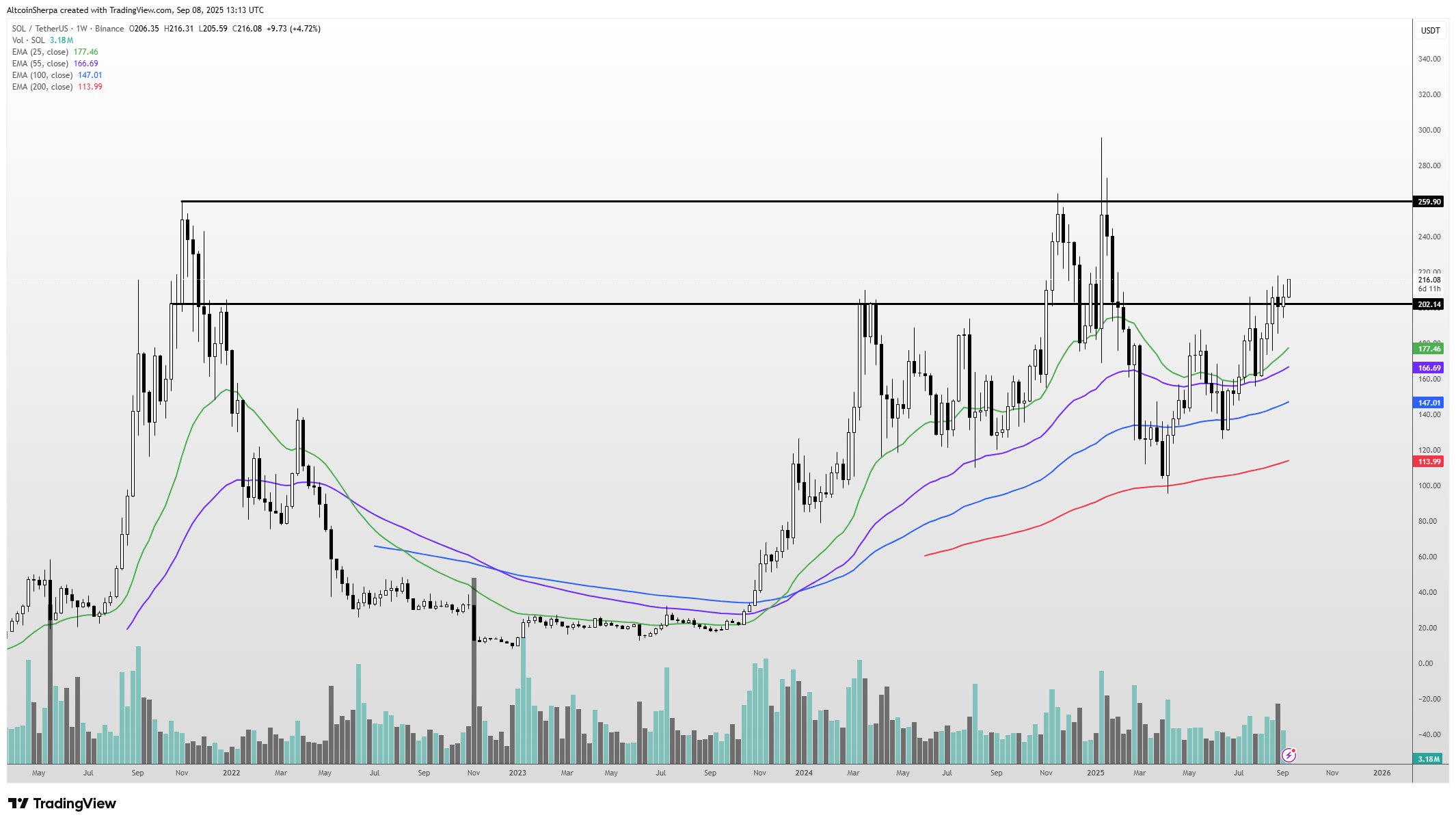

Sherpa shared the chart above, discussing how $250 is closer than one might think for SOL Coin.

Yoddha, on the other hand, is focusing on Ethereum $4,295 . The king of altcoins is still below $4600, and the analyst mocks those expecting a downturn.

“If you think this ETH chart shows a bearish trend, you will never profit. A new peak is coming in the upcoming months…”

If this prediction holds true, it could signify a robust movement for these altcoins as well. While BNB Coin seems calm, it is also targeting $1000 and remains strong at $880 during the preparation of this article.

VET Coin Insights

As previously noted, one of Michael Poppe’s favorite altcoins is VET Coin. It’s a project that has managed to survive over the years and, more importantly, continues to develop. This is not commonly encountered in the crypto world.

Even in today’s evaluation, Michael Poppe shared promising insights:

“Strong fundamental projects are still below the 20-week moving average.

This isn’t a bad thing, rather it’s a major opportunity. VET is one of them. Joining the Stargate program and gaining additional rewards for early participation is still possible.

In the last cycle, I gained significant additional returns by staking assets, and assuming VeChain’s valuation is still relatively low, I can say it strengthens the thesis of adding VeChain to your portfolio.”