Fed Rate Cuts Incoming: Can Bitcoin Smash Through 120K?

Bitcoin price is back at a critical juncture . The U.S. labor market is flashing signs of weakness, with job gains falling well short of expectations and unemployment ticking higher. That shift has markets convinced the Federal Reserve will start cutting rates as soon as September, a move that could change the liquidity backdrop for risk assets. For Bitcoin, this intersection of softer economic data and potential monetary easing comes just as the chart shows signs of stabilization after weeks of decline. The question now is whether upcoming Fed cuts will be the catalyst that pushes BTC price into a fresh rally or if the macro clouds still weigh it down.

Bitcoin Price Prediction: Labor Market Signals and Fed Policy Shifts

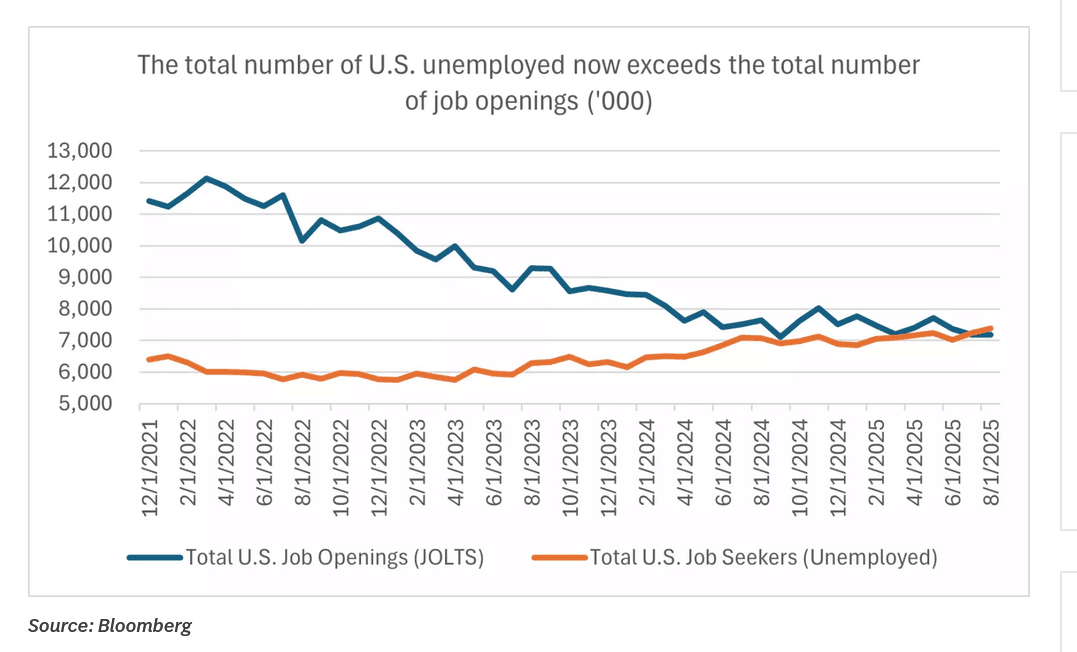

The latest U.S. jobs data paints a clear picture of a cooling labor market. Only 22,000 jobs were added in August, far short of the 75,000 expected, while unemployment ticked up to 4.3%. This marks the weakest labor backdrop since 2020. Job openings have fallen below the number of unemployed for the first time in years, suggesting employers are actively scaling back on hiring.

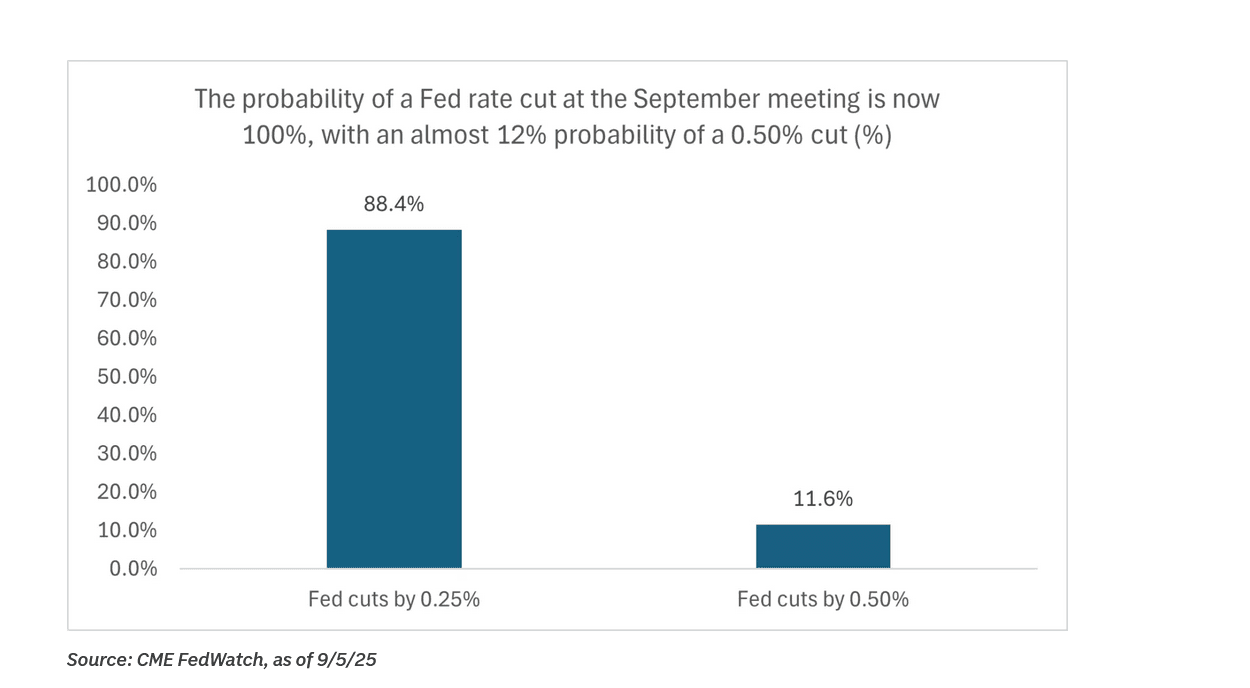

For investors, the key takeaway is the Fed’s response. With markets pricing in a 100% chance of a September rate cut—and even some probability of a 0.5% reduction—monetary conditions are about to loosen. Historically, Fed rate cuts during non-recessionary periods have been bullish for risk assets, including crypto. Lower yields and borrowing costs support liquidity, which tends to spill into equities and Bitcoin alike.

Bitcoin’s Current Technical Setup

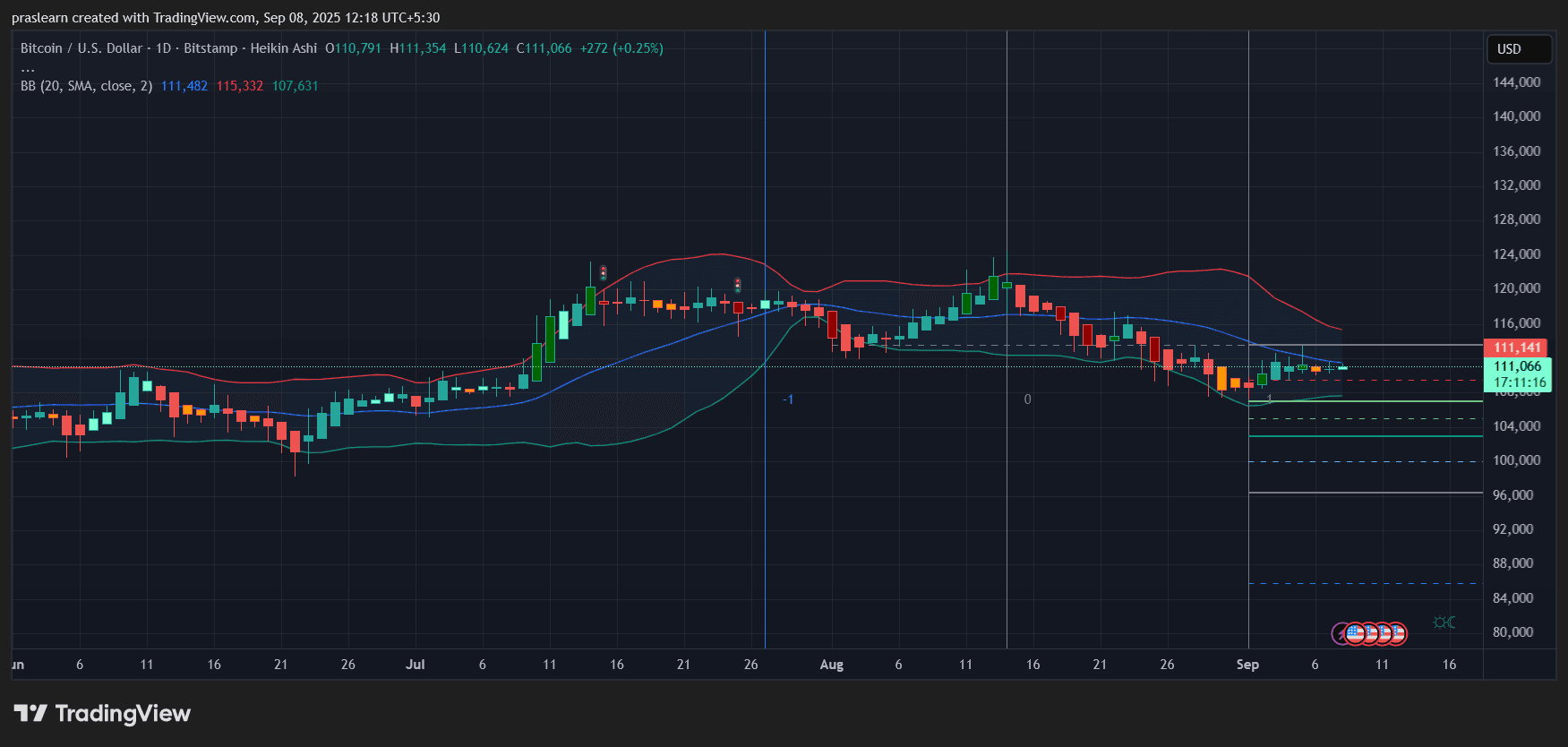

BTC/USD Daily chart- TradingView

BTC/USD Daily chart- TradingView

Looking at the BTC price daily chart, price is consolidating just above 111,000 after a month-long correction from its mid-July highs near 120,000. The Bollinger Bands show narrowing volatility, with the upper band near 115,300 acting as resistance and the lower band around 107,600 as support.

The recent candles indicate stabilization, with buyers defending the lower band and preventing further breakdown. However, the 20-day moving average (blue line) is still trending lower, signaling that the market hasn’t fully flipped bullish yet.

The short-term structure is a battle between relief rallies and broader consolidation. If Bitcoin can reclaim and sustain above 112,000–113,000, the next upside test lies at 115,000–116,000. A rejection here could trigger another retest of the 108,000 support zone. Below that, the chart leaves space for deeper tests toward 102,000–104,000.

Macro Meets Crypto: Why This Backdrop Matters

What makes this setup interesting is the timing. Bitcoin price has historically rallied in periods where the Fed transitions from tightening to easing. Liquidity expansion fuels speculative appetite, and crypto tends to benefit disproportionately compared to equities.

But the labor market weakness isn’t paired with recession-level contractions yet. This means investors are betting that growth can hold while rates fall—a sweet spot for risk assets. If inflation readings this week show signs of cooling, it could give the Fed more room to act aggressively, further supporting Bitcoin’s upside case.

What to Watch in September

- Fed meeting on Sept. 17 – The rate decision will be pivotal. A 0.25% cut is priced in, but a surprise 0.5% cut could ignite a risk rally.

- Inflation data (CPI/PPI) – If inflation softens alongside labor weakness, markets may price in multiple cuts ahead.

- BTC price chart breakout – A daily close above 113,000 would suggest bulls are regaining momentum. Failure here keeps Bitcoin vulnerable to a retest of sub-108,000 levels.

Bitcoin Price Prediction: Where Does BTC Price Go Next?

Given the convergence of soft labor data, imminent rate cuts, and $Bitcoin technical consolidation, the market leans toward an upside breakout. If bulls clear 115,000, a run toward 120,000 by October is achievable. However, failure to hold above 111,000 in the coming sessions risks a slide to the 104,000–106,000 support zone before any meaningful rebound.

The macro backdrop favors higher prices into Q4, but volatility around the Fed decision and inflation releases will keep traders on edge. For now, $BTC sits at a crossroads—positioned for a breakout if the Fed delivers, but still fragile if economic data worsens faster than expected.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.