XRP Accumulation Hits 2-Year High, Is Price About To Rebound?

XRP is seeing record accumulation, fueling hopes of a breakout above $3, though elevated NVT signals could slow near-term momentum.

XRP has seen its recent decline slow, allowing the altcoin some breathing room in a volatile market.

Investors appear to be taking advantage of these lower prices, accumulating XRP in large volumes in hopes of capturing future gains.

XRP Investors Move To Accumulate

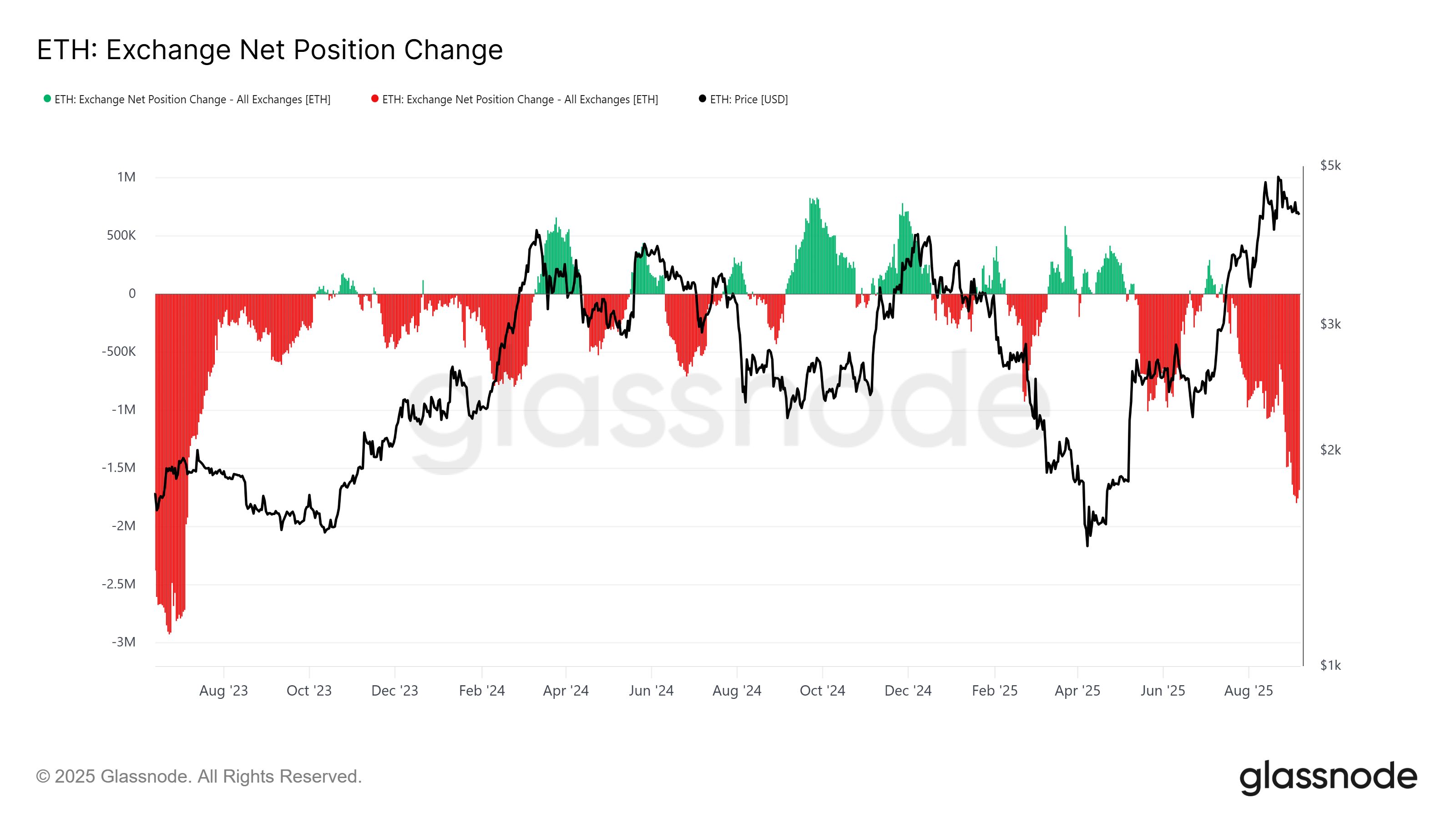

The exchange net position change data highlights that the recent XRP accumulation is the largest in more than two years. This renewed interest suggests that market participants are confident in the asset’s potential recovery and are preparing for a price breakout.

Over the past month, investors have accumulated approximately 1.7 million XRP, reflecting optimism despite broader market uncertainty. Such strong accumulation at current price levels highlights a belief that XRP has room for growth and could soon test higher resistance levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Exchange Net Position Change. Source:

Glassnode

XRP Exchange Net Position Change. Source:

Glassnode

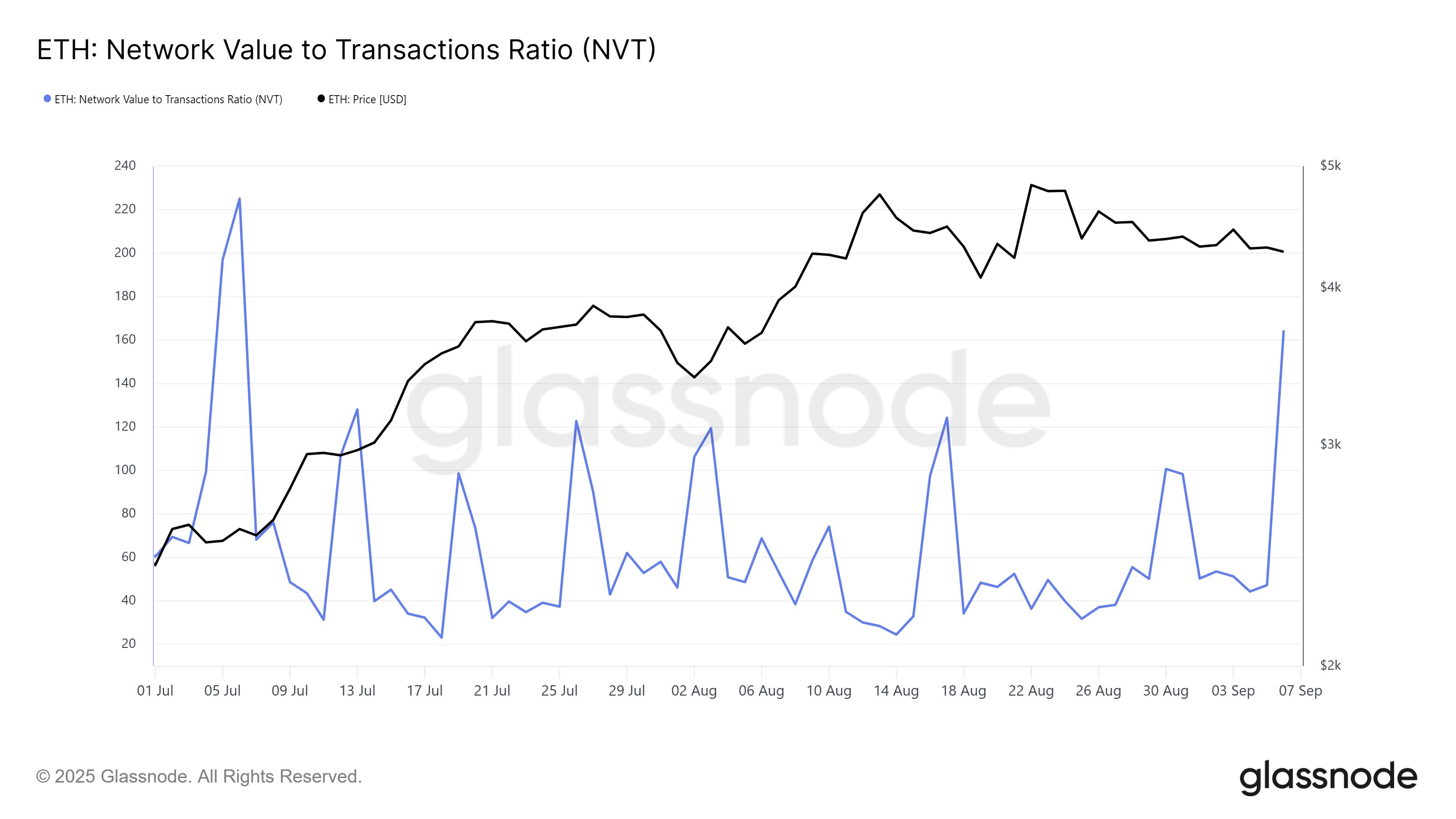

From a macro perspective, the Network Value to Transactions (NVT) ratio has spiked in the past 24 hours. This surge pushed the indicator to its highest point in two months, hinting that XRP’s network valuation is exceeding its transaction activity.

Historically, such spikes can signal that accumulation momentum is cooling in the short term. While sentiment remains bullish, a high NVT ratio can indicate overvaluation, potentially creating a temporary hurdle for XRP’s price trajectory in the near future.

XRP NVT Ratio. Source:

Glassnode

XRP NVT Ratio. Source:

Glassnode

XRP Price Is Looking At A Rise

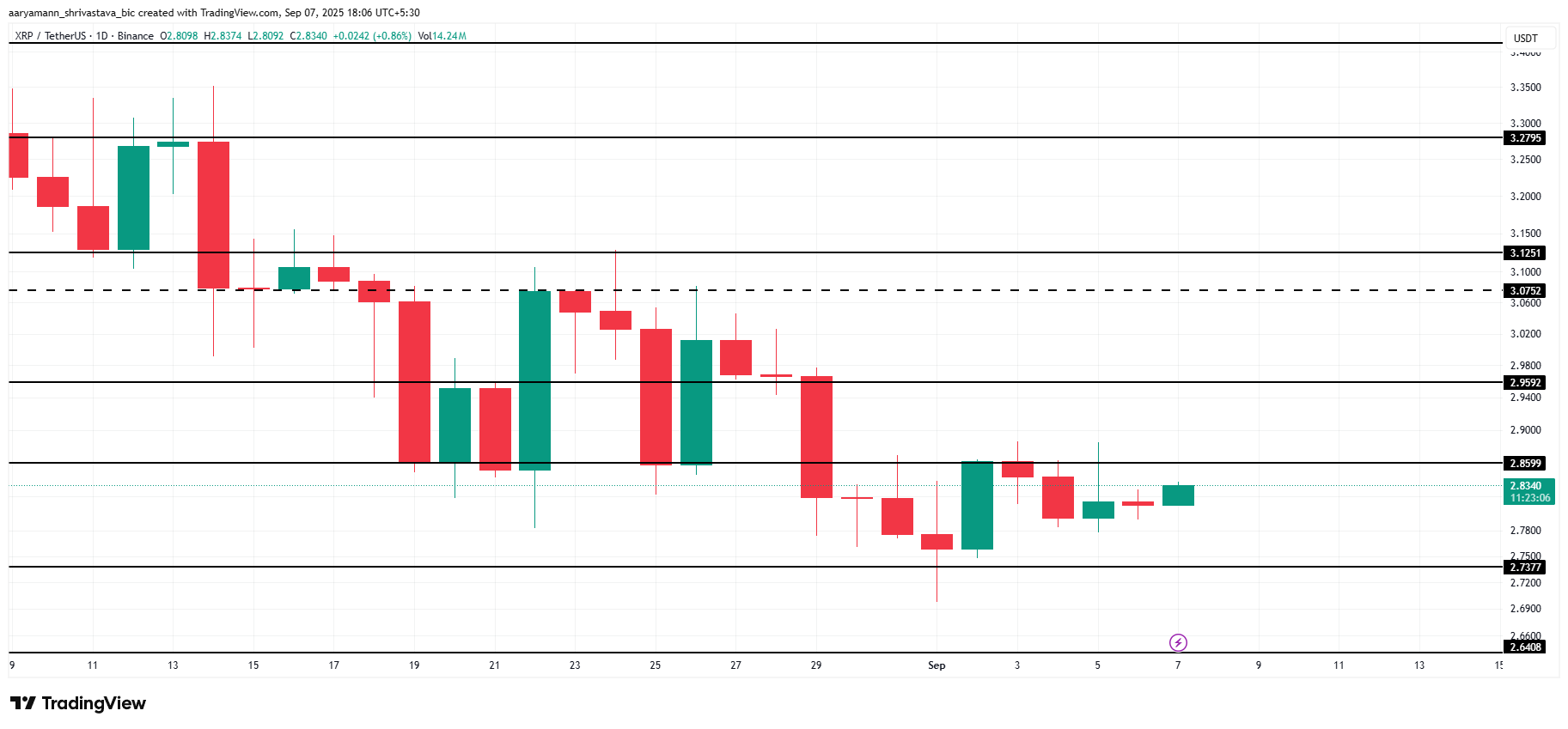

XRP is currently trading at $2.83, positioned just below the $2.85 resistance. Thanks to the sharp surge in accumulation, the altcoin is looking to break out.

If XRP flips $2.85 into support, it could climb toward $2.95 and potentially breach $3.07. Crossing this milestone would signal renewed strength in market momentum and validate the confidence shown by long-term holders.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if XRP faces pressure from the elevated NVT ratio, it may struggle to maintain gains. A rejection at resistance could push the price down to $2.73, or even further to $2.64, which would invalidate the bullish outlook and extend the consolidation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.