Solana Price Receives a Major Bullish Signal Based On Exchange Data

Heavy Solana accumulation worth $770 million is keeping its price above $200, with bullish momentum eyeing resistance at $206 and beyond

Solana’s price has held steady over the last few days, moving sideways around the $200 mark.

This period of consolidation could shift toward bullish momentum as investors step in with heavy accumulation, signaling renewed optimism for the altcoin’s near-term prospects.

Solana Investors Pick Up Supply

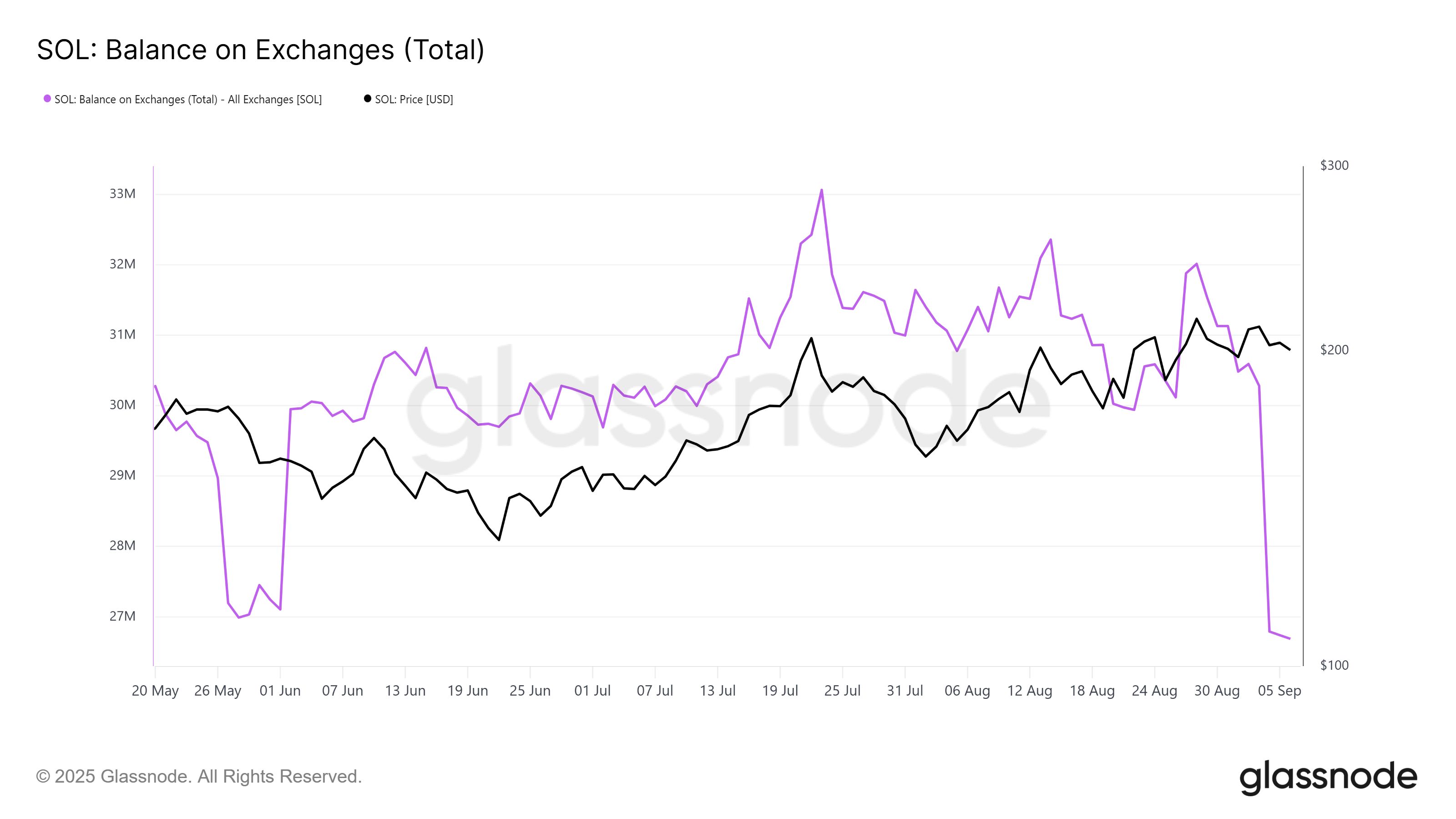

Data shows that balances on exchanges have dropped by 3.79 million SOL since the start of the month. This marks a clear shift in investor behavior as coins leave centralized platforms, a typical sign of accumulation and long-term holding.

In just a week, investors scooped up $770 million worth of SOL, highlighting a strong bullish stance. The expectation is that continued accumulation will strengthen support above $200, potentially enabling Solana’s price to break through higher resistance levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana Exchange Balance. Source;

Glassnode

Solana Exchange Balance. Source;

Glassnode

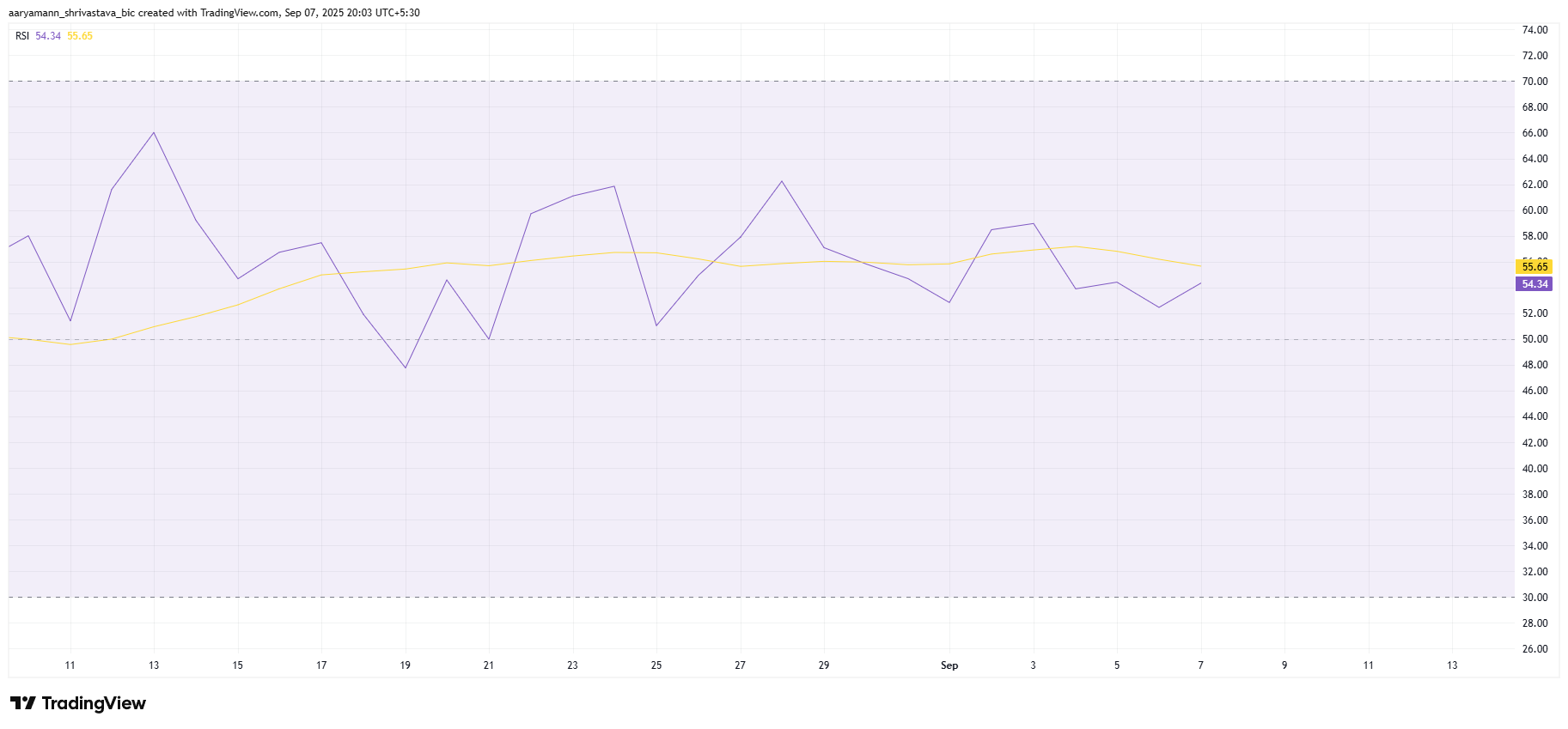

From a technical perspective, Solana’s Relative Strength Index (RSI) is holding comfortably above the neutral 50.0 mark. The indicator remains in positive territory, suggesting bullish momentum persists and that the altcoin still has room for upward movement.

This positioning also signals resilience against broader market pressures. With RSI not yet in the overbought zone, Solana appears well-placed to continue its climb, provided investor inflows remain steady and no sharp selling undermines the trend.

Solana RSI. Source:

TradingView

Solana RSI. Source:

TradingView

SOL Price Awaits Breakout

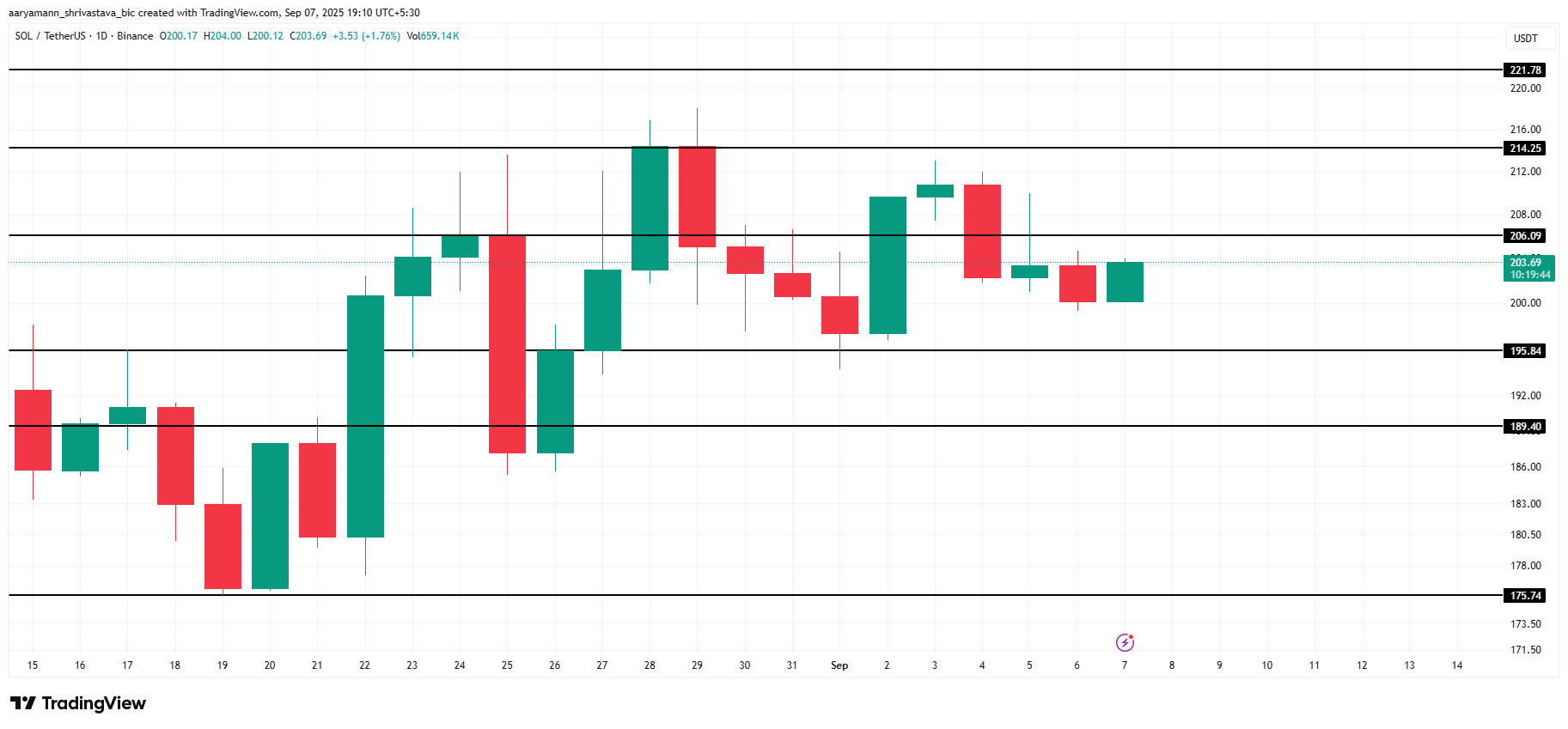

At the time of writing, Solana is priced at $203, just under the immediate resistance of $206. Holding above $200 remains key, as it provides the foundation for further gains in the near term.

Strong investor support could push SOL past $206 and toward $214 in the coming days. A successful breakout above that level would open the door to $221, adding momentum to the bullish outlook.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

However, if holders decide to lock in profits, Solana could face a pullback. Losing the $195 support would expose the price to a decline toward $189 or lower. This would effectively invalidate the bullish case and extending sideways action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ADP data sounds the alarm again: US companies cut 11,000 jobs per week

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The US SEC and CFTC may accelerate the development of crypto regulations and products.

The Most Understandable Fusaka Guide on the Internet: A Comprehensive Analysis of Ethereum Upgrade Implementation and Its Impact on the Ecosystem

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.