In 4 days, this will get even worse.

— The Kobeissi Letter (@KobeissiLetter) September 5, 2025

On September 9th, the BLS will revise US jobs numbers for the 12 months ending March 2025.

According to Goldman Sachs, a DOWNWARD revision of up to -950,000 jobs is coming.

This would be the biggest downward revision since 2010. pic.twitter.com/1gbn3XCdVg

Rate Cut Bets Fuel Investor Optimism On Wall Street

By:Cointribune

At this back-to-school period, major banks are revising their outlook. Faced with a clear slowdown in the American economy, the idea of two to three rate cuts this year is gradually taking hold. Investors, hanging on the Fed’s slightest signals, see in this change of course a potential turning point.

In brief

- Several major banks, including Bank of America, Goldman Sachs and Citigroup, now forecast two to three benchmark rate cuts in 2025.

- This reversal is explained by a series of disappointing economic statistics, notably a clear slowdown in the US labor market.

- For cryptocurrencies, a rate cut could create a favorable environment for renewed liquidity and a new bullish phase.

- This dynamic could also rekindle institutional interest in the sector, provided inflation remains under control.

Wall Street revises its outlook : a turning point in rate forecasts

The deterioration of American economic indicators, notably in the labor market, triggered a wave of revisions among major investment banks.

The August employment report fell far short of expectations, with only 22,000 job creations against 75,000 anticipated, which strengthened expectations of a monetary course change, as argued by Christopher Waller .

Subsequently, Bank of America, long opposed to the idea of easing this year, changed its position : “we now forecast two 25 basis point cuts in September and December 2025”, it stated .

The same observation applies to Goldman Sachs, which now forecasts a series of three consecutive rate cuts in fall 2025, a trajectory also taken up by Citigroup .

Here is a precise summary of the current projections of major banks for this year :

- Bank of America: two 25 basis point cuts expected, in September and December 2025 ;

- Goldman Sachs: three 25 basis point cuts, spread over September, October and November ;

- Citigroup: also three 25 basis point cuts, but spread over September, October and December.

This shift in forecasts echoes remarks by Jerome Powell , Fed Chair, who acknowledged during his August 22 speech at Jackson Hole “clear signs of moderation in the labor market”.

According to The Kobeissi Letter, the June report was revised to show a net loss of 13,000 jobs, and cumulative revisions could reach 950,000 jobs for 2025.

These signals reinforce the idea that the Fed may be forced to ease its policy to fulfill its dual mandate: full employment and price stability.

A window of opportunity for cryptos ?

Beyond macroeconomic signals, market data support the idea of monetary easing. According to CME Group forecasting tools, 88% of traders already anticipate a first 25 basis point cut at the FOMC meeting this month.

12% even foresee a more marked cut, of 50 basis points. These expectations, based on market data rather than mere official statements, reflect investors’ repositioning. They indicate that the prospect of medium-term credit expansion is now integrated into asset allocation strategies.

This potential monetary easing could act as a catalyst for the crypto market, which has always benefited from a low-rate and abundant liquidity environment. In previous cycles, notably between 2020 and 2021, accommodative policies were associated with spectacular increases on Bitcoin and altcoins.

If rate cuts materialize this year on a regular schedule, as Goldman Sachs foresees , it could create a favorable environment for a return of risk appetite. This remains, of course, contingent on inflation evolution and overall macroeconomic stability, but the foundations for a crypto recovery scenario are laid.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation

Bitcoinworld•2025/12/17 05:27

Pi Network stock price remains under pressure, momentum weakens

币界网•2025/12/17 05:15

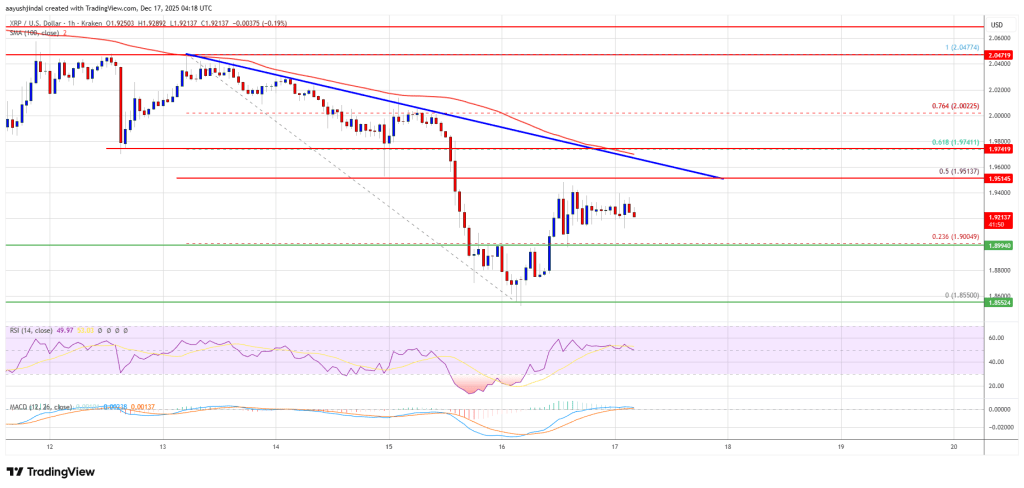

XRP price recovery appears fragile—can bulls break through the price ceiling?

币界网•2025/12/17 05:15

Pantera: 2025 will be a year of structural progress for the crypto market

币界网•2025/12/17 05:15

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$86,477.36

+0.65%

Ethereum

ETH

$2,927.72

+0.28%

Tether USDt

USDT

$0.9998

-0.00%

BNB

BNB

$858.33

+0.53%

XRP

XRP

$1.91

+2.29%

USDC

USDC

$1.0000

+0.01%

Solana

SOL

$127.85

+1.38%

TRON

TRX

$0.2798

+0.33%

Dogecoin

DOGE

$0.1307

+1.46%

Cardano

ADA

$0.3794

-0.60%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now