3 Altcoins To Watch This Weekend | September 6 – 7

This weekend could be pivotal for altcoins as MANTRA tests support, Memecore eyes new highs, and Polygon approaches a critical breakout zone.

The coming weekend could be a turning point for the altcoins considering Bitcoin begun noting recovery this past week. In addition to broader market cues, other external developments could also play a role in altcoins’ price action.

BeInCrypto has analysed three such altcoins that the investors should watch over the coming weekend.

MANTRA (OM)

OM price declined 14% over the past week, currently trading at $0.207. The altcoin is testing the $0.200 support level, a critical threshold for maintaining short-term stability. Holding this line could prevent further losses and provide a base for potential recovery in the days ahead.

This weekend may serve as a catalyst for OM, as MANTRA shifts Association liquidity from the OM/USDC pool on Osmosis to MANTRA Swap. Consolidating liquidity is expected to deepen trading pools and improve efficiency. If successful, OM could rise toward $0.228 resistance, supporting short-term price recovery momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

OM Price Analysis. Source:

OM Price Analysis. Source:

OM Price Analysis. Source:

OM Price Analysis. Source:

If bearish pressure persists, OM risks falling below $0.200. Losing this crucial support could drive the altcoin further down to $0.188. Such a decline would erase any chance of near-term recovery and invalidate the current bullish thesis, leaving OM exposed to extended downside risk in the market.

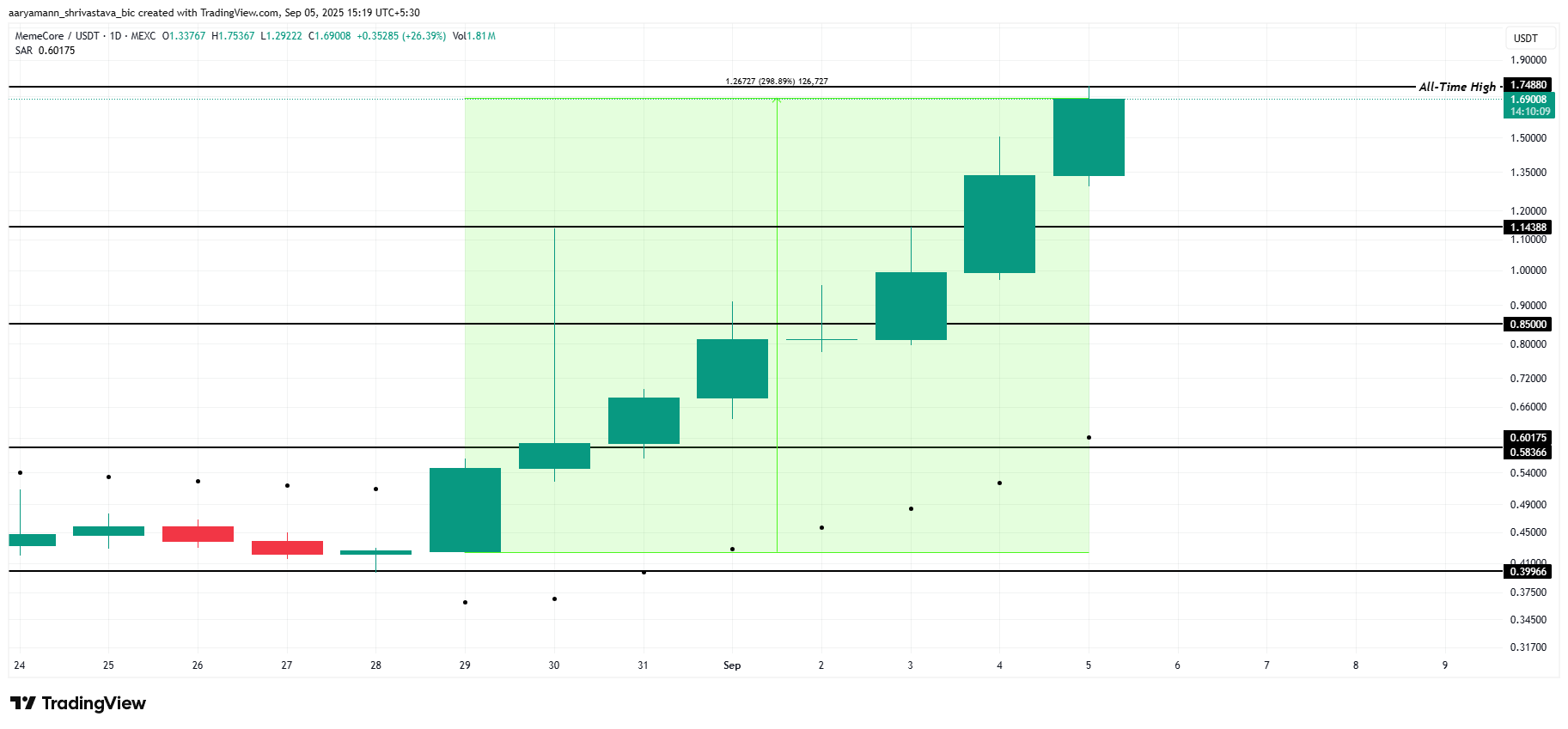

Memecore (M)

M has become one of the most trending cryptocurrencies, surging nearly 300% within a week. The impressive rally pushed the altcoin to a new all-time high of $1.74. This sharp rise highlights renewed investor interest and speculative momentum driving the token’s performance.

The bullish outlook for M remains intact as technical indicators support continued growth. With the weekend expected to bring increased volatility, the Parabolic SAR positioned below the candlesticks signals an active uptrend.

M Price Analysis. Source:

M Price Analysis. Source:

M Price Analysis. Source:

M Price Analysis. Source:

If momentum holds, M could climb toward $2.00 and form another all-time high. However, profit-taking remains a risk. Should investors sell their holdings, the altcoin could lose ground and slip toward the $1.14 support level, undermining recent gains and weakening the current bullish outlook.

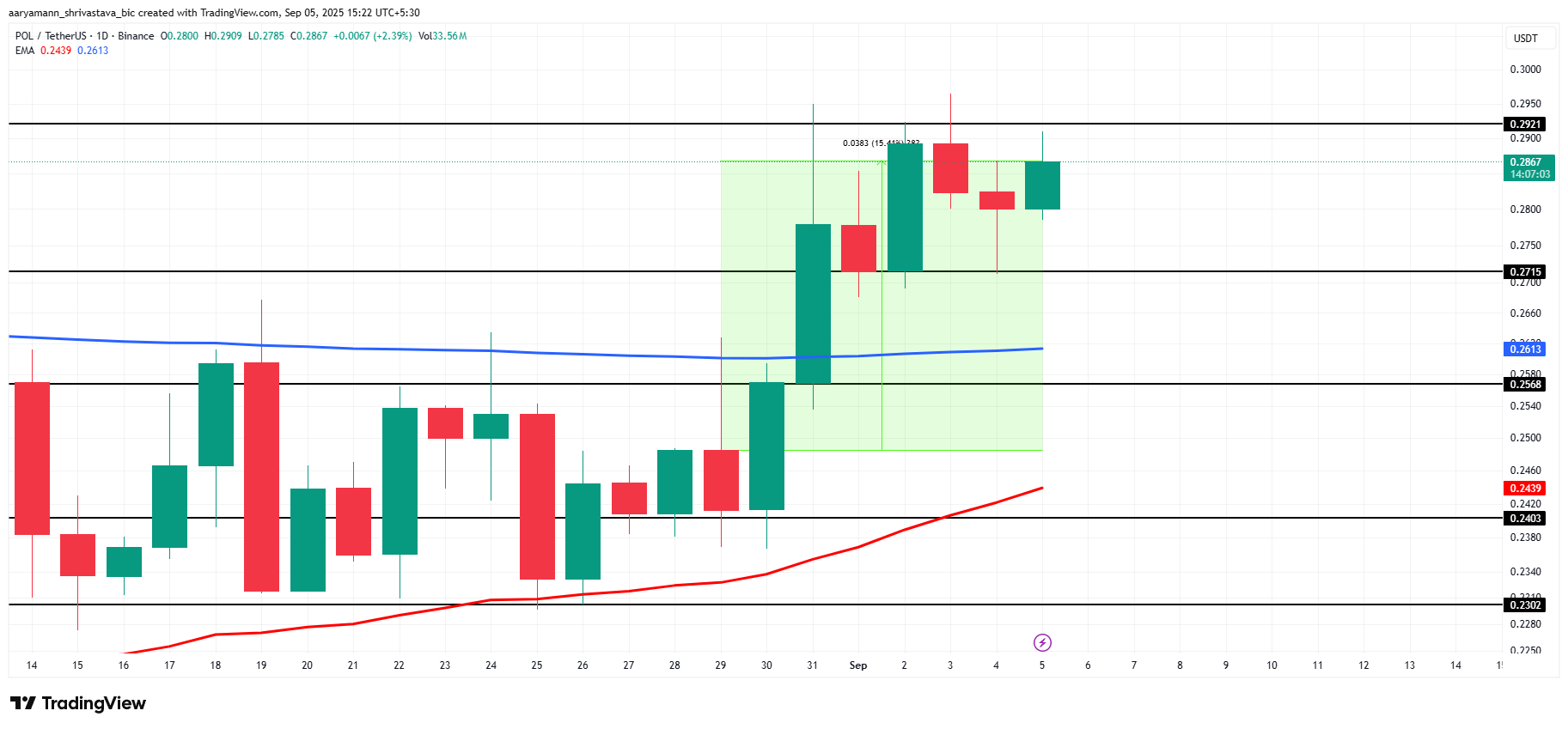

Polygon (POL)

POL price has gained 15.4% over the past week, currently trading at $0.286. Despite the bullish performance, the altcoin remains capped under the $0.292 resistance. Breaking this level will be critical for POL to maintain upward momentum.

Technical indicators suggest potential strength ahead, with the EMAs signaling a possible Golden Cross if bullish momentum continues. Such a development would confirm long-term optimism, allowing POL to push past $0.292 and potentially rise above $0.300.

POL Price Analysis. Source:

POL Price Analysis. Source:

POL Price Analysis. Source:

POL Price Analysis. Source:

If selling pressure emerges, POL could lose momentum and fall back to $0.271 support. A sharper decline could drag the price down to $0.256, invalidating the bullish setup. This would weaken market sentiment and highlight the risks of volatility still present in the altcoin’s price trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interpretation of the CoinShares 2026 Report: Farewell to Speculative Narratives, Embracing the First Year of Practicality

The year 2026 will be a key turning point for digital assets, shifting from speculation to utility and from fragmentation to integration.

Clash of Titans: Global Opinion Leaders Debate the Future Path of Bitcoin

Trend Research: The "Blockchain Revolution" is underway, remaining bullish on Ethereum

In a scenario of extreme fear, where capital and sentiment have not yet fully recovered, ETH is still in a relatively good buying "strike zone."

![[Bitpush Daily News Highlights] Ripple, Circle, and three other crypto companies receive conditional bank license approval in the US; Tether submits an all-cash acquisition offer, aiming for full control of Serie A giant Juventus and pledges to inject 1 billion euros; Moody’s plans to launch a stablecoin rating framework, with reserve asset quality as the core indicator; Fogo cancels its $20 million token presale, mainnet launch will switch to airdrop distribution.](https://img.bgstatic.com/multiLang/image/social/96c285805bf77c355ca73a8b952ce0b91765614780984.png)