Justin Sun says his WLFI pre-sale allocation was “unreasonably frozen” after a $9M transfer flagged by blockchain trackers triggered a WLFI token blacklist; he urges the World Liberty Financial team to unfreeze the tokens to preserve investor rights and confidence in WLFI.

-

Blacklisting triggered by blockchain flags

-

Justin Sun disputes accusations and asks WLFI to unlock his pre-sale allocation.

-

Blockchain intelligence platforms reported a $9M transfer and Bubblemaps tracked moves to HTX.

Justin Sun WLFI tokens: Sun urges WLFI to unfreeze his pre-sale allocation after a $9M transfer was flagged—read the latest developments and reactions.

What happened to Justin Sun’s WLFI tokens?

Justin Sun’s WLFI pre-sale allocation was blacklisted after blockchain intelligence platforms flagged a roughly $9 million transfer. Sun says the freeze is “unreasonable” and has publicly asked World Liberty Financial to unlock his allocation to protect investor rights and market confidence.

Sun was identified after analytics from blockchain intelligence providers flagged movement from his WLFI address. The team behind World Liberty Financial responded by blocking the address, citing the flagged transfer.

Source: Justin Sun

How did blockchain trackers and exchanges respond?

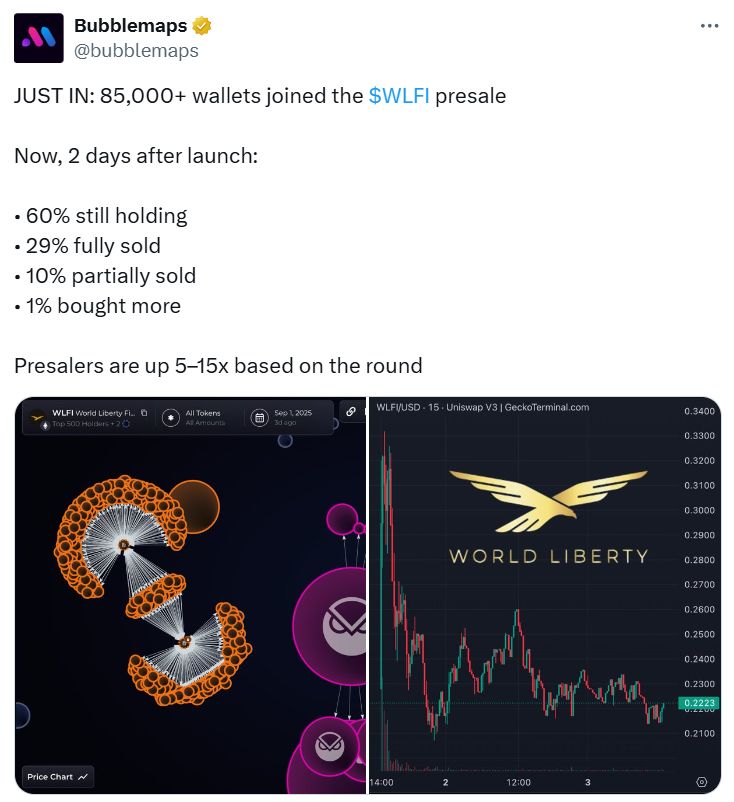

Blockchain trackers reported a $9M transfer from Sun’s WLFI address, prompting a blacklist by World Liberty Financial. Bubblemaps separately tracked token flows and observed movements of WLFI to the HTX exchange, noting around $9M moved to HTX and roughly $10M sent to CEXs over three days.

Analytics platforms named in public posts include Nansen and Arkham, which flagged the initial transfer. Those analyses formed the basis for the WLFI team’s decision to freeze the allocation.

Sun disputes the characterization of the transfers as a sale. He says he plans to hold long-term, is creating yield on HTX for WLFI deposits, and has minted funds on Tron to support the ecosystem, according to public statements.

Source: WLFI

Why does Justin Sun call the freeze a violation of investor rights?

Sun argues that freezing pre-sale tokens contradicts core blockchain principles of token inviolability and harms investor trust. He said the freeze is “unreasonable” and urged the WLFI team to respect decentralization principles by unlocking his allocation.

In his public post, Sun wrote: “Tokens are sacred and inviolable—this should be the most basic value of any blockchain. It’s also what makes us stronger and more fair than traditional finance.”

What are the differing analyst views?

Some analysts suggested the transfers amounted to an attempt to exit a position while tokens were still unvested. Quinten François, co-founder of a social decentralized app, publicly argued that freezing might be justified if a founder sold unvested tokens after offering high APY to depositors.

Other voices dispute that Sun sold. Alex Svanevik, founder of a blockchain analytics platform, reported that an AI agent initially flagged Sun as the cause of a dump but later, after timestamp analysis, concluded Sun likely did not cause it.

Source: Bubblemaps

How did the WLFI project respond and what’s next?

The WLFI platform posted that Justin Sun and the WLFI team are in active communication. WLFI noted Sun’s prior statements about holding tokens and providing ecosystem liquidity and yield.

Both parties publicly indicate discussions are ongoing. The resolution will hinge on WLFI’s governance rules for pre-sale allocations and any contractual vesting terms, which remain the central point for investor scrutiny.

Frequently Asked Questions

Was Justin Sun selling his WLFI allocation?

Public blockchain tracking showed token movements to exchanges, but analysts disagree. Some flagged potential selling activity; others, after timestamp analysis, say there is no clear evidence Sun sold. Investigations and WLFI governance rules will determine intent.

Can a project legally freeze pre-sale tokens?

Projects can freeze addresses if their smart-contract permissions or custodial agreements allow it. The legality depends on token terms, jurisdiction, and any contractual commitments made during the pre-sale.

How can investors verify token flows and blacklists?

Use on-chain explorers and blockchain intelligence tools to trace transactions and check public blacklist notices. Cross-referencing timestamps and exchange deposit records helps establish the sequence of events.

Key Takeaways

- Freeze prompted by flagged transfer: Blockchain intelligence flagged a $9M WLFI transfer that led to a blacklist.

- Disputed intent: Justin Sun contests the freeze and says he is a long-term holder supporting WLFI liquidity.

- Resolution pending: WLFI and Justin Sun are in active communication; governance terms and transaction timestamps will be key.

Conclusion

Justin Sun WLFI tokens became a flashpoint after blockchain trackers flagged large transfers and World Liberty Financial blacklisted the address. The dispute centers on investor rights, on-chain transparency, and project governance. Watch for WLFI’s governance clarification and further on-chain analysis to resolve the matter.

Published: 2025-09-05 | Updated: 2025-09-05