Sei's EVM Ascendance: Rewriting the Growth Curve Between Performance and Ecosystem

Active User Count Once Surpassed Solana, Sei, leveraging EVM compatibility and high-performance architecture, is pushing itself towards a new growth curve and becoming a central narrative in the industry

ETH is approaching a new all-time high under the narrative of the new Treasury, while traditional financial forces represented by Stripe and Circle have announced their entry into the space to build their own Layer1 solutions, the EVM ecosystem has recently been unparalleled in its success.

Along with the gradual establishment of Ethereum ecosystem's development tools, liquidity, and user network as the industry standard, EVM compatibility has evolved from a nice-to-have feature to a fundamental requirement. It is in this context that Sei, once known for its high-performance order book chain, has chosen a different path. This article will review the key milestones of Sei's technical upgrade and ecosystem expansion over the past year and explore its long-term competitiveness in the reshaping multi-chain landscape.

EVM Upgrade and Infrastructure Integration

In mid-2024, Sei initiated the V2 upgrade, formally introducing parallelized EVM to the mainnet. At the architectural level, it retained the underlying modular advantages of the Cosmos SDK while enabling seamless interaction with Ethereum applications, not only preserving the existing network's consensus and governance mechanisms but also bridging the gap with the world's largest smart contract ecosystem. This move was quite contrary to the trend in the multi-chain environment at the time—while most public chains were slowing down their development pace, Sei added value in terms of performance and compatibility.

One of the supporting measures of the upgrade was a wallet compatibility partnership with EVM ecosystem infrastructure MetaMask. As the most widely used wallet gateway globally, MetaMask's integration significantly lowered the barriers for user migration and asset management, allowing users who were previously on Ethereum, Arbitrum, and other chains to seamlessly enter Sei at almost zero learning cost.

Shortly thereafter, the team drove Etherscan's imminent launch on Sei. This was not only a significant milestone in the developer toolchain's enhancement but also meant that on-chain data transparency would be on par with the Ethereum mainnet, providing a unified standard interface for debugging, auditing, and analysis. Rather than calling this a passive shift, it is more accurate to describe it as Sei's proactive move in reshaping the multi-chain landscape—through performance, wallet access, and data visualization avenues, while simultaneously expanding developer coverage and liquidity reach.

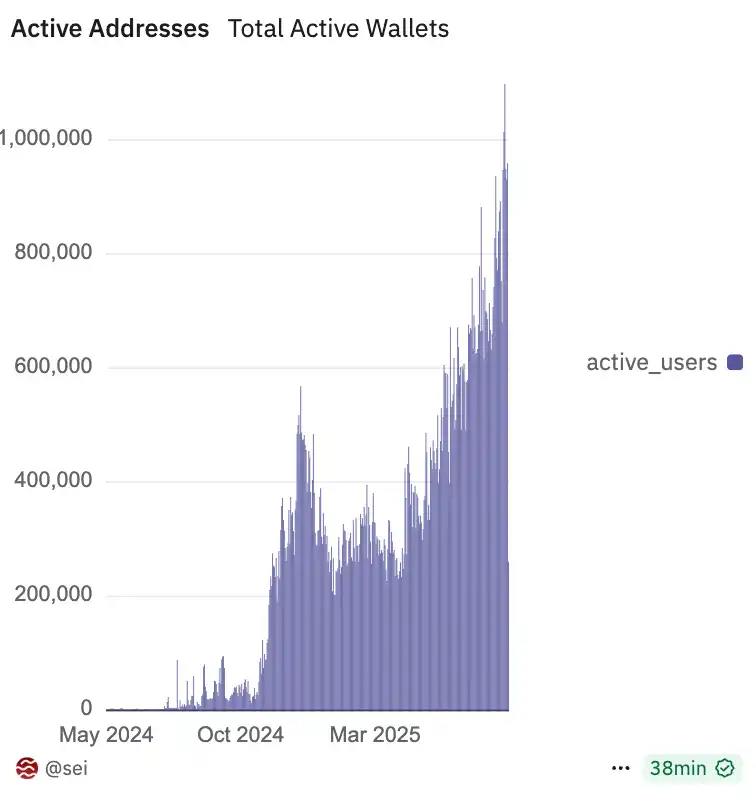

Since the launch of Sei V2, the Sei ecosystem has experienced explosive growth, with daily active users soaring from 1,300 to nearly 900,000, daily transaction volume increasing from 57,000 to 1.65 million, and TVL rising from $100 million to a recent peak of $687 million. For a public chain that was deeply rooted in the Cosmos world but actively opened up to a larger ecosystem, this is not just a reshaping of a growth curve but also a turning point in its strategic narrative.

Why the Upgrade?

Currently, Sei once simultaneously supported both the EVM and CosmWasm execution environments, attempting to cater to the needs of different developer groups in a "dual-track parallel" manner. This strategy provided flexibility in the early stages and made Sei one of the few networks capable of achieving native interoperability between EVM and WasmVM-based applications.

However, with the expansion of the network scale and the evolution of the ecosystem structure, the drawbacks of this architecture gradually became apparent. Users had to manage two sets of addresses simultaneously, infrastructure providers needed to write custom logic for cross-environment interactions, and the codebase had to bear the long-term maintenance burden of cross-compatibility. Jay Jog, Co-Founder of Sei Labs, admitted that such complexity not only slowed down the iteration speed but also inadvertently diluted the performance advantages.

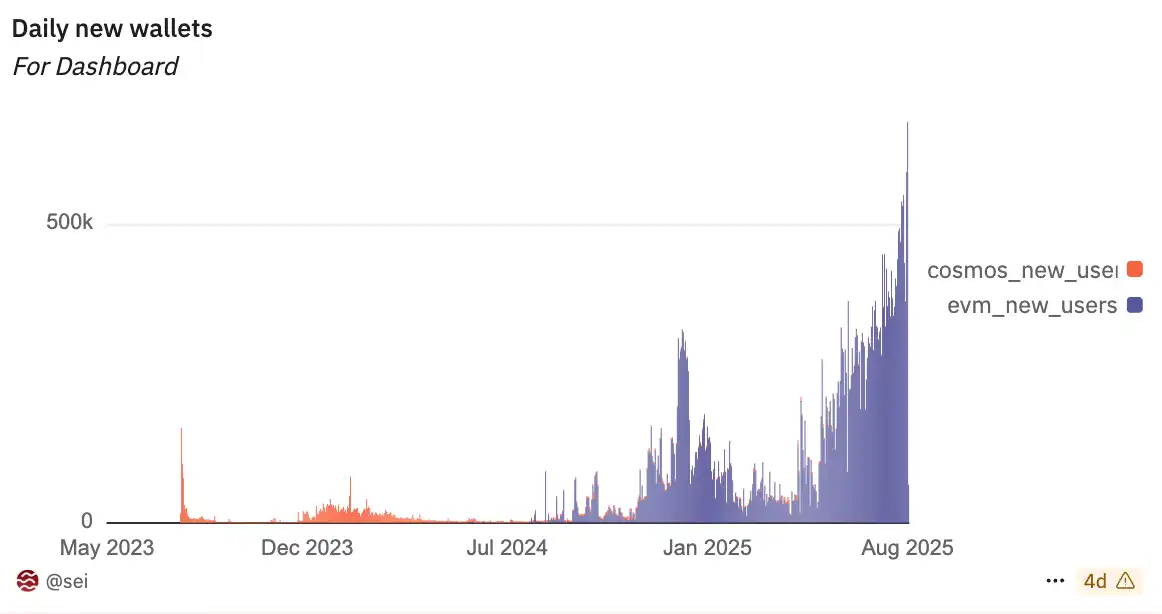

Since the introduction of parallelization of EVM in Sei v2, the usage of EVM has rapidly taken the lead in network activity. On-chain data from Dune Analytics shows that new users and newly deployed applications mostly chose the EVM environment, while the proportion of CosmWasm in transaction volume and development interest continued to decline.

For developers accustomed to Solidity and the Ethereum toolchain, the EVM is not only a familiar programming interface but also carries mature debugging tools, a vast open-source component library, and cross-chain portability — all of which are advantages that CosmWasm finds difficult to replace in the short term.

From developer psychology to ecosystem network effects, the EVM has formed an entrenched stickiness that is hard to shake. In this context, maintaining the dual architecture not only loses its original strategic significance but also consumes valuable research and maintenance resources.

Therefore, SIP-3 Proposal has emerged, a proposal introduced by Sei Labs, which directly points to a single goal — transitioning Sei to an EVM-only architecture, completely deprecating CosmWasm contracts and native Cosmos transactions.

The plan will be phased in, first establishing a pointer mechanism on the EVM side to allow existing Cosmos and CosmWasm assets to be accessed, then freezing new CosmWasm deployments and inbound IBC asset flows, and finally disabling the execution of old contracts and transaction support for non-EVM addresses.

Sei addresses will not disappear entirely; they will still play a role in internal protocol aspects such as validator identity, staking, and governance, which will be achieved through EVM precompiles to ensure the continuity of on-chain governance.

Proactive Breakthrough: How Does Sei Integrate with EVM?

The core of the upgrade measures lies in the dual management of technical execution and ecosystem migration. The Sei team clearly divided this process into controllable stages to reduce the impact on the existing ecosystem. Technically, Optimistic Parallelization remains at the heart of Sei's performance, allowing transactions to run concurrently and only falling back to sequential execution mode when conflicts arise.

The Twin Turbo consensus mechanism compresses block finality to approximately 360 milliseconds, outperforming Ethereum by thousands of times. This provides a solid performance guarantee for high-frequency DeFi, gaming, and order book applications, meaning users can hardly feel any latency. SeiDB's layered storage structure continues to support efficient state access and historical data queries.

In terms of infrastructure adaptation, MetaMask has become a key user entry point for Sei, and the upcoming launch of Etherscan will fill the gap in on-chain data exploration and developer debugging.

The parallel development of facilities such as cross-chain bridges, data indexing, multi-signature accounts, and more enables Sei to quickly achieve a development experience comparable to or even surpassing that of the Ethereum mainnet. For CosmWasm developers, the official team will provide migration guides and technical support to ensure applications can smoothly transition to an EVM-compatible form. Asset holders can transfer native Cosmos assets to an EVM wallet through a cross-chain bridge or exchange to minimize liquidity loss.

Sei's EVM-only Era: The Bet on Speed and Compatibility

The data transformation has validated the effectiveness of this transformation. Since the V2 upgrade, Sei's daily active wallet count has surged from 1,300 to nearly 900,000, daily transaction volume has skyrocketed from 57,000 to 1.65 million transactions, and TVL has peaked from $100 million to $687 million.

This growth is not only reflected in on-chain data but is also gradually permeating into the traditional financial system. In May 2025, Canary Capital submitted the S-1 filing for the Staked SEI ETF, indicating that Sei is poised to become one of the few blockchains that can be included in compliant asset portfolios. The Sei Development Foundation, based in the US, ensures governance that guarantees the robustness of development direction, policy alignment, and compliance promotion.

In early August, according to @EmberCN's monitoring, the daily active users of the Sei Network exceeded the Solana Network for the first time on August 2. Sei recently launched native USDC, introduced Ondo and Backpack, and a large number of adoptions have doubled Sei's daily active users in the last 3 months—from 380,000 to the current 752,000. Additionally, in just 10 days, the issuance of native USDC on Sei reached $108 million, surpassing chains such as zkSync, Algorand, and Polkadot.

Related Read: "When the Top Stablecoin Confronts a High-Throughput Layer 1, Why Does Sei Stand Out?"

As a result, Sei is poised to become a blockchain platform truly oriented towards the traditional capital market. Against the backdrop of emerging next-generation on-chain assets such as stablecoins, RWAs, and DePIN, Sei's "high throughput + regulatory compliance + accessibility" features have earned it the initiative in ecosystem evolution.

In line with the dominance of the EVM ecosystem in the developer community and leveraging Sei's technological accumulation in parallel execution and low-latency consensus, the platform is attempting to find a new balance between performance and ecosystem. Ultimately, the success of this upgrade depends not only on the smoothness of technical implementation but also on the cooperation of ecosystem migration—whether existing users and applications can switch with minimal friction and continue to expand under the new EVM-only architecture.

From a more macro perspective, Sei's transformation reflects a trend in the entire industry. In the landscape of multi-chain coexistence, EVM is still the default standard in developers' minds. Whether due to technical familiarity, toolchain maturity, or ecosystem network effects, the attractiveness of EVM has led many emerging chains to proactively adopt compatibility. Sei's innovation on top of this foundation is an attempt to address the shortcomings of Ethereum and its L2 solutions in high-frequency application scenarios with faster performance and lower latency. For developers and capital looking for the best combination of speed and compatibility in the Web3 world, this may be the answer they have been waiting for.

As the Giga architecture plan progresses, Sei aims to further enhance performance by an order of magnitude and continue to expand the application boundaries in high-frequency scenarios such as finance, AI, gaming, and social. In the reshuffling of the multi-chain landscape, speed, liquidity, and ecosystem breadth may determine the future of a public chain.

Sei's choice is to position itself at the heart of the industry's most competitive arena—where the opportunities are immense, but the margin for error left to the unsuccessful is minimal. Its next growth trajectory hinges on its ability to not just survive in the EVM world's red ocean, but to become a crucial infrastructure driving the next wave of applications.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster announces a $10 million trading competition, combined with Stage 4 airdrop and Rocket Launch incentives, driving multi-layered growth in platform depth and liquidity.

After achieving strong performance in Stage 3, Stage 4 (Harvest) airdrop plan was launched, and the “Double Harvest” trading competition with a total reward of 10 million USD will be introduced on November 17.

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.