Treasury BV to Acquire 1,000 Bitcoins Backed by Winklevoss

- Treasury BV to purchase 1,000 Bitcoins with Winklevoss support.

- Europe sees largest corporate Bitcoin acquisition with Winklevoss backing.

- Bitcoin reserve strategy signals shift in European corporate treasury.

European firm Treasury BV will acquire over 1,000 Bitcoins backed by Winklevoss Capital and Nakamoto Holdings, planning a listing on Euronext Amsterdam via a reverse merger with MKB Nedsense.

This move signifies a substantial increase in European corporate Bitcoin holdings, potentially influencing market sentiment and institutional interest.

Treasury BV’s Landmark Acquisition

Treasury BV, a European firm, announced plans to purchase over 1,000 Bitcoins. The acquisition will be backed by funding from Winklevoss Capital and Nakamoto Holdings.

The initiative, aiming for Bitcoin as a primary reserve asset, is led by CEO Khing Oei. The backing involves support from Cameron and Tyler Winklevoss, renowned figures in the cryptocurrency sector.

The acquisition of 1,000+ BTC is expected to solidify Europe’s corporate position in the cryptocurrency market. This large-scale purchase will impact Bitcoin’s standing as a corporate asset in the region.

The €126M funding round underscores a growing shift towards Bitcoin-based reserves. Such moves contrast with traditional fiat-based treasuries, indicating a strategic financial pivot for European corporations. “Our investment in Treasury BV showcases our commitment to expanding Bitcoin’s role as a vital reserve asset in Europe.” – Cameron Winklevoss

The plan involves a reverse merger with MKB Nedsense to list on Euronext Amsterdam. This demonstrates Treasury BV’s commitment to expanding its market presence through strategic financial moves .

Treasury BV’s decision is reminiscent of past U.S. corporate purchases, notably by MicroStrategy and Tesla. These actions typically precede increased institutional interest and Bitcoin market activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC price bull market lost? 5 things to know in Bitcoin this week

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

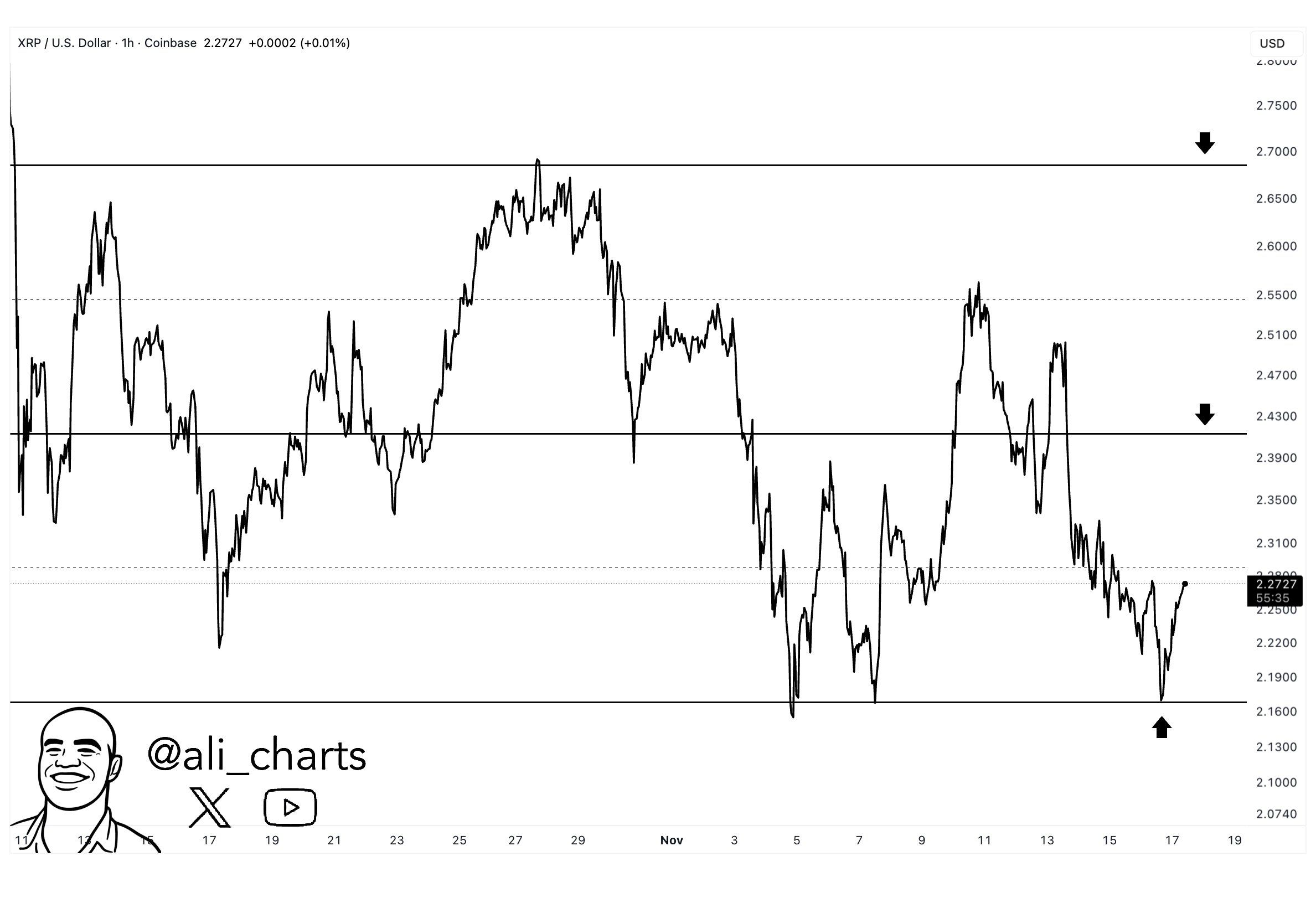

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand