Citi survey: Cryptocurrency expected to account for one-tenth of the post-trade market by 2030

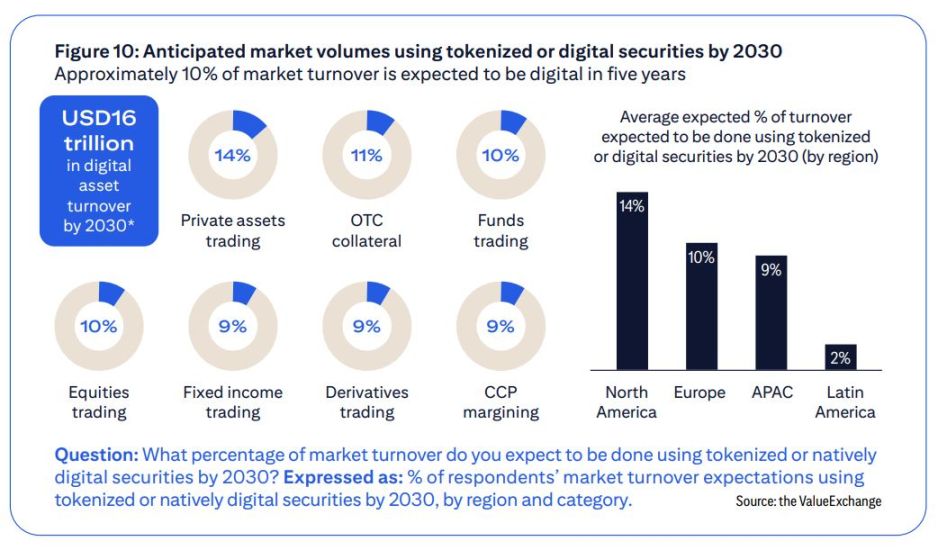

According to Citibank's latest "Securities Services Evolution Report," a survey of 537 global financial executives shows that by 2030, approximately 10% of global post-trade market volume is expected to be processed through digital assets such as stablecoins and tokenized securities.

According to Citi Bank's latest "Evolution of Securities Services Report," a survey of 537 global financial executives shows that by 2030, approximately 10% of global post-trade market volume is expected to be processed through digital assets such as stablecoins and tokenized securities. This survey was conducted between June and July, covering custodians, banks, broker-dealers, asset management firms, and institutional investors across the Americas, Europe, Asia-Pacific, and the Middle East.

Stablecoins and Tokenized Securities Lead the Transformation

The report points out that bank-issued stablecoins are seen as a primary means to improve collateral efficiency, fund tokenization, and private market securities trading. The post-trade market is responsible for ensuring the verification, execution, and final settlement of securities transactions. In recent years, with the United States passing legislation to regulate stablecoins earlier this year, Wall Street's interest in stablecoins has increased significantly.

Citi Bank states that since 2021, the adoption of digital assets has gradually shifted from the early experimental stage to strategic implementation. Although the industry has not yet reached a "tipping point," Citi predicts that this moment is "close at hand." The report emphasizes that the global post-trade industry is about to undergo an international transformation in terms of speed, cost, and resilience.

Blockchain Technology Drives Efficiency Improvements

The survey shows that enhanced liquidity and post-trade cost efficiency are the main drivers for investing in distributed ledger technology (DLT). Most respondents believe that blockchain will significantly impact these areas within the next three years. Citi notes that more than half of respondents clearly state that DLT can accelerate the circulation of securities in global capital markets, thereby significantly reducing financing costs, financial resource requirements, and operational costs by 2028.

Regional Differences in Expectations for Digital Assets

The U.S. market is expected to have the highest proportion of tokenized securities trading. Source: Citi

The survey shows that the U.S. has higher expectations for digital asset growth than other regions, with 14% of U.S. market volume expected to be completed through digital or tokenized assets by 2030, compared to 10% in Europe and 9% in Asia-Pacific. The optimism in the U.S. market is mainly driven by regulatory changes, such as the "GENIUS Act" signed by President Donald Trump in July 2025. In addition, the leadership of major institutions such as stablecoin issuer Circle and asset management firm BlackRock in expanding digital liquidity has also contributed to the shift in market sentiment.

The Impact of Generative Artificial Intelligence (GenAI)

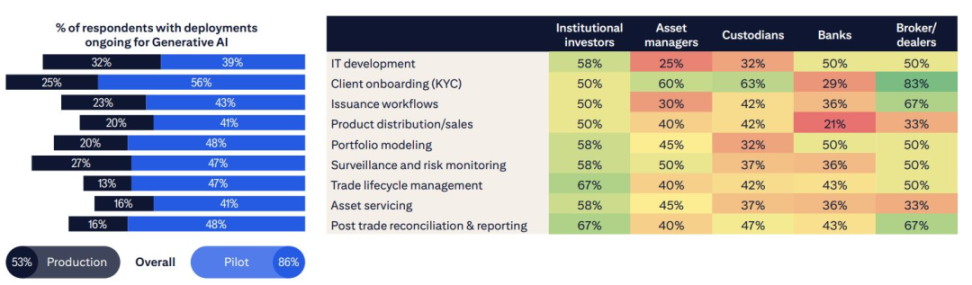

More than half of respondents said their institutions are piloting GenAI in post-trade operations. Source: Citi

Generative Artificial Intelligence (GenAI) is also expected to play an important role in the post-trade market. 57% of respondents said their institutions are piloting the use of GenAI for post-trade operations. At least 67% of institutional investors said they use GenAI for post-trade reconciliation, reporting, clearing, and settlement.

In addition, 83% of broker-dealers, 63% of custodians, and 60% of asset management firms are using GenAI to optimize client onboarding processes. Citi points out that in an environment where "faster, more efficient onboarding directly translates to returns," this use case is an ideal starting point for connecting retail and institutional clients.

The Industry Is Approaching a Tipping Point

The Citi report concludes that after years of infrastructure development, the global post-trade industry is about to undergo a comprehensive transformation in speed, cost, and resilience. Although the crypto industry has not fully reached the tipping point, with improvements in the regulatory environment, deeper technology adoption, and the push from major institutions, digital assets and blockchain technology are expected to significantly change the way global financial markets operate within the next five years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: The Fear Index Drops to 10, But Analysts See a Reversal

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?