Tom Lee: ETH is experiencing its "1971 moment," a $60,000 valuation is reasonable

This article is from: Medici Network

Translated by | Odaily (@OdailyChina); Translator | Azuma (@azuma_eth)

Original Title: Tom Lee's Latest Podcast: We Are Witnessing ETH's "1971 Moment", $60,000 Is the Reasonable Valuation

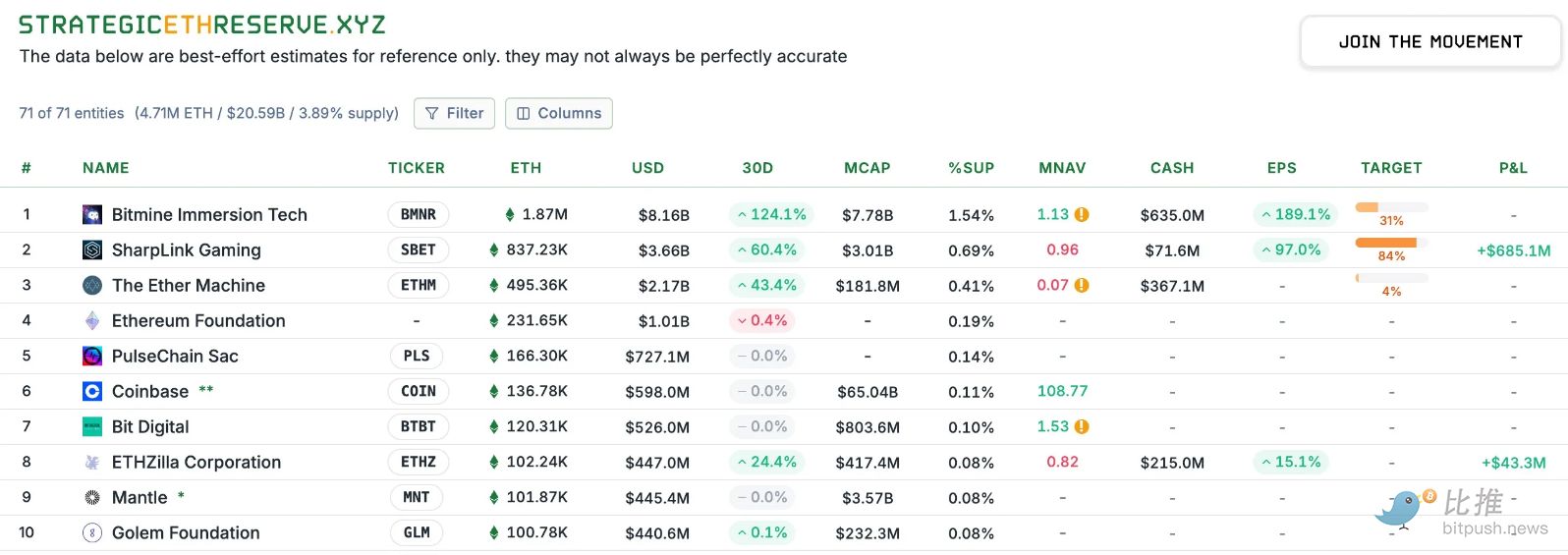

Editor's Note: What is the strongest buying force behind ETH's current rally? The answer is undoubtedly ETH treasury companies. With BitMine (BMNR) and Sharplink Gaming (SBET) continuously increasing their holdings, the discourse power of ETH has quietly shifted—see "Unveiling the Two Major Players Behind ETH's Surge: Tom Lee VS Joseph Rubin" for details.

According to Strategic ETH Reserve data, as of September 4 (GMT+8), BitMine's ETH holdings have reached 1.87 million coins, worth about $8.16 billion. Tom Lee, the head of BitMine, has long become the biggest whale with the most influence in the current Ethereum ecosystem.

On the evening of September 3, Tom Lee participated in an interview on Level Up, a podcast under Medici Network. In the conversation, Tom Lee discussed ETH's positioning in the global financial sector, the rise of BitMine as the leading ETH treasury, and the macro environment surrounding digital assets. He also shared his views on the long-term potential of cryptocurrencies, the vision of decentralization, and BitMine's plans to further increase its reserves.

The following is the original interview content, translated by Odaily—some content has been omitted for readability.

-

Host: Can you briefly tell us your story? How did you get into the cryptocurrency market? (When introducing Tom Lee, the host referred to him as "the man with the best hairstyle on Wall Street" in addition to his regular titles.)

Tom Lee: Simply put, after graduating from college (at Wharton), my entire career has basically been focused on one thing: market research. My first job was at Kidder, Peabody & Company, researching the tech industry, especially wireless communications, from 1993 to 2007.

That experience taught me some important things. Wireless communications were just starting out at the time—there were only 37 million mobile phones globally, and today there are nearly 8 billion. The growth was exponential. But what surprised me was that many clients were actually very skeptical of wireless technology—at the time, the core business of the telecom industry was long-distance and local calls, and mobile phones were seen as just an "upgraded wireless phone" that might become free in the future.

So I realized then: fund managers in their forties and fifties often can't truly understand technological disruption, because they're essentially vested interests. Later, I became chief strategist at JPMorgan and stayed until 2014. Then I founded Fundstrat, with the original intention of building Wall Street's first company to "democratize institutional research"—that is, to open up research previously only available to hedge funds and large asset managers to the broader public. We wanted to make research services originally provided to hedge funds and large institutions accessible to the public.

Then, around 2017, I started noticing news that bitcoin had broken through $1,000. This reminded me of discussions we had on the JPMorgan forex team, when bitcoin was still under $100, about whether this digital currency could be recognized as a form of money.

But at JPMorgan, the attitude was very negative; people thought bitcoin was just a tool for drug dealers and smugglers. But in my 20-year career, I had never seen an asset go from under $100 to $1,000, with a market cap exceeding $1 billion. This was definitely not something to ignore—I had to study it.

So we started researching. Although I couldn't fully understand at the time why a "proof-of-work blockchain" could become a store of value, I found that just two variables could explain over 90% of bitcoin's price increase from 2010 to 2017: the number of wallets and the activity per wallet.

Based on these two variables, we could even model and project bitcoin's possible future trends. This was my first real "journey" into crypto. So, when bitcoin was still below $1,000, we published our first white paper. We proposed: if someone treats bitcoin as a substitute for gold, and it only takes 5% of the gold market share, then the reasonable price for bitcoin would be $25,000. This was our prediction for bitcoin's price in 2022, and by 2022, bitcoin was indeed around $25,000.

-

Host: You just talked about BTC, but you're also doing some interesting things with ETH. Can we talk about the macro opportunity for ETH?

Tom Lee: For a long time, roughly from 2017 to 2025, our core view in crypto has always been—bitcoin occupies a very clear position in many people's investment portfolios, because it has been proven in terms of scale and stability, and more importantly, it can serve as a store of value.

When we think about how investors should allocate within crypto assets beyond bitcoin, there are many projects on the market—like Solana, Sui, and various projects you often write about. But starting this year, we've taken a fresh, serious look at Ethereum.

The reason is: I think the U.S. regulatory environment is moving in a favorable direction this year, which has made Wall Street start to take crypto and blockchain more seriously. Of course, the real "killer app" or so-called ChatGPT moment here is stablecoins and Circle's IPO, followed by the "Genius" Act and the SEC's Project Crypto initiative.

I think there are many positive factors for ETH here, but the main point is—when we look at the asset tokenization projects Wall Street is advancing, whether it's the dollar or other assets, the vast majority are being done on Ethereum.

Moreover, I think people need to take a step back: what's happening on Wall Street in 2025 is very similar to the historic moment of 1971. In 1971, the U.S. dollar was decoupled from gold, abandoning the gold standard. At the time, gold did benefit, and many people bought gold, but the real core wasn't gold's benefit—it was that Wall Street began financial innovation. Suddenly, the dollar became fiat money, no longer backed by gold, and people had to build new rails for dollar transactions and payments. So, the real winner was Wall Street.

By 2025, the innovation brought by blockchain is solving many problems, and Wall Street is migrating to crypto "rails". In my view, this is ETH's "1971 moment". This will bring huge opportunities, migrating a large number of assets and transactions to the blockchain. Ethereum won't be the only winner, but it will be one of the main winners.

From the perspective of institutional adoption, I hear a lot of related discussions. BTC is already highly institutionalized. When I meet with investors, they all know how to build models and think about BTC's future value. So, BTC is already in many portfolios. In contrast, ETH's holding rate is still very low, more like BTC in 2017.

I think ETH today is not really seen as an "institutional asset", so it's still at a very early stage, which is why I think the opportunity for ETH is even greater.

-

Host: I know you've set a target price for Ethereum, around $60,000. How did you come up with this prediction?

Tom Lee: Yes, that's right. But I must clarify, ($60,000) is not a short-term target. So don't come at me on December 31 saying "it didn't go up that much"—this is not a prediction to be fulfilled next week.

Actually, I was quoting an analysis we did for ETH, completed by Mosaics and some other researchers. Their thinking is to treat now as a turning point similar to 1971. They considered Ethereum's value from two angles: first, as a payment rail; second, the market share of payments that Ethereum could capture. I think these two concepts can be combined.

Their assumption is, if you look at the market covered by the banking system and assume half of it migrates to the blockchain, then Ethereum could capture about $3.88 trillion in value. Then, looking at Swift and Visa, they process about $450 billion in payments annually. If you assume each transaction incurs a gas fee and convert that to network revenue, then give it a relatively conservative 30x P/E ratio, you get about $3 trillion in valuation. Add these two parts together, and Ethereum's reasonable valuation should be around $60,000, which is about 18 times growth from now.

-

Host: Recently, ETH's bullishness has been largely due to continuous buying by digital asset treasury companies. As chairman of BitMine, how do you think investors should view different investment avenues, such as choosing between ETFs, spot, and treasury company stocks?

Tom Lee: First, if someone wants to get ETH exposure through an ETF, that's totally fine, because it allows you to invest directly in ETH without much price difference, just like a BTC ETF gives you BTC exposure.

But if you look at BTC treasury companies, MicroStrategy is bigger than the largest BTC ETF. In other words, more investors are willing to indirectly hold BTC through MicroStrategy than through ETFs. The reason is simple: treasury companies don't just give you a static ETH holding—they actually help you increase the amount of ETH per share. MicroStrategy is an example: when they switched to a BTC strategy in August 2020, the stock price was about $13, and now it's $400, a 30x increase in five years, while BTC itself went from $11,000 to $120,000, about an 11x increase. This shows MicroStrategy successfully increased the BTC held per share, while BTC ETFs just stayed the same during this period.

In other words, over five years, an ETF might give you an 11x return, but MicroStrategy's treasury strategy can let investors earn more. They use the liquidity and volatility of the stock to continuously increase the BTC holding per share. Michael Saylor's strategy is like this: from initially $1–2 of BTC per share to $227 today—a huge increase.

-

Host: You just mentioned that traditional investors' interest in Ethereum is increasing. I'm curious, in the past few months when you've talked to some non-crypto-native institutional clients about treasury companies, how has their attitude changed?

Tom Lee: Frankly, most people look at crypto treasuries with skepticism. Many people who invested in MicroStrategy have done well, but even so, its holders aren't as widespread as you might think, because there are still a lot of institutions that simply don't believe in crypto. For example, a recent Bank of America survey showed that 75% of institutional investors have zero crypto exposure. In other words, three-quarters have never touched crypto assets. So when they see treasury companies, their first reaction is: "Why not just buy the token directly?"

So we spend a lot of time in meetings educating them. Take BitMine's data as an example: the difference is that treasury companies can help you increase the amount of ETH per share. For example, when we switched to an ETH treasury on July 8, each share corresponded to only $4 of ETH. By the July 27 update, each share corresponded to $23 of ETH—a nearly 6x increase in just one month. This gap is huge and demonstrates the "per-share ETH acceleration effect" brought by the treasury strategy.

-

Host: There are many ETH treasury companies on the market, but obviously BitMine moves the fastest. How did you achieve this?

Tom Lee: I think MicroStrategy provided a great template. The first BTC treasury company was actually Overstock, but it didn't really win over investors, and the stock price didn't benefit. Saylor was the first to do this on a larger, more systematic scale, which inspired us. So our strategy at BitMine is to keep the path extremely clear and simple, relying entirely on common stock operations, without complex derivative structures, so investors can understand at a glance. In the future, we may add strategies that use volatility or market cap, but the first step is to have a clear strategy that shareholders can trust.

Why is this important? Because investors need to believe they're buying not just ETH, but a long-term macro trading opportunity. Palantir can get a premium valuation not just because of its product, but because shareholders feel they're holding something "meaningful." What we need to do is make investors understand that Ethereum is one of the biggest macro trading trends for the next 10–15 years.

-

Host: On the topic of treasury company premiums, Michael Saylor once said he would use ATM (issuing new shares on the open market) more aggressively at a premium range of 2.5 to 4 times. I think among all treasury companies, you've always been more aggressive in increasing NAV through ATM, right? Even at lower premium levels, but this has allowed you to achieve sustained and strong NAV growth. How do you consider the appropriate premium multiple? Like Saylor said, he's at one extreme, thinking it's not worth acting aggressively below 4x. What do you think?

Tom Lee: I think there's a strange math problem here.

Theoretically, every financial instrument requires certain trade-offs—this might be a bit technical for listeners—common stock is actually a great financing tool because it gives everyone equal upside with no conflict of interest—both new and old shareholders are betting on the company's future success.

But when you finance with convertible bonds, it's different. Buyers not only care about the stock price, but also about capturing volatility, and may even hedge to eliminate volatility. Preferred stock and debt are essentially liabilities—although ETH treasury companies can use staking rewards to pay debts, those financings are still debt. Debt holders don't care about the company's success, only about interest payments.

So, if you introduce conflicting motives and different incentives when changing the capital structure, you may actually harm the company—too many convertibles suppress volatility, which in turn hinders the flywheel effect (volatility is the basis of stock liquidity).

Therefore, it's hard to precisely calculate the optimal range for graded operations. Another thing to remember—in the next crypto winter (which will inevitably happen), the company with the cleanest balance sheet will win. That way, you won't be forced to finance at a discount to meet payment obligations, nor will you have natural short positions due to derivative structures—when the stock price falls, coverage requirements trigger more shorting, forming a death spiral. That's why BitMine keeps its structure simple.

If a treasury company's premium is only 10% above NAV, it's hard to justify ATM operations—mathematically, at a 1.1x premium, you'd have to sell 100% of the circulating shares (doubling the total shares) to have a positive impact on ETH per share. But at a 4x premium, you only need to sell 25% of shares to double the ETH per share. I guess that's Saylor's logic, but my thinking is different—I think it's better to think more strategically.

-

Host: You mentioned the inevitability of down cycles. We've been through several crypto winters. What impact do you think this will have on treasury companies?

Tom Lee: It's hard to say, but the best analogy might be the oil services industry. The simplest analogy for crypto treasury companies is oil companies—investors can buy oil, oil contracts (even for physical delivery), but many people buy oil company stocks, like ExxonMobil or Chevron, which always trade at a premium to proven reserves because these companies are actively acquiring more oil.

When capital markets become unfriendly, companies with more complex capital structures collapse. In a crypto winter, valuation differences will be greater, and companies with the cleanest balance sheets can acquire assets, and may even trade at a discount to NAV.

-

Host: Do you mean there will be some mergers/acquisitions among treasury companies?

Tom Lee: Yes, the Bankless guys mentioned a good point. They said that in the bitcoin treasury track, MicroStrategy is clearly far ahead, but in the Ethereum treasury track, there's no absolute leader yet. For now, everyone can still get funding smoothly, so it's not yet time for consolidation.

If consolidation does happen, I think it's more likely in the bitcoin treasury market, because bitcoin has already had a big rally (though I'm still bullish and think it can go to $1 million), but Ethereum is still at an earlier stage of value realization. So the situation you described is more likely to happen with bitcoin.

-

Host: You mentioned keeping a clean balance sheet. In a crypto winter, if the company's stock is at a discount, would you consider buying back shares? Would you do it by issuing debt, or keep extra cash reserves outside of the ETH position?

Tom Lee: That's a good question, but we can only discuss it theoretically. First, I don't think a crypto winter will happen soon. To be clear, we're still bullish on the market, so I don't expect a winter soon. Of course, at some point in the future it will happen, and by then BitMine will have several cash flow sources:

First, from our traditional main business;

Second, from staking rewards, because staking yields can be converted to fiat when necessary for buybacks, theoretically even achieving a 3% buyback scale, which is already significant;

Third, considering whether to use capital markets to support buybacks.

At that time, the company with the cleanest balance sheet can do a lot. For example, using ETH as collateral for loans, with known market interest rates, so there will be many ways, but in practice each company will be different. If the balance sheet is complex, it's basically impossible to protect yourself during a discount.

-

Host: To keep BitMine's stock price above its NAV, would you consider acquisitions? Because that would be accretive from a per-share ETH perspective. At what level of discount do you think an acquisition would make sense?

Tom Lee: I think every company has its own algorithm. If a company can't keep its stock price above NAV even when there's huge upside for ETH, then it's just following ETH's beta exposure. Companies that get a premium must make alpha choices. In other words, you can buy more ETH for beta exposure, but to outperform, you need an alpha strategy.

The reasons for a company's discount may vary—poor liquidity, high debt, complex business, etc.—all of which can lead to reasonable premiums or discounts.

-

Host: Changing the topic, although it's not directly related to BitMine, I want to ask, do you think MicroStrategy will be included in the S&P 500 in September?

Tom Lee: The S&P 500 committee's work is confidential, but they do a great job. If you look at historical data, every 10 years, over 20% of index returns come from companies not included in the index ten years ago. In other words, the S&P 500 is actually actively picking stocks, not just mechanically following rules.

In fact, their performance is much better than all-market indices like the Wilshire 5000, and better than the Russell 1000 (market cap weighted). This shows they're not just picking the biggest companies, but making thematic judgments. AI is definitely a focus, crypto is also important, and they'll consider reducing exposure to commodities-sensitive sectors.

-

Host: Speaking of indices, BitMine is growing fast. Is there a chance it could be included in some indices?

Tom Lee: S&P series is not possible for now, because it requires positive net profit, which we can only achieve after starting native staking. The Russell indices are quantitative, only looking at trading volume and free float market cap. The threshold for Russell 1000 is about $5 billion, and the rebalancing is every June. Starting in 2026, it will be every six months. By this standard, BitMine is already well above the threshold.

-

Host: I think our discussion is about done for today. This has been a great conversation. Do you have any final thoughts or key points you'd like to leave with the audience?

Tom Lee: I'd like to sum up: we're actually witnessing a historic moment in the financial industry. Blockchain solves many problems, democratizes finance, and breaks the gatekeeper structure that controlled resources in the past. Even when discussing universal basic income, blockchain and crypto can provide solutions. So I think we should not only remain optimistic about the short-term prices of bitcoin and Ethereum, but also see the profound positive impact they bring to society.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025