Fireblocks Launches Stablecoin Network for Business Payments

- Fireblocks Launches Stablecoin Payment Network

- More than 40 companies already use the new infrastructure

- Stablecoins could move trillions in value in the coming years

Fireblocks announced the launch of a stablecoin-based payments network designed to assist cryptocurrency companies and financial institutions in moving dollar-pegged tokens and developing new products. The announcement was made in an official post on X, highlighting the beginning of a strategic phase for the company.

The Fireblocks Network for Payments has landed.

A unified layer for global stablecoin payments across 100+ countries.

→ Open

→ Compliant

→ Built for productionNo more patchwork. This is the infrastructure stablecoins needed.

Read the exclusive announcement with…

— Fireblocks (@FireblocksHQ) September 4, 2025

According to Fireblocks, more than 40 participants already use the network, including Circle, Bridge, Zerohash, and Yellow Card. Circle, the issuer of USDC, the second-largest stablecoin on the market, is a key partner in the initiative.

Michael Shaulov, co-founder and CEO of Fireblocks, said:

"Fireblocks is the backbone of stablecoin payments. By introducing unified APIs and workflows, as well as APIs specifically designed for stablecoin use cases, the Fireblocks Network for Payments gives institutions the ability to securely move value across any provider, blockchain, or fiat platform."

The expected growth of the stablecoin market to trillions of dollars in the coming decades reinforces the revenue potential of this segment. Traditional financial institutions, such as Bank of America, have already signaled plans to launch their own dollar-pegged tokens, creating a competitive environment for infrastructure solutions.

Chris Maurice, CEO of Yellow Card, highlighted the relevance of the partnership:

"With Fireblocks, we've transformed a process that used to be slow and manual into a fast, secure, and compliant growth engine. It's the core infrastructure that allows us to confidently scale our payment services to customers in over 20 African countries and emerging markets."

Fireblocks, valued at $8 billion after raising $550 million in 2022, has major investors including Sequoia Capital, Coatue, Ribbit, Bank of New York Mellon, Paradigm and SCB10x.

With the new network, the company seeks to establish itself as an essential infrastructure in the stablecoin payments sector, offering solutions that unify liquidity, security, and interoperability between different blockchains and financial providers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US and China Make Mutual Positive Statements Regarding Tariffs – Here Are the Details

Crypto, Gold, Hedge Funds US Investors Shift Strategies

Pump.fun (PUMP) Gains Momentum with Key Breakout Retest – Are More Gains Ahead?

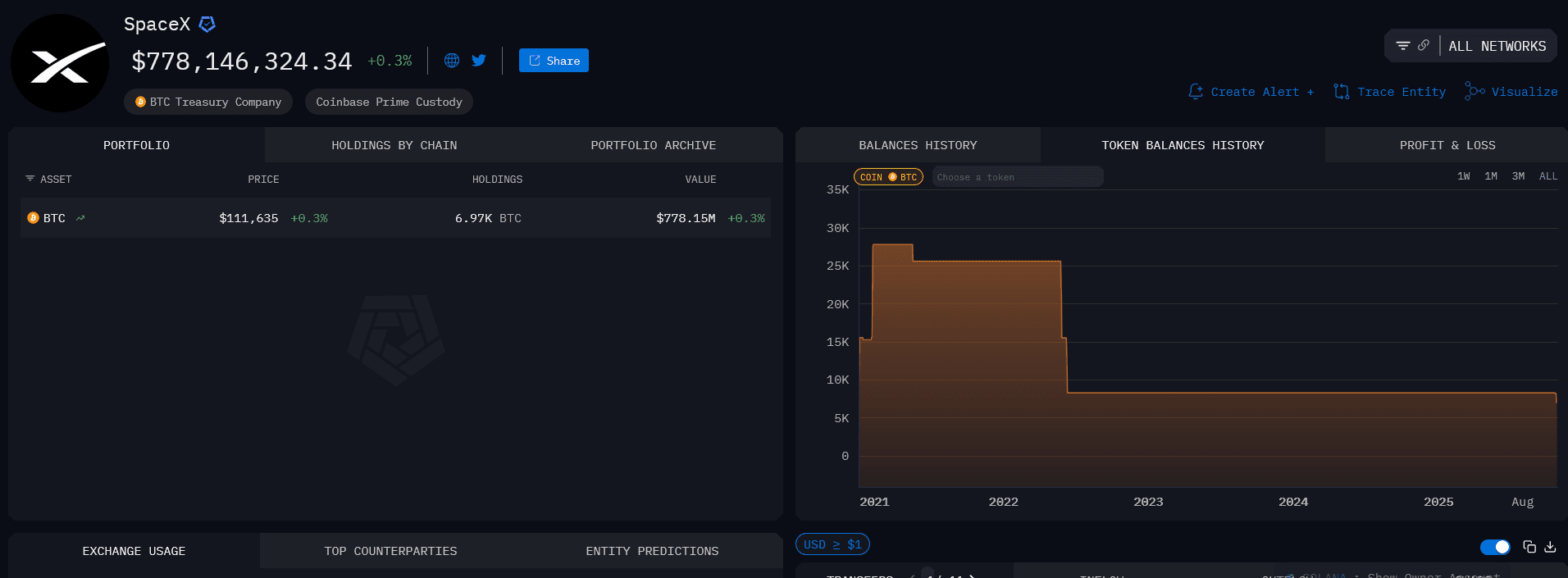

Elon Musk’s SpaceX Transfers $134 Million Worth of Bitcoin