Mega Matrix Inc. announced a new facility to buy stablecoin governance tokens, starting with Ethena (ENA). The company announced a $2B universal shelf registration, allowing the company to list a wide range of equity and debt in the next two years.

Mega Matrix Inc. filed for a $2B facility on its latest S-3 form. The universal shelf registration will allow Mega Matrix to tap a wide range of equity and debt instruments within a three-year time frame.

The company’s digital asset treasury (DAT) approach aims to tap tokens that are used for issuing, backing, and governance of special stablecoins. Stablecoin issuers are a relatively risky type of crypto project, which nevertheless tap the overall market performance.

The first token to be added to the treasury will be Ethena (ENA), the issuer of USDe and sUSDe. While most treasury companies are still focused on Ethereum, Mega Matrix goes directly to Ethena as a way to tap both ETH earnings and the protocol’s native yield.

Mega Matrix move shows confidence in Ethena

Following the news, Mega Matrix MPU shares traded around $1.83, down from their August peak of $3.66. MPU rallied as of August 23, when the first version of the S-3 filing emerged, and the market had already discounted the news of a treasury.

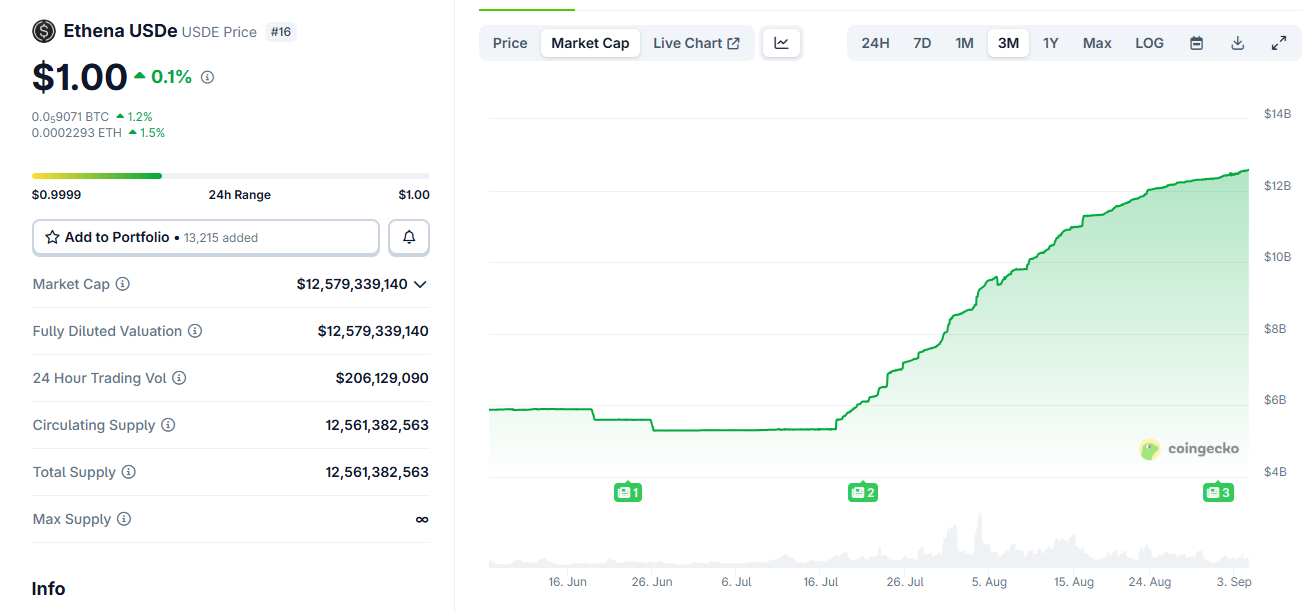

ENA still traded around $0.70, close to the higher range for the past three months. The Ethena project benefitted from the August ETH rally, as it expanded USDe stablecoin issuance to 12.5B tokens, an all-time peak.

While just months ago, Ethena was seen as too risky, the ETH bull market boosted the protocol, turning it into one of the key providers of liquidity. Ethena has also been stress-tested by ETH downturns and liquidations, managing its USDe asset without price shocks.

Ethena’s USDe increased its supply to a record 12.5B tokens, tracking the ETH bull market. | Source: Coingecko

Ethena’s USDe increased its supply to a record 12.5B tokens, tracking the ETH bull market. | Source: Coingecko

The Mega Matrix treasury move also shows renewed confidence in new approaches to stablecoin issuers. The market has also left behind the Terra (LUNA) crash, with lessons learned and a more sophisticated toolset for issuing and staking stablecoins.

Mega Matrix still seeks buyers to start its DAT strategy

The shelf registration was announced, but it still needs to be executed. MPU will be able to sell shares and debts for up to $2B, including Class A common stock, preferred stock, debt securities, or other combinations of fundraising.

Mega Matrix will add prospectus supplements for each offering if there are suitable buyers.

“The $2 billion universal shelf registration, once effective, provides MPU with the flexibility to support our DAT strategy in this new era. Governance tokens are the equity of stablecoin ecosystems, such as $ENA. By building strategic positions, MPU gains both financial upside and a seat at the table where the future of money is being coded,” stated the management of Mega Matrix.

An ENA treasury is thus not guaranteed, as with multiple cases of crypto reserves that failed to see sufficient demand. ENA remains attractive for its revenue-sharing program, meaning treasuries may offer additional yield for staking.

USDe also offers significant annualized returns for holding. However, the announcement of new treasuries now has a more subdued effect on both stocks and the underlying asset.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free .