Author: Tristero Research

Translation: TechFlow

Background Introduction

The slowest assets in finance—loans, buildings, commodities—are being tied to the fastest markets in history. Tokenization promises liquidity, but in reality, it only creates an illusion: a shell of liquidity wrapping a non-liquid core. This mismatch is known as the “Real World Asset (RWA) Liquidity Paradox.”

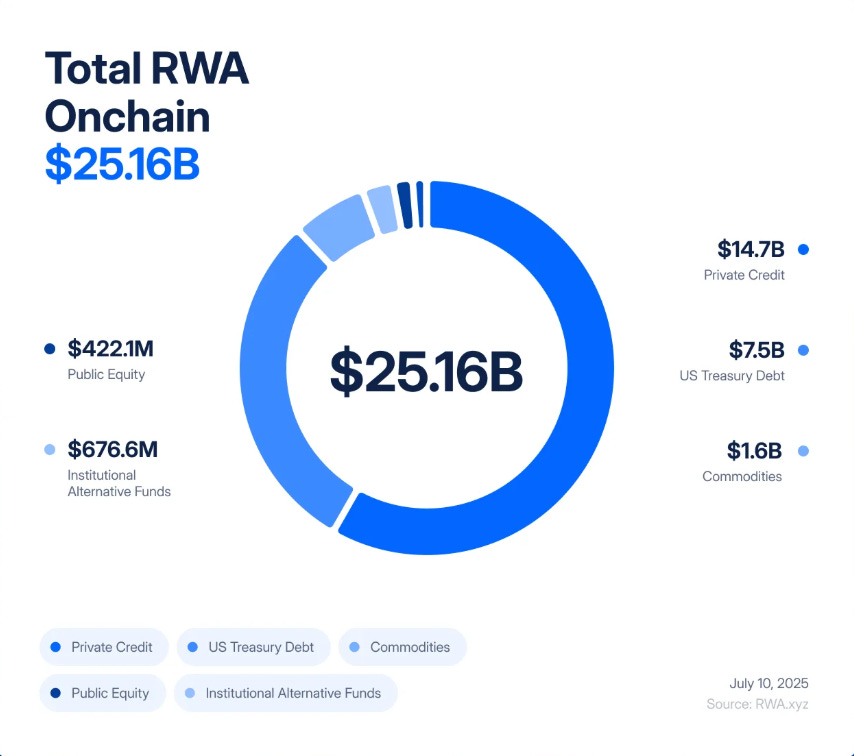

In just five years, RWA tokenization has leapt from an $85 million experiment to a $25 billion market, achieving “245x growth between 2020 and 2025, mainly driven by institutional demand for yield, transparency, and balance sheet efficiency.”

BlackRock has launched tokenized treasuries, Figure Technologies has put billions of dollars in private credit on-chain, and real estate transactions from New Jersey to Dubai are being fractionalized and traded on decentralized exchanges.

Analysts predict that trillions of dollars in assets may follow this trend in the future. To many, this seems to be the long-awaited bridge between traditional finance (TradFi) and decentralized finance (DeFi)—an opportunity to combine the security of real-world yields with the speed and transparency of blockchains.

However, beneath this enthusiasm lies a structural flaw. Tokenization does not change the fundamental properties of office buildings, private loans, or gold bars. These assets are inherently slow and illiquid—they are bound by legal and operational constraints of contracts, registries, and courts. All tokenization does is wrap these assets in a hyper-liquid shell, making them instantly tradable, leveraged, and liquidated. The result is a financial system that transforms slow credit and valuation risk into high-frequency volatility risk, with contagion spreading not in months, but in minutes.

If this sounds familiar, it’s because it is. In 2008, Wall Street learned a painful lesson about what happens when illiquid assets are transformed into “liquid” derivatives. Subprime mortgages collapsed slowly; collateralized debt obligations (CDOs) and credit default swaps (CDS) unraveled rapidly. The mismatch between real-world defaults and financial engineering detonated the global system. Today’s danger is that we are rebuilding this architecture—only now it runs on blockchain rails, and the speed of crisis is the speed of code.

Imagine a token linked to a commercial property in Bergen County, New Jersey. On paper, the building seems solid: tenants pay rent, loans are serviced on time, and title is clear. But transferring that title legally—title checks, signatures, filing with the county clerk—takes weeks. That’s how real estate works: slow, methodical, bound by paper and courts.

Now put the same property on-chain. The title is held in a special purpose vehicle (SPV), which issues digital tokens representing fractional ownership. Suddenly, this once-silent asset can be traded 24/7. In a single afternoon, these tokens might change hands hundreds of times on decentralized exchanges, be used as collateral for stablecoins in lending protocols, or be bundled into structured products promising “safe real-world yields.”

The problem is: nothing about the building itself has changed. If the main tenant defaults, the property value drops, or the SPV’s legal rights are challenged, the real-world impact may take months or years to materialize. But on-chain, confidence can evaporate instantly. A rumor on Twitter, a delayed oracle update, or a sudden sell-off can trigger a chain reaction of automated liquidations. The building doesn’t move, but its tokenized representation can collapse in minutes—dragging down collateral pools, lending protocols, and stablecoins into distress.

This is the essence of the RWA liquidity paradox: tying illiquid assets to hyper-liquid markets does not make them safer—it makes them more dangerous.

2008’s Slow Collapse vs. 2025’s Real-Time Meltdown

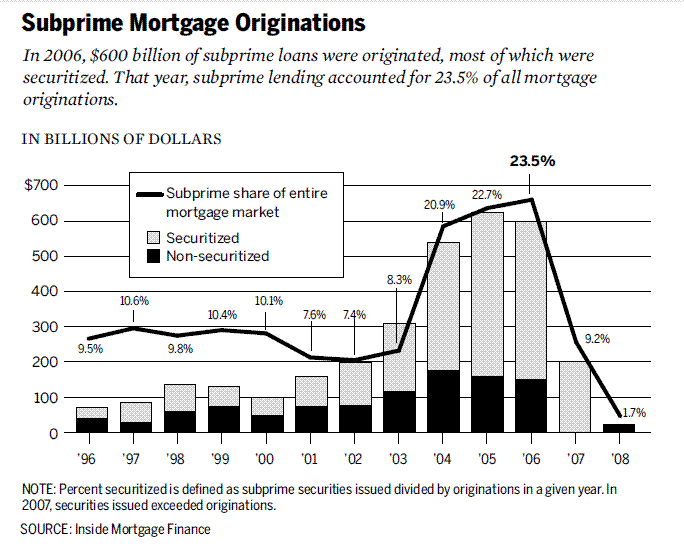

In the mid-2000s, Wall Street transformed subprime mortgages—illiquid, high-risk loans—into complex securities.

Mortgages were pooled into mortgage-backed securities (MBS), then sliced into tranches of collateralized debt obligations (CDOs). To hedge risk, banks layered on credit default swaps (CDS). In theory, this “financial alchemy” turned fragile subprime loans into “safe” AAA assets. In reality, it built a tower of leverage and opacity on a shaky foundation.

The crisis erupted when the slow-moving defaults of mortgages collided with the fast-moving CDO and CDS markets. Foreclosures took months, but the derivatives linked to them could be repriced in seconds. This mismatch wasn’t the only cause of the collapse, but it amplified local defaults into a global shock.

The tokenization of RWAs is facing a replay of this mismatch risk—only faster. We’re no longer tranching subprime mortgages, but fractionalizing private credit, real estate, and treasuries into on-chain tokens. We’re no longer using CDS, but will see “RWA-enhanced” derivatives: options, synthetic assets, and structured products based on RWA tokens. Rating agencies once labeled junk assets as AAA; now we outsource valuations to oracles and custodians—the new black boxes of trust.

This similarity is not superficial; the logic is identical: wrap illiquid, slow assets in seemingly liquid structures, then let them circulate in markets that move orders of magnitude faster than the underlying assets. The 2008 system took months to collapse. In DeFi, a crisis can spread in minutes.

Scenario 1: Credit Default Chain Reaction

A private credit protocol has tokenized $5 billion worth of SME loans. On the surface, yields are steady at 8% to 12%. Investors treat the tokens as safe collateral and use them for borrowing and lending on Aave and Compound.

Then, the real economy starts to deteriorate. Default rates rise. The true value of the loan book drops, but the oracle providing on-chain prices updates only once a month. On-chain, the tokens still look robust.

Rumors start to spread: some large borrowers are overdue. Traders rush to sell before the oracle catches up. The market price of the tokens falls below their “official” value, breaking their peg to the dollar.

This is enough to trigger automated mechanisms. DeFi lending protocols detect the price drop and automatically liquidate loans collateralized by the token. Liquidation bots repay debts, seize collateral, and dump it on exchanges—driving prices down further. More liquidations follow. In minutes, a slow credit issue becomes a full-blown on-chain meltdown.

Scenario 2: Real Estate Flash Crash

A custodian manages $2 billion worth of tokenized commercial real estate, but a hack threatens its legal rights to the properties. Meanwhile, a hurricane hits the city where the buildings are located.

The off-chain value of the assets becomes uncertain; the on-chain token price collapses instantly.

On decentralized exchanges, panicked holders rush to exit. Automated market maker liquidity is drained. Token prices plummet.

Across the DeFi ecosystem, these tokens were used as collateral. Liquidation mechanisms kick in, but the seized collateral is now worthless and highly illiquid. Lending protocols are left with unrecoverable bad debt. Lending protocols ultimately fall into an unrecoverable bad debt predicament. What was once touted as “on-chain institutional-grade real estate” instantly becomes a massive hole on the balance sheets of DeFi protocols and any associated TradFi funds.

Both scenarios show the same dynamic: the speed of the liquidity shell’s collapse far outpaces the reaction speed of the underlying asset. The buildings still stand, the loans still exist, but the on-chain asset representation evaporates in minutes, dragging down the entire system.

The Next Stage: RWA-Squared

Finance never stops at the first layer. Once an asset class appears, Wall Street (and now DeFi) builds derivatives on top. Subprime mortgages spawned mortgage-backed securities (MBS), then collateralized debt obligations (CDOs), then credit default swaps (CDS). Each layer promised better risk management; each layer amplified fragility.

Tokenization of RWAs will be no different. The first wave of products is relatively simple: fractionalized credit, treasuries, and real estate. The second wave is inevitable: RWA-enhanced (RWA-Squared). Tokens are bundled into index products, tranching into “safe” and “risky” parts, and synthetic assets allow traders to bet on or against baskets of tokenized loans or properties. A token backed by New Jersey real estate and Singapore SME loans can be repackaged into a single “yield product” and leveraged in DeFi.

Ironically, on-chain derivatives look safer than 2008’s CDS because they are fully collateralized and transparent. But risk doesn’t disappear—it mutates. Smart contract bugs replace counterparty defaults; oracle errors replace ratings fraud; protocol governance failures replace AIG’s problems. The result is the same: layers of leverage, hidden correlations, and a system vulnerable to single points of failure.

The promise of diversification—mixing treasuries, credit, and real estate into a tokenized basket—ignores one reality: all these assets now share a single correlation vector—the underlying DeFi tech stack. Once a major oracle, stablecoin, or lending protocol fails, all RWA derivatives built on top will collapse, regardless of the diversity of their underlying assets.

RWA-enhanced products will be touted as the bridge to maturity, proof that DeFi can rebuild complex TradFi markets. But they may also become the catalyst ensuring that when the first shock hits, the system doesn’t buffer—it collapses outright.

Conclusion

The RWA boom is being promoted as a bridge between TradFi and DeFi. Tokenization does bring efficiency, composability, and new avenues for yield. But it does not change the nature of the assets themselves: even if loans, buildings, and commodities are traded at blockchain speed, they remain illiquid and slow to transact.

This is the liquidity paradox. Bundling illiquid assets into high-liquidity markets increases fragility and reflexivity. The tools that make markets faster and more transparent also make them more vulnerable to sudden shocks.

In 2008, it took months for mortgage defaults to spread into a global crisis. For tokenized real-world assets, a similar mismatch could spread in minutes. The lesson is not to abandon tokenization, but to fully account for its risks in design: more conservative oracles, stricter collateral standards, and stronger circuit breakers.

We are not doomed to repeat the last crisis. But if we ignore this paradox, we may end up accelerating the next one.