Nvidia GPU, 94% market share

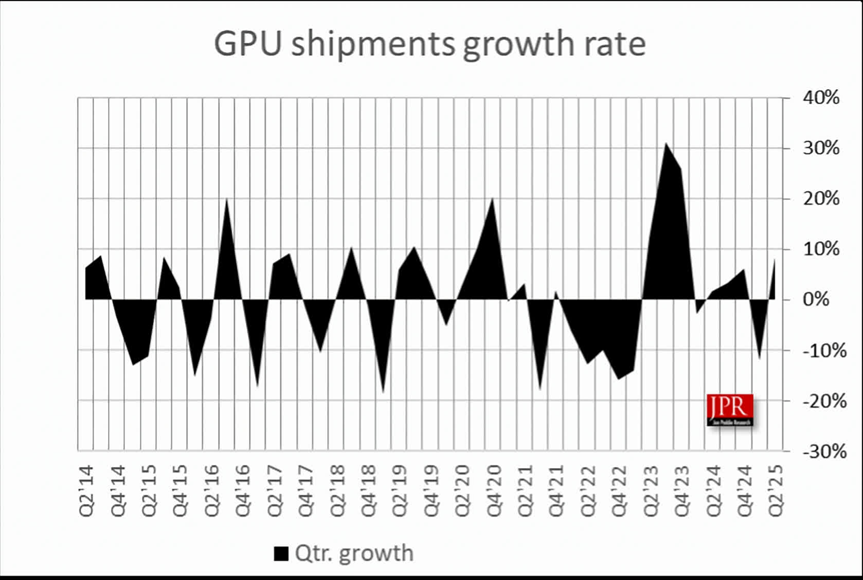

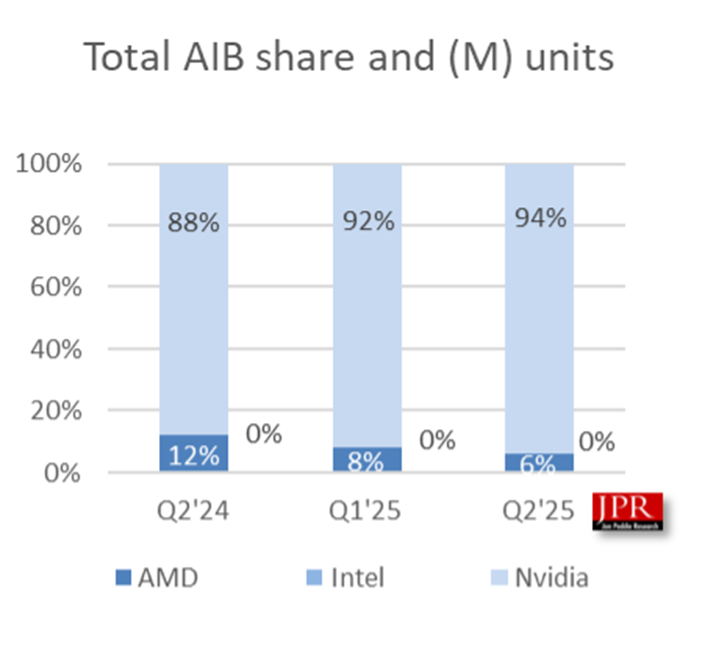

According to the latest report, the GPU market performed strongly in the second quarter of 2025, with global PC graphics AIB shipments reaching 11.6 million units, a quarter-on-quarter increase of 30%. Nvidia's market share further expanded to 94%, while AMD's share dropped to 6%, and Intel remained at 0%. The desktop AIB attach rate rose to 154%, indicating strong user demand for upgrades.

Jon Peddie Research has released its latest GPU market status report, which is good news for the entire industry, especially for Nvidia. Last quarter, add-in board shipments increased by 27%, and Team Green's total share rose to 94%.

JPR wrote that in the second quarter of 2025, the global PC-based graphics AIB market reached 11.6 million units, a quarter-on-quarter increase of nearly 30%. At the same time, data center GPU shipments also increased, up 4.7% quarter-on-quarter.

Unsurprisingly, Nvidia's dominance in this field continues to strengthen, while AMD is at a disadvantage. In the second quarter, the Red Team's share fell by 2% to just 6%, while Nvidia's share increased by the same margin to 94%. Intel's market share remained at 0.0%.

The latest Steam survey shows Nvidia's dominant position in the graphics card market, occupying nearly 75% of the market share. Despite criticism of graphics cards, 7 out of the 13 best-performing GPUs in August were from the Blackwell RTX 5000 series.

JPR also revealed that GPU shipments are 5.2% above the 10-year average.

JPR President Dr. Jon Peddie stated that prices for mid-range and entry-level cards have fallen, while high-end AIB prices have risen, and most retail suppliers are out of stock. He noted that this is very unusual for the second quarter.

He explained: "We believe that due to tariffs and buyers trying to get ahead of the curve, prices are expected to continue to rise."

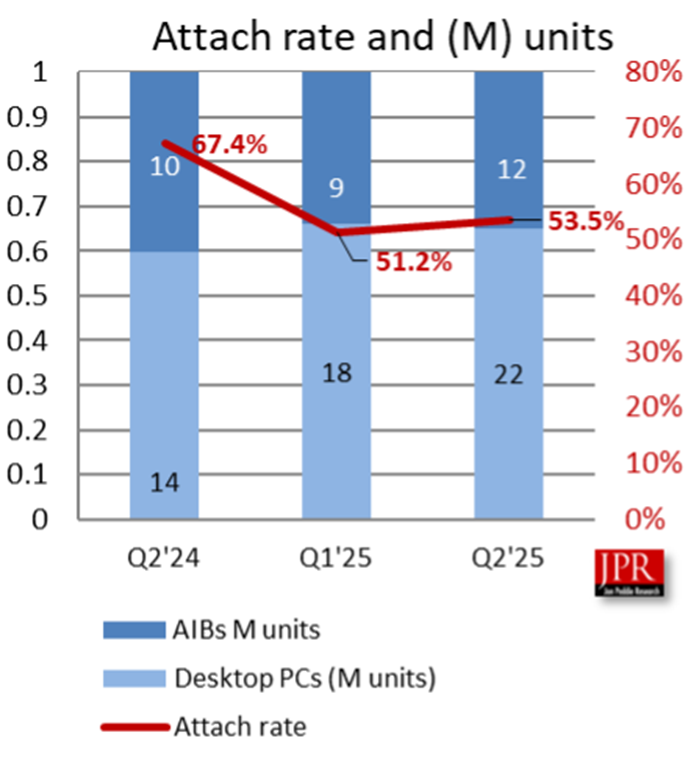

The report also pointed out that the overall desktop AIB attach rate (the ratio of cards sold to the number of desktop computers shipped) increased by 2.3% this quarter, reaching 154%.

In terms of desktop CPUs, the market grew 21.6% quarter-on-quarter, but fell 4.4% year-on-year. AMD shipments increased by 27%, and Intel grew by 2%.

"Mid-range and entry-level AIB prices have fallen, while high-end AIB prices have risen, and most retail suppliers are out of stock. This is very unusual for the second quarter," said Jon Peddie, President of Jon Peddie Research. "We believe that due to tariffs and buyers trying to get ahead of the curve, prices are expected to continue to rise."

Peddie continued to emphasize the impact of tariffs on the market. "The turmoil and uncertainty brought by tariffs have not subsided, making it difficult or even impossible for PC suppliers to plan. The supply chain is being reconfigured every week in an attempt to offset the threat of tariffs and the impact of some actual cases," he said. "Consumers are equally confused and worried, which may lead to a market pullback and further exacerbate market volatility. In such uncertain times, we believe the market has no choice but to decline."

Looking ahead, JPR stated that the compound annual growth rate of AIB from 2024 to 2028 will be -5.4%, and the installed base will reach 163 million units by the end of the forecast period.

The RTX 5000 series graphics cards will be released in early 2025, but rumors about the imminent release of the Super version are rampant. Some say the Super version may even be released by the end of this year, which would be much shorter than the 15-month gap between the first RTX 4000 graphics card (RTX 4090 released in October 2022) and the RTX 4000 Super series graphics cards released in January 2024. Meanwhile, AMD's UDNA graphics cards are expected to be released in late 2026 or early 2027.

Intel took the lead in launching its latest generation of GPUs, which will go on sale in December 2024. On the other hand, both Nvidia and AMD released their latest generation GPUs in the first quarter of this year, while Nvidia will successively release its cost-effective models in the second and third quarters of 2025. However, all these GPU launches have encountered shortages, and buyers have been unable to purchase suitable GPUs at the suggested retail price. This situation even continued into the beginning of the third quarter of this year, and the prices of mid-range graphics cards did not return to normal until last month.

Nevertheless, the data shows that gamers seem willing to spend money to upgrade their systems. The report even points out that the overall attach rate for desktops has risen to 154%, meaning that for every CPU purchased, 1.54 GPUs are sold. Therefore, in addition to people assembling brand new computers (or buying pre-built computers), it seems that a considerable number of people are buying new graphics cards to upgrade their systems.

Jon Peddie Research believes that this growth is driven by concerns over tariffs, especially after the US government announced and postponed the imposition of hefty import taxes on many semiconductor products, including GPUs. Nevertheless, the research firm expects the GPU market to decline by 5.4% between 2024 and 2028.

If the expectation of market contraction continues, then this growth is likely just a temporary phenomenon caused by tariffs and artificially induced GPU shortages. There may be many reasons for this decline, including gamers leaving (or no longer engaging in) PC gaming, or the emergence of processors with powerful integrated graphics, such as AMD's Strix Halo chips.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The crypto industry is experiencing a wave of mergers and acquisitions: giants are bottom-fishing, and the Web3 ecosystem is being restructured.

While small projects are still struggling for their next round of funding and token launches, industry giants are already using cash to buy time and acquisitions to secure their future.

A Brief Discussion on the Eight Major Potential Risks of Stablecoins

As a significant innovation in the cryptocurrency sector, stablecoins are designed with "stability" as their primary intention. However, their potential risks and hazards have attracted widespread attention from global regulatory bodies, academia, and the market.

A heavyweight player enters the gold market! Stablecoin giant Tether poaches top HSBC trader

Tether has recruited the core precious metals team from HSBC, making a strong entry into the precious metals market and challenging the existing industry landscape. In recent years, the company has accumulated one of the world's largest gold reserves.

Robinhood makes a rare bet: Lighter and its genius founder

Aster has aligned itself with Binance, while Lighter has chosen to embrace capital investment.