1 to 4: Bitcoin Drops Once, Treasury Companies Drop Four Times

MetaPlanet and other Bitcoin Treasury Companies face amplified volatility, with internal corporate decisions often driving deeper declines than Bitcoin itself. For investors, BTCTCs are a double bet on BTC and company execution.

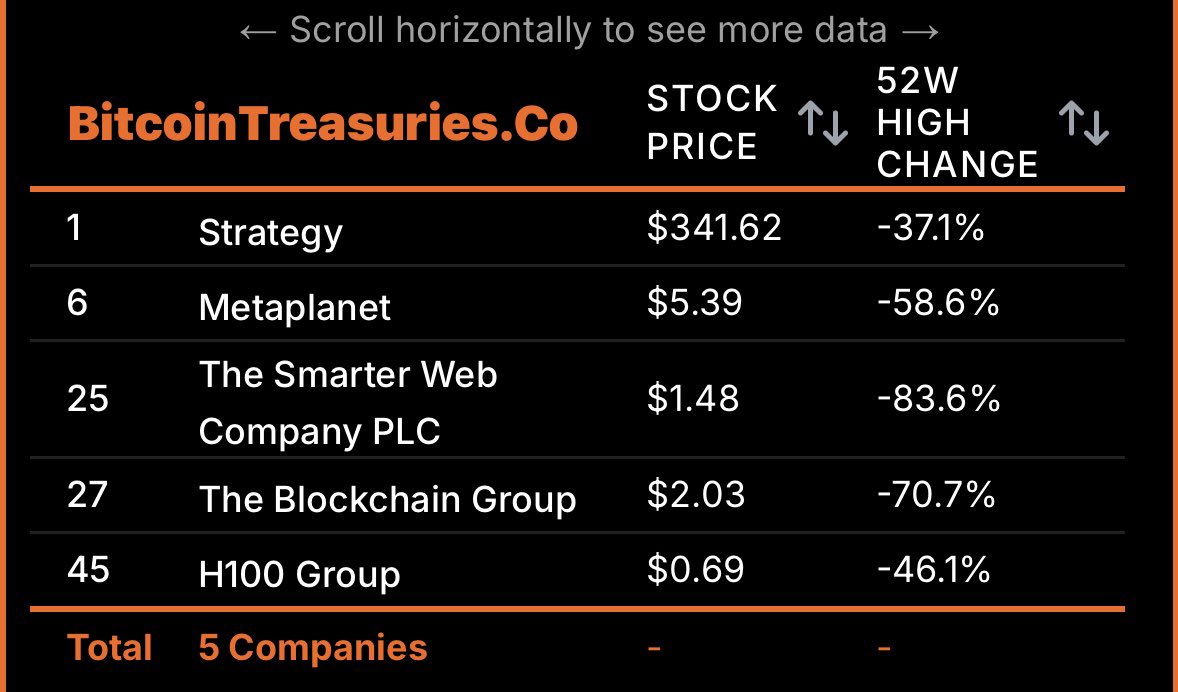

Over the past 10 weeks, Bitcoin Treasury Companies (BTCTCs) stocks have plummeted by 50–80%, sparking widespread concerns among investors.

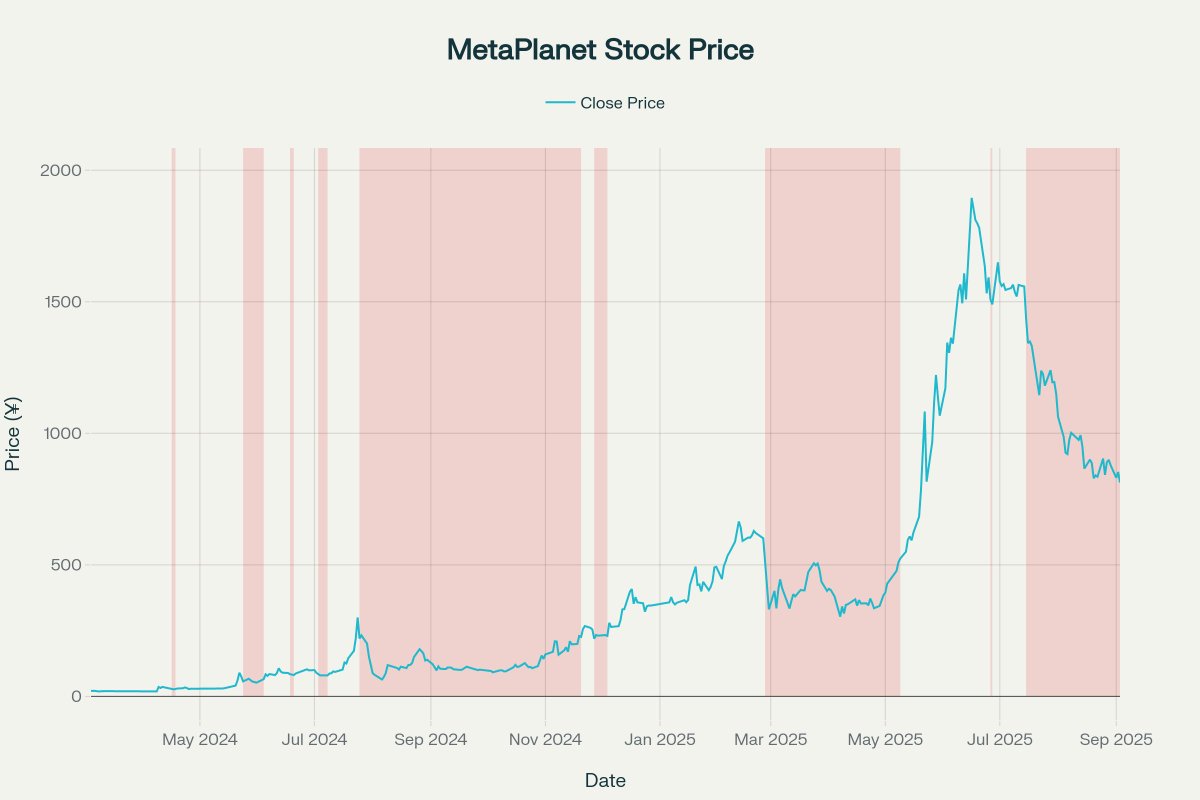

The case of Metaplanet (MTPLF) highlights the harsh volatility, as within 18 months, it went through 12 “mini-bear markets.” This raises the question: do BTCTC stocks mirror Bitcoin’s volatility, or do internal corporate factors also drive them?

When BTCTCs’ Stocks Are Riskier Than Bitcoin Itself

In the past 10 weeks, Bitcoin Treasury Companies (BTCTCs) stocks have recorded 50–80% declines, which has triggered a wave of concern across the investment community. Metaplanet ($MTPLF) is a clear example of this severe volatility.

Price fluctuations of Bitcoin Treasury Companies’ stocks. Source:

X

Price fluctuations of Bitcoin Treasury Companies’ stocks. Source:

X

Within 18 months, Metaplanet endured 12 mini-bear markets — ranging from single-day drops to prolonged downtrends. On average, each decline was about -32.4% and lasted 20 days. Notably, the worst phase saw the stock decline by 78.6% in 119 days (July 25 – November 21, 2024).

Metaplanet stock price. Source:

Mark Moss

Metaplanet stock price. Source:

Mark Moss

The question is whether these downturns fully affect Bitcoin’s (BTC) own volatility.

According to analyst Mark Moss, data shows that only 41.7% (5 out of 12) of Metaplanet’s corrections coincided with Bitcoin’s down cycles. Conversely, more than half were triggered by internal corporate factors, including option issuance, capital raising, or the shrinkage of the “Bitcoin premium” — the gap between the stock price and the actual value of BTC holdings.

Still, Mark observed a partial link.

Specifically, Metaplanet’s deepest declines (such as -78.6% or -54.4%) tended to overlap with significant Bitcoin drawdowns. This suggests that once BTC enters a high-volatility phase, BTCTC stocks often remain weak for longer, suffering a double hit from both market and internal dynamics.

Of course, Bitcoin remains the dominant influence. However, corporate variables act as the real “leverage,” amplifying BTCTCs’ volatility far beyond that of BTC itself. If Bitcoin can be understood through a 4-year cycle, BTCTCs behave like “4 cycles in a single year.”

“So, in summary, the partial synchronization suggests that BTC vol does influence Metaplanet…” noted Mark Moss.

For investors, holding BTCTCs is not merely a bet on Bitcoin’s price, but also a gamble on corporate capital management, financial structure, and business strategy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interview with VanEck Investment Manager: From an Institutional Perspective, Should You Buy BTC Now?

The support levels near $78,000 and $70,000 present a good entry opportunity.

Macroeconomic Report: How Trump, the Federal Reserve, and Trade Sparked the Biggest Market Volatility in History

The deliberate devaluation of the US dollar, combined with extreme cross-border imbalances and excessive valuations, is brewing a volatility event.

Vitalik donated 256 ETH to two chat apps you've never heard of—what exactly is he betting on?

He made it clear: neither of these two applications is perfect, and there is still a long way to go to achieve true user experience and security.

Prediction Market Supercycle