Written by: Umbrella, Deep Tide TechFlow

The once globally popular Pokémon trading cards are now experiencing a resurgence on the blockchain.

Yesterday, the price of CARDS, the token of the on-chain trading card platform Collector Crypt, which incorporates the RWA concept, soared, drawing countless investors’ attention to the crypto trading card sector.

In fact, crypto trading cards are not a new narrative. According to on-chain data, the total TCG (Trading Card Game) transaction volume on Solana alone has already exceeded $95 million.

What kind of sparks will fly when crypto collides with trading cards?

Let’s dive deep into the Crypto+TCG (Trading Card Game) sector and see which projects and assets are worth paying attention to.

Collector Crypt: The King of TCG in the Solana Ecosystem

Founded in 2021, Collector Crypt, as the earliest TCG RWA platform in the Solana ecosystem, has established an undisputed leading position in the sector. The project’s monthly revenue exceeds $1.2 million, with annual revenue approaching $40 million, holding over 95% of the entire crypto trading card market share.

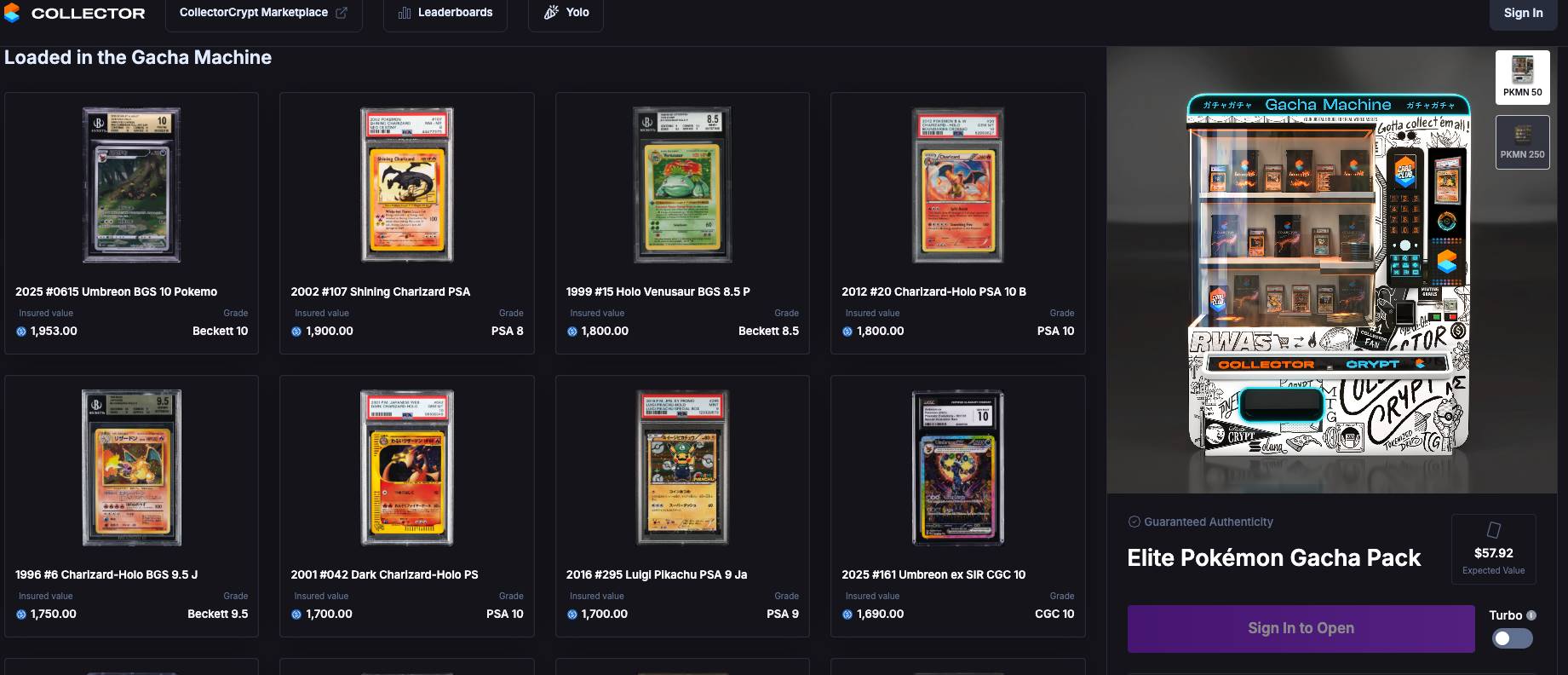

Collector Crypt’s core innovation lies in its Gacha mechanism, which is similar to the real-world blind box draw. Users pay about $50 to obtain a random Pokémon NFT card, with each NFT corresponding to a real physical card, valued between $30 and $5,000. This mechanism cleverly combines the thrill of card drawing with the satisfaction of collecting.

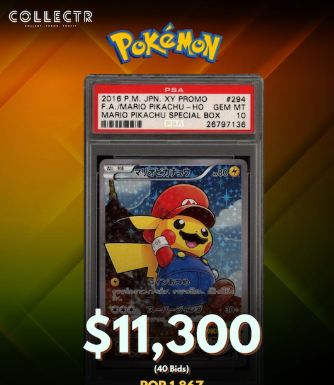

To date, more than 3,000 unique wallets have spent over $49.6 million on Gacha draws on Collector Crypt, with the average user spending as much as $16,500—far surpassing other platforms, reflecting users’ strong recognition and enthusiasm for this model. Among them, two cloaked Pikachu cards were sold at high prices of $15,099 and $16,750, respectively.

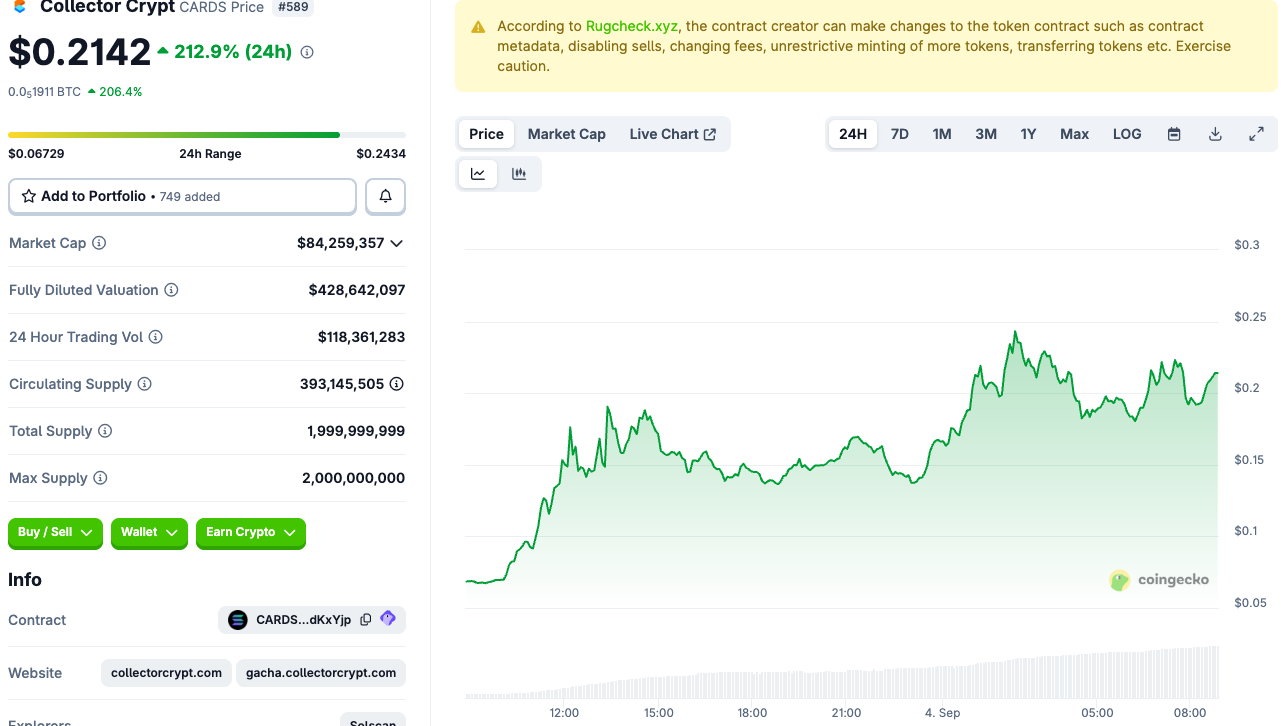

On August 29, 2025, Collector Crypt officially issued the CARDS token, becoming the first Pokémon trading platform with its own token. According to Coingecko data, the token’s daily price increases reached 260% and 212% over the past two days, with a current market cap of $84.25 million and daily trading volume doubling for two consecutive days to $118 million.

The uniqueness of the CARDS token lies in its backing by a platform inventory of Pokémon cards worth millions of dollars, providing investors with tangible asset support.

In addition to the Gacha mechanism, Collector Crypt also offers an industry-leading eBay sniping tool, helping users buy their desired cards at the lowest prices. This comprehensive service ecosystem has made it not only the largest crypto trading card platform but also a one-stop service center for card enthusiasts.

Courtyard: Cross-chain Trading Card Financial Exploration

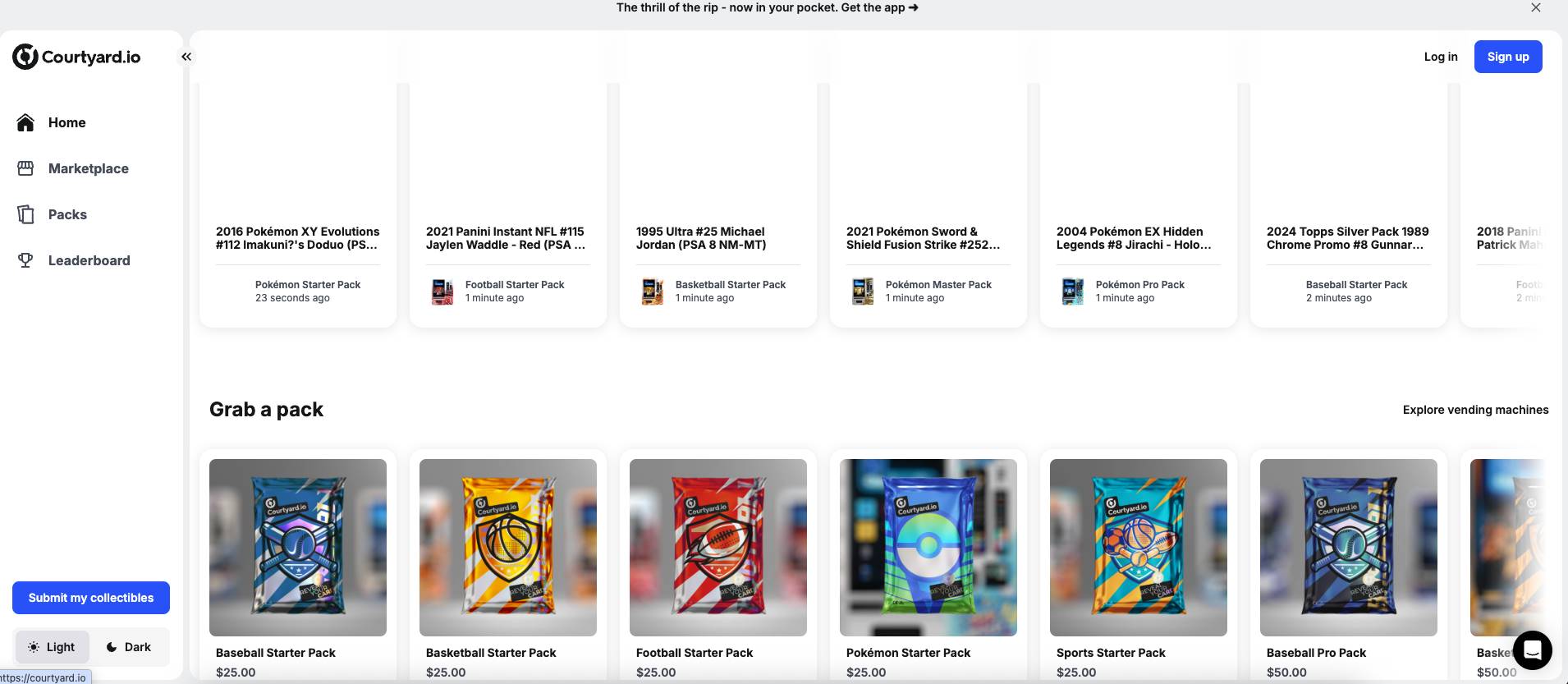

Courtyard, also launched in 2021, is a trading card platform that once set a global NFT market transaction record in April this year, with a single-week trading volume reaching $20.7 million, even surpassing the total NFT trading volume on the ETH network.

Courtyard’s core competitive advantage lies in its Web2-native user experience design. The platform supports credit card top-ups and charges zero storage fees, with a simple and clear trading interface, greatly lowering the entry barrier for traditional collectors into the crypto space. The platform’s daily trading volume still remains above $1 million.

Unlike other crypto trading card platforms, Courtyard focuses on the card grading needs that collectors care about. Every NFT card on the platform comes with a complete PAS certification record and insurance coverage. This professional service model has attracted many high-value card holders.

Phygitals: The Fastest-Growing Emerging Force

Although Phygitals officially launched as a new project in December 2024, its growth rate is remarkable. Since the end of July this year, the platform’s weekly revenue has surged, already generating over $665,000 in Gacha revenue. In just a few months, it has attracted 6,200 unique wallet users, 63% of whom are new users in 2025.

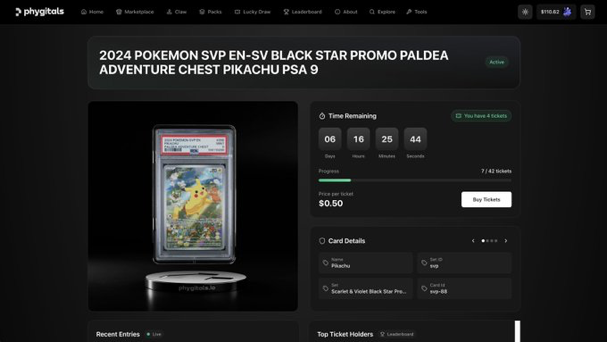

Compared to the Gacha model of other platforms, Phygitals innovatively launched the “LuckyDraw” raffle model at the end of May this year: users can purchase “tickets” for high-value cards at a very low price, and after ticket sales end, a lucky user will win the high-value card; high-value card holders can issue tickets for their cards for others to participate in the LuckyDraw raffle. The raffle logic, number of tickets issued, and end time are all written into Solana smart contracts to ensure transparency and openness.

This innovative model allows users to gain instant gratification through more frequent and smaller raffles, while also lowering the participation threshold, causing Phygitals’ daily trading volume to triple rapidly at the time.

At the same time, Phygitals places special emphasis on building social elements. Users can unlock achievements and compete on leaderboards by collecting cards, and can instantly redeem physical cards with their NFTs. This gamified social mechanism design makes collecting no longer a lonely personal activity for collectors, but instead builds a bridge of communication for all collectors, providing an excellent community experience for each one.

TCG Emporium: The Breakout Path of a Rising Star

TCG Emporium officially launched on May 6, 2025. Although it entered the market relatively late, its performance is impressive. In just 90 days after launch, the platform’s transaction volume reached $36 million, already accounting for 38% of the entire Solana TCG ecosystem’s market share.

Compared to its predecessors in the sector, TCG Emporium adopts a lower platform fee strategy, quickly gaining market share through small profits and quick turnover. It also introduced a unique “buy-the-dip” buyback mechanism: when high-value cards remain unsold on the secondary market for a long time, the platform will proactively buy them at 60% of the oracle price, effectively reducing the price spread in the secondary market and improving market liquidity.

In terms of marketing, TCG Emporium showcases high-value cards drawn by users through Gacha to create a viral effect, including a Mario Pikachu card with the highest single transaction price of $11,300. This strategy has also effectively promoted the platform’s brand.

Other Types of Projects in the TCG Sector

In addition to the above TCG trading platforms, TCG and blockchain have also sparked other types of projects.

Project O

Founded in 2024, Project O is a mobile trading card battle game that also launched its limited edition physical cards. Each game lasts 7-9 minutes, with players using 13 cards to battle across three lanes in-game.

SolForge Fusion

SolForge Fusion, co-designed by Richard Garfield, the creator of the world-renowned card game Magic: The Gathering, adopts an innovative “hybrid deck-building” model. Each physical starter card set has a corresponding NFT version, and players can scan physical cards to NFT-ize them, enabling over 40,000 unique card combinations.

From the above projects, we can see that the crypto trading card market is on the rise. The root of this rise is not only the integration of technological innovation but also the embodiment of countless collectors’ emotional attachment to the combination of crypto and collecting.

The traditional TCG trading market faces issues such as fragmented liquidity, difficulty distinguishing authenticity, and high platform fees. However, when this market moves onto the blockchain, not only are these pain points solved, but smart contracts, NFTs, and DeFi mechanisms can inject unprecedented vitality into this market worth hundreds of billions of dollars.

Someone once said, “The best Web3 applications are often not brand-new concepts, but upgrades and financialization of existing behavioral patterns.” Perhaps for the trading card collecting industry, crypto may be an effective solution to its pain points. As this global trend sweeps into the crypto market, we as investors should also pay attention to the future development of this sector.