Data Soars to Historic Highs! USDT On-Chain Trading Volume Surges, Market Braces for Intense Volatility

USDT on-chain trading volume has reached a record high, indicating that the market may be about to experience significant volatility. The report shows a surge in USDT liquidity demand, suggesting that investors may be strategically accumulating. U.S. macroeconomic events such as the Federal Reserve interest rate decision and the non-farm payroll report will affect market trends. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still in the process of iterative updates.

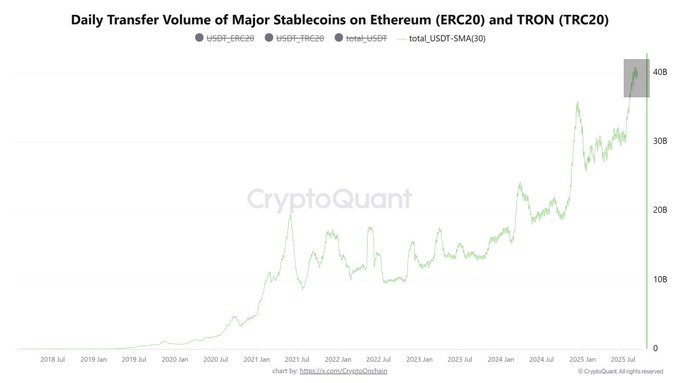

CryptoOnchain today (3rd) released its latest analysis report through CryptoQuant, pointing out that the trading volume of the US dollar stablecoin USDT has seen a significant increase recently, indicating that the market may be on the verge of dramatic volatility.

USDT Trading Volume Surges, Investors Poised to Act

The report from CryptoOnchain provides a detailed analysis of USDT’s on-chain activity on Ethereum and TRON, revealing significant changes in stablecoin liquidity. Firstly, the report notes that the 30-day simple moving average (SMA-30) of USDT trading volume has reached a historical high, reflecting a strong demand for liquidity among market participants. Secondly, on August 22, USDT’s single-day trading volume soared to $77.8 billion, marking the highest level since the LUNA crisis on May 12, 2022. However, unlike the panic-driven and capital flight market environment at that time, the current market is relatively stable. This trading volume peak appears to be “smart money” engaging in strategic accumulation, rather than FUD-driven sell-offs.

Based on the data, the CryptoOnchain report suggests that the on-chain status of USDT may indicate several scenarios: large investors are preparing to “buy the dip,” global demand for USDT (especially on the low-cost TRON network) is increasing, and the market is preparing for an upcoming period of high volatility:

These signals suggest that the market may be on the eve of dramatic volatility.

Investors Focus on U.S. Macroeconomic Events

Investors Focus on U.S. Macroeconomic Events

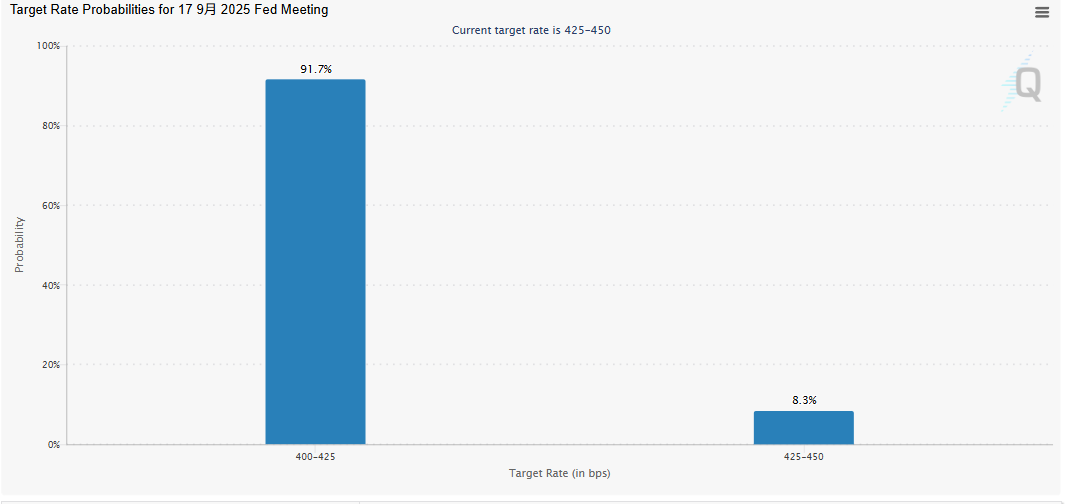

Echoing the CryptoOnchain report, the market generally believes that this month’s cryptocurrency market will be influenced by the upcoming U.S. Federal Reserve’s latest interest rate decision, which will be announced in September. At that time, the Fed will decide whether to resume rate cuts in September and by how much. According to the CME Fed Watch tool, the market currently sees a 91.7% probability that the Federal Reserve will resume rate cuts this month, with only an 8.3% chance that rates will remain unchanged.

It is also worth noting that before the FOMC meeting, the U.S. Bureau of Labor Statistics (BLS) will release the August non-farm payroll report this Friday (September 5). This report will reveal employment growth in the U.S. non-agricultural sector, the unemployment rate, and other key labor market indicators. Analysts believe that if the non-farm payroll report shows a weakening labor market, it will further heighten expectations for a Fed rate cut; conversely, if the labor market remains strong, the Fed’s path to rate cuts may face new obstacles and uncertainties.

Currently, the market is holding its breath in anticipation of potential upcoming volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Telegram, the world's largest social platform, launches major update: Your graphics card can now mine TON

Telegram’s ambition for privacy-focused AI

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

An overview of two new projects in the Polkadot ecosystem and what they will bring to Polkadot Hub

HIC: Continue to bring truly valuable new projects to Polkadot in a sluggish market!