Date: Wed, Sept 03, 2025 | 06:25 AM GMT

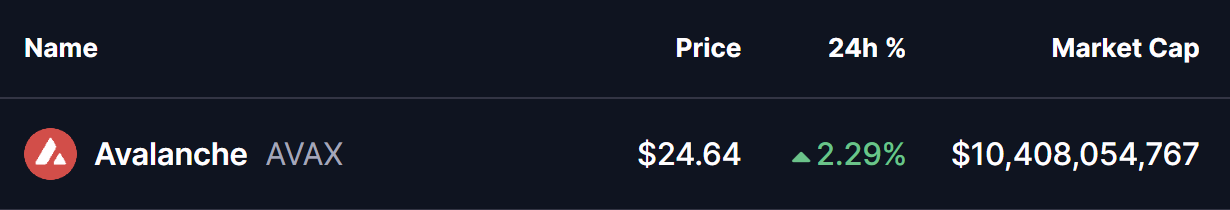

The cryptocurrency market remains choppy as Bitcoin (BTC) consolidates near $110,000, while Ethereum (ETH) hovers around $4,300 after retreating from its recent high of $4,953. Despite this broader choppiness, several altcoins are delivering mixed performances, with Avalanche (AVAX) beginning to flash early signs of strength.

AVAX is trading back in the green today, and more importantly, its chart is now displaying a key pattern formation that hints at a potential breakout in the sessions ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Symmetrical Triangle in Play?

On the daily chart, AVAX is shaping a Symmetrical Triangle pattern, a setup often viewed as a continuation structure but one that can break either way depending on momentum.

The latest rejection from the resistance trendline near $26.75 pulled the price down toward its support base around $22.74. Buyers defended that level convincingly, sparking a rebound. This recovery has helped AVAX reclaim its 50-day moving average ($23.87), with the token now trading around $24.65, signaling early resilience.

Avalanche (AVAX) Daily Chart/Coinsprobe (Source: Tradingview)

Avalanche (AVAX) Daily Chart/Coinsprobe (Source: Tradingview)

The triangle has been narrowing steadily, suggesting that a breakout is getting closer. Traders will be watching closely as AVAX approaches the apex of this consolidation.

What’s Next for AVAX?

From here, the price action is likely to test the resistance trendline near $26.20. A clean breakout above that barrier, ideally backed by strong volume, would confirm bullish momentum and potentially trigger a run toward the technical target of $33.00 based on the triangle’s measured move projection.

On the other hand, failure to sustain momentum and a drop back below $22.74 would exposing AVAX to a deeper retracement before any fresh attempt at recovery.