Bitcoin Price Prediction: BTC Might NOT Hold $111K as Risk Looms...

Bitcoin at a Crossroads: $111K in Focus

Bitcoin ($ BTC ) is currently trading near $111,365, just above a critical support level at $111,350. The chart shows a decisive moment as BTC struggles to break above the 50-day SMA ($115,648), while the 200-day SMA ($101,465) is holding as long-term support.

The question now is whether Bitcoin can build momentum toward $118,616 resistance, or if bearish pressure will push it down to test the $100K level again.

Key Support and Resistance Levels

- Immediate Resistance: $112,142 and the 50-day SMA at $115,648

- Strong Resistance Zone: $118,616 – a breakout above this level could shift momentum bullish

- Immediate Support: $111,350 (current line of defense)

- Major Support: $101,465 (200-day SMA) and psychological $100,000

- Extended Downside Risk: $75,000 – highlighted as a potential bottom if macro weakness intensifies

BTC/USD 1-day chart - TradingView

These levels are guiding traders’ decisions, with the market consolidating inside a narrowing channel.

Technical Indicators

- Downtrend Line: BTC remains under a descending red trendline, signaling bearish dominance unless broken.

- RSI (14): Currently at 45.91, showing neutral-to-weak momentum, with room for either upside recovery or further decline.

- Moving Averages: The 50-day SMA is trending below resistance, capping rallies, while the 200-day SMA acts as a solid long-term support.

If $Bitcoin closes decisively above the 50-day SMA, it could attract bullish momentum. A breakdown below the 200-day SMA, however, risks deeper correction.

Bitcoin Price Prediction over the Medium-Term

- Bullish Scenario: A breakout above $115K–$118K could send BTC back toward the $120K zone, with further upside potential if momentum strengthens.

- Bearish Scenario: Failure to hold $111K support may lead to a retest of the $100K mark, and if broken, open the way toward the $75K support zone.

Given current indicators , Bitcoin’s price action remains range-bound but vulnerable to macroeconomic shocks and market sentiment shifts.

Outlook

Bitcoin’s next major move depends on whether bulls can defend $111K and reclaim $115K resistance. Until then, BTC trades cautiously between crucial moving averages, with risks skewed to the downside if support levels crack.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The strengthening of the Chinese yuan may support bitcoin prices

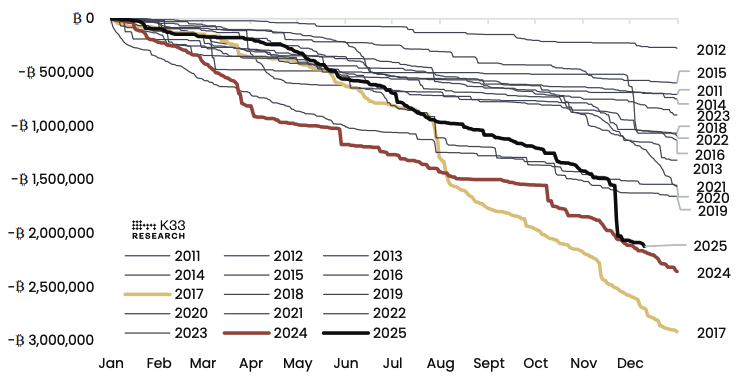

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX