Health Technology Company CIMG Inc Adds 500 Bitcoin to Corporate Reserves

Digital health and sales development firm CIMG Inc has raised $55 million through a share sale to purchase 500 Bitcoin for its corporate treasury. According to Cointelegraph, the company completed this transaction on Tuesday by issuing 220 million common shares at 25 cents each.

The Bitcoin purchase represents approximately $55.51 million at current market prices. CIMG chairman and CEO Wang Jianshuang stated the company remains committed to a long-term Bitcoin holding strategy. The company plans to establish this as a solid value foundation for investors moving forward.

The acquisition follows similar moves by other major Bitcoin holders. Strategy recently purchased 4,048 Bitcoin for $449.3 million between August 25 and Monday. Japanese company Metaplanet also secured shareholder approval to restructure its capital for additional Bitcoin acquisitions.

Corporate Bitcoin Adoption Reaches New Momentum in 2025

This move reflects accelerating corporate adoption of Bitcoin as a treasury asset. CNBC reports that public companies acquired 131,000 Bitcoin in the second quarter alone. This represents an 18% increase in corporate Bitcoin holdings during that period.

The trend extends beyond large corporations to smaller firms seeking diversification. Deloitte found that 23% of North American CFOs expect their treasury departments to utilize cryptocurrency within two years. This percentage rises to nearly 40% among organizations with revenues exceeding $10 billion.

CIMG's strategy aligns with companies viewing Bitcoin as protection against inflation and currency devaluation. We previously analyzed how regulatory clarity has improved institutional confidence, with policy frameworks becoming more defined across major markets. The Global Bitcoin Policy Index shows countries are developing balanced approaches that address risks while enabling innovation.

Bitcoin Treasury Strategies Transform Corporate Finance Landscape

The corporate Bitcoin treasury model is reshaping traditional financial management approaches. Strategy holds 636,505 Bitcoin worth over $60 billion, making it the largest public Bitcoin treasury globally. Metaplanet holds 20,000 Bitcoin, ranking sixth among public Bitcoin treasuries worldwide according to BitcoinTreasuries.NET data.

Charles Schwab notes that these companies offer investors new ways to gain cryptocurrency exposure. Bitcoin treasury holdings may help companies manage risk while providing growth potential through digital asset appreciation. However, investors must account for balance sheet effects and earnings volatility from mark-to-market accounting requirements.

The trend faces challenges including regulatory uncertainty and price volatility concerns. Companies must navigate evolving compliance requirements while managing potential liquidity risks. PYMNTS reports that clearer accounting rules and regulatory frameworks are giving CFOs more confidence in managing Bitcoin's financial reporting requirements. The movement represents a fundamental shift from viewing Bitcoin as speculation to recognizing it as a legitimate corporate asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC price bull market lost? 5 things to know in Bitcoin this week

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

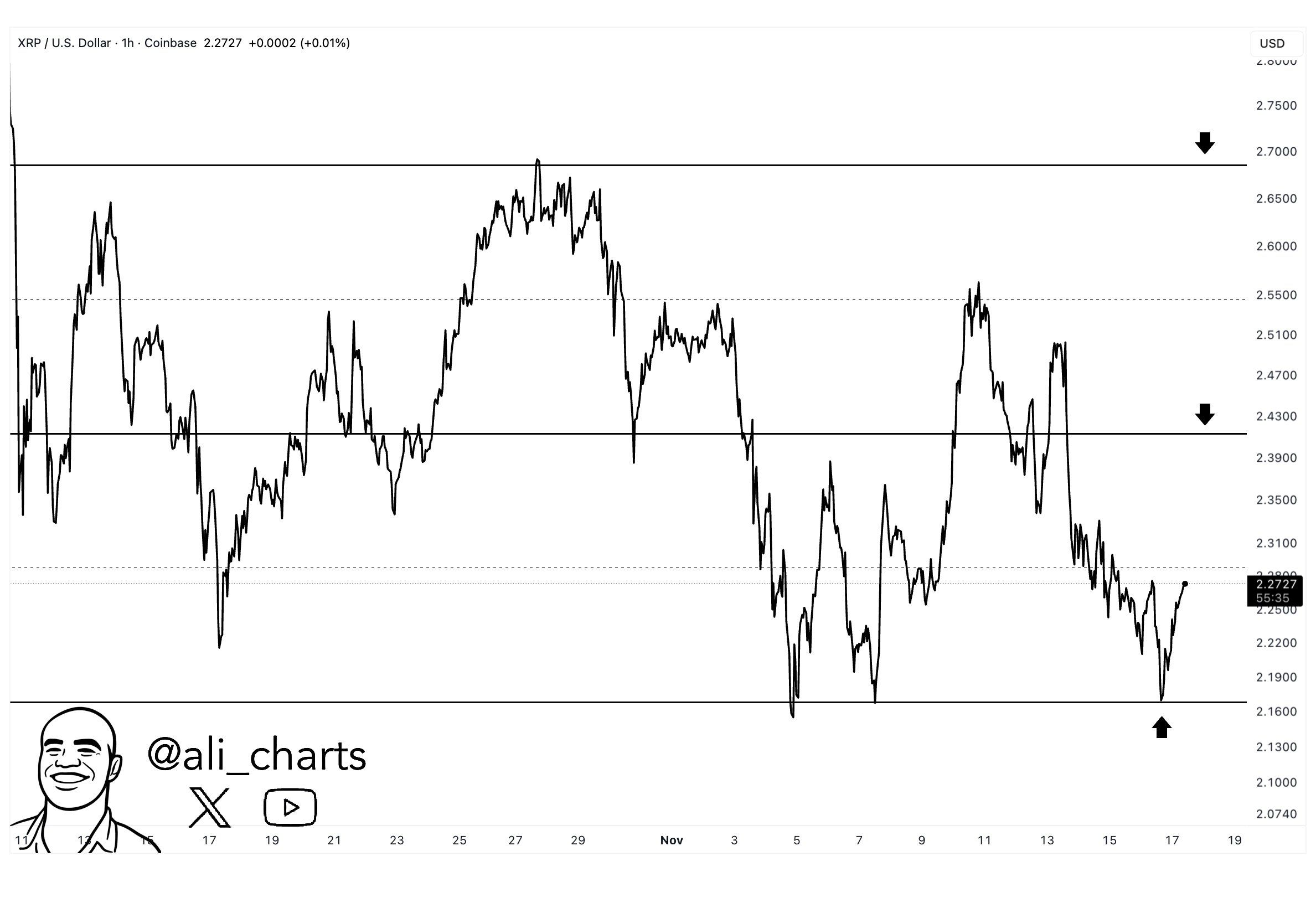

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand