Cardano price rose 2.10% to $0.8180 on September 2, 2025, driven by ETF approval optimism and bullish technicals; analysts say ADA could test $1.00 and potentially reach $1.20 if an ETF is approved and volume increases significantly.

-

Cardano price up 2.10% today to $0.8180, led by ETF optimism.

-

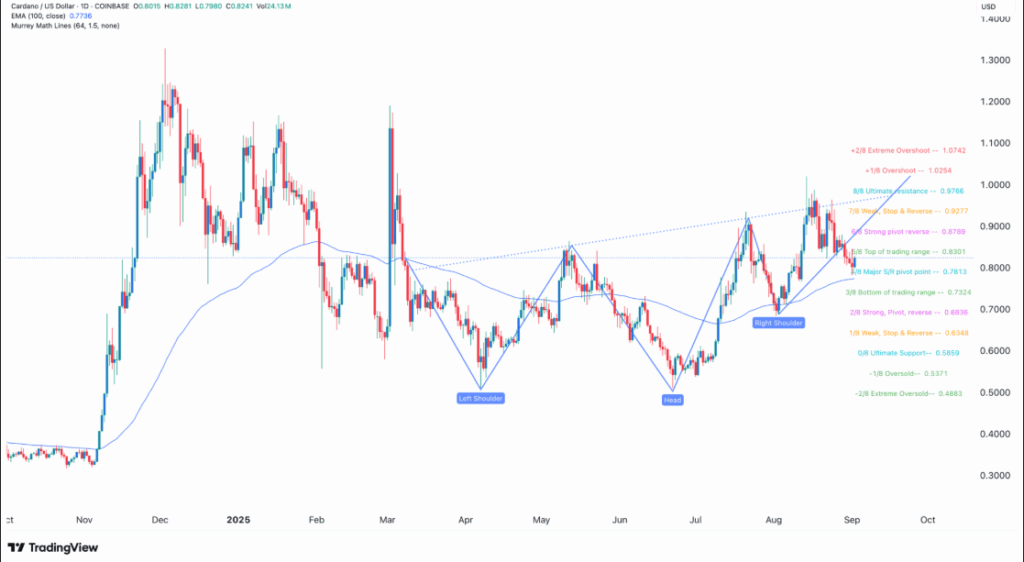

Technical signals include an ascending channel, inverse head-and-shoulders and support at the 100-day moving average.

-

ETF inflows historically: Bitcoin ~$54B, Ethereum ~$13B; similar flows for ADA could materially boost price.

Cardano price update: Cardano price climbs 2.10% to $0.8180 amid ETF optimism — read analysis and targets for ADA. Learn more.

What is driving the Cardano price rise today?

Cardano price rose 2.10% to $0.8180 on September 2, 2025, primarily due to growing optimism about a potential Cardano ETF approval and improving chart structure. Volume upticks, bullish technical patterns and macro ETF precedent are front-line drivers of the current move.

How likely is Cardano ETF approval and what would it mean for ADA?

Market consensus among many analysts places approval odds high, citing regulatory progress and institutional demand. ETF approval typically channels large inflows—Bitcoin ETFs have seen approximately $54 billion and Ethereum ETFs around $13 billion in recent windows—which could translate to substantial capital for ADA if a Cardano ETF is greenlit.

Frequently Asked Questions

How high can ADA go if the ETF is approved?

Analysts project an initial move to test $1.00 resistance; a sustained breakout above $1.00 could open upside toward $1.20, contingent on ETF inflows and sustained trading volume.

What technical levels should traders watch for ADA price action?

Traders should monitor immediate resistance at $1.00, a confirmation level at $0.88 for short-term rallies, and critical downside support near $0.70 which would undermine bullish scenarios if broken.

Cardano price sees a 2.10% gain today, with predictions for a $1.20 surge. ETF approval and strong technical indicators point to bullish momentum.

- Cardano’s price rises 2.10% today, driven by investor optimism and ETF approval anticipation.

- Strong technical signals suggest ADA may rise to $1.20 in the coming weeks.

- Analysts believe the SEC will approve the ADA ETF, further boosting the price.

Cardano price has surged to $0.8180 today, September 2, 2025, marking a 2.10% increase. This rebound follows a recent dip, driven by investors looking to capitalize on the market pullback. Growing optimism around the upcoming Cardano ETF decision deadline in October has fueled buying interest, with some analysts projecting ADA could climb to $1.20 if approval and inflows materialize.

A market analyst highlighted that Cardano price might soon break out of its bearish trend after forming an ascending channel on the four-hour chart that recently retested the lower boundary, suggesting a potential rebound. On the daily timeframe, ADA has found support at the 100-day moving average, a historically relevant level that preceded a 43% rebound in August.

Cardano $ADA must break $0.88 to confirm a rally toward $1.20! pic.twitter.com/BpCLzSor4B

— Ali (@ali_charts) September 1, 2025

Additional technical structure includes a developing inverse head-and-shoulders pattern with a neckline near the 1.00 area, which would be bullish on confirmation. Murrey Math Lines also show the recent bottom landing on a major support/resistance pivot, a common reversal zone historically for ADA.

When will the Cardano ETF decision affect price momentum?

ETF decision timelines can create graded price responses: an approval announcement often triggers immediate inflows and volatility. The October decision window is the near-term catalyst; in the weeks leading up to it, sentiment and positioning tend to cause measured price swings rather than instant moves.

The primary trigger for recent ADA strength is the looming Cardano ETF decision in October. Industry participants increasingly reference the U.S. Securities and Exchange Commission in plain text as the decision-maker whose approval could unlock meaningful institutional capital into ADA.

Comparatively, Bitcoin ETFs have attracted roughly $54 billion in inflows and Ethereum ETFs about $13 billion over recent 12-month periods. If Cardano were to capture even a fraction of such flows, the price impact could be significant, especially when combined with protocol fundamentals like the Chainlink partnership and the upcoming Leios upgrade driving utility and demand expectations.

| Bitcoin | $54 billion |

| Ethereum | $13 billion |

| Potential Cardano | Variable—could range from hundreds of millions to several billion |

How should traders manage risk around ADA price moves?

Risk management should focus on defined stop levels, position sizing and watching the $0.70 support as the key invalidation level for bullish scenarios. Traders can scale into positions above confirmation levels such as $0.88 and trim into overhead resistance near $1.00.

Key Takeaways

- Immediate move: Cardano price rose 2.10% to $0.8180 on ETF optimism.

- Technical setup: Ascending channel, 100-day MA support, and inverse H&S suggest bullish potential.

- Watch levels: $0.88 to confirm a rally, $1.00 as primary resistance, $0.70 as downside invalidation.

Conclusion

Cardano price has shown a measured bounce to $0.8180 driven by growing Cardano ETF optimism and supportive technical patterns. If the SEC approves an ADA ETF in October, institutional inflows could meaningfully change market structure and push ADA toward $1.20, but traders must monitor $0.70 downside risk and volume confirmation before increasing exposure. COINOTAG will continue to track developments and update readers as the ETF timeline progresses.