Yield-chasing ETH treasury firms are most at risk: Sharplink Gaming CEO

Companies that buy and hold Ether to try to squeeze the most yield out of their holdings will be significantly more at risk if the market declines, says Sharplink Gaming co-CEO Joseph Chalom.

“There will be people just like in traditional finance who wanna get that last 100 basis points of yield, and think that it is riskless,” Chalom said in an interview with Bankless on Monday.

He said that while there are ways to achieve double-digit yields on Ether (ETH), they come with significant risks.

“It comes with credit risk, it comes with counterparty risk, it comes with duration risk, it comes with smart contract risk,” he said, adding that companies that try to make up lost ground also present a real risk.

“I think the biggest risk is that people who are far behind are going to take risks that I don’t think are prudent.”

Wider industry could be tainted by “imprudent” moves

Chalom said the sector “could be tainted by people that do imprudent things,” such as how they go about raising capital or differentiating themselves in the yield that they derive from their ETH holdings.

“If you overbuild and there is a downturn, how do you make sure your call structure is in such a way that you build to the highest price of Ethereum?” he said.

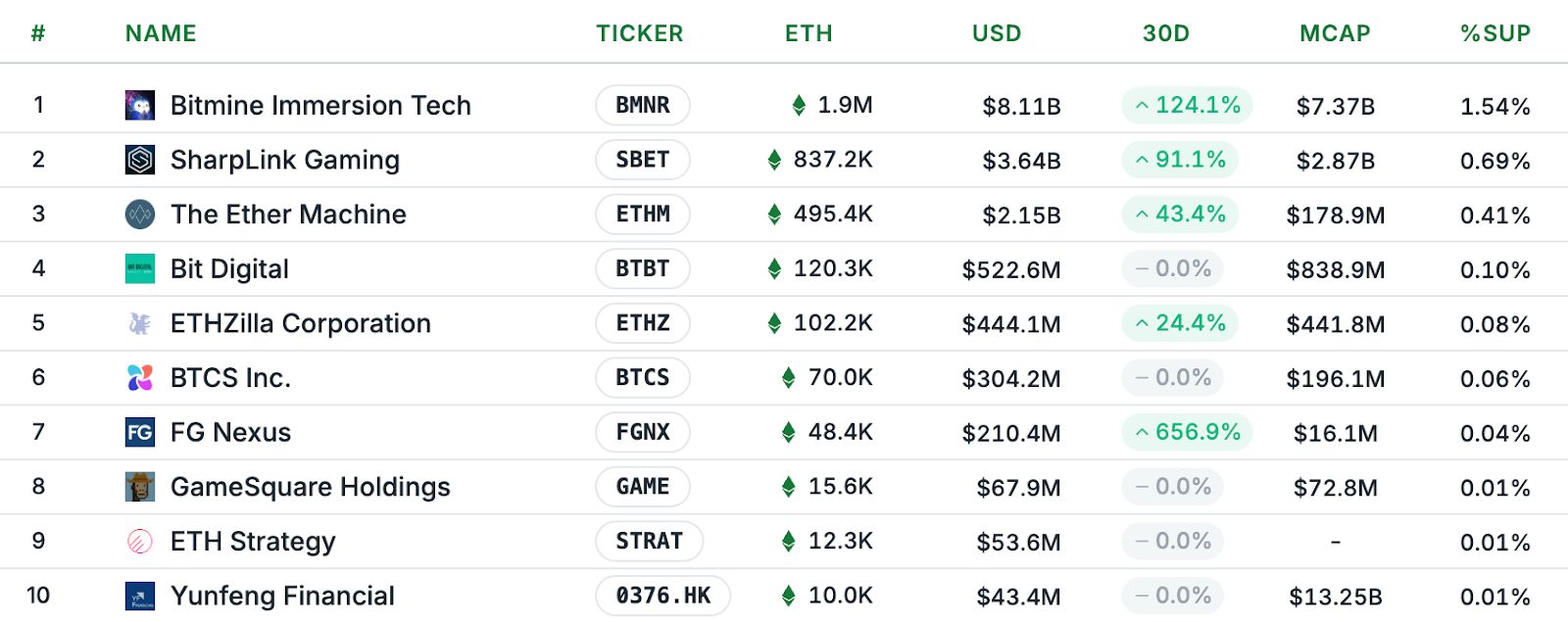

Sharplink Gaming is the second-largest public holder of ETH, with $3.6 billion worth, trailing only behind BitMine Immersion Technologies, which holds $8.03 billion.

ETH treasury companies hold approximately 3.6 million ETH, worth approximately $15.46 billion at the time of publication, according to StrategicETHReserve data.

Some see the model as having dire consequences

Josip Rupena, the CEO of lending platform Milo and a former Goldman Sachs analyst, recently told Cointelegraph that crypto treasury firms pose similar risks as collateralized debt obligations, securitized baskets of home mortgages and other types of debt that triggered the 2008 financial crisis.

On the other hand, Matt Hougan, chief investment officer at Bitwise, recently said that Ether treasury and holding companies have solved Ethereum’s narrative problem by packaging the digital asset in a way that traditional investors understand, drawing in more capital and accelerating adoption.

Related: Ether breaks below ‘Tom Lee’ trendline: Is a 10% incoming?

Chalom said that “the beautiful thing” about ETH treasury companies is that they are almost infinitely scalable. Ether is trading at $4,327 at the time of publication, according to CoinMarketCap.

Concerns about the broader crypto treasury model have been mounting recently.

Glassnode lead analyst James Check said in an X post on July 5 that his “instinct is the Bitcoin (BTC) treasury strategy has a far shorter lifespan than most expect.”

On June 29, venture capital (VC) firm Breed said only a few Bitcoin treasury companies will stand the test of time and avoid the vicious “death spiral” that will impact BTC holding companies that trade close to net asset value.

Magazine: Bitcoin to see ‘one more big thrust’ to $150K, ETH pressure builds: Trade Secrets

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster announces a $10 million trading competition, combined with Stage 4 airdrop and Rocket Launch incentives, driving multi-layered growth in platform depth and liquidity.

After achieving strong performance in Stage 3, Stage 4 (Harvest) airdrop plan was launched, and the “Double Harvest” trading competition with a total reward of 10 million USD will be introduced on November 17.

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.