Hyperscale Data's Strategic Accumulation of XRP and Bitcoin: A Pathway to $20M in Bitcoin Holdings?

- Hyperscale Data allocates 60% of its $125M ATM proceeds to Bitcoin, aiming to accumulate $20M in holdings via mining and capital allocation. - The company's 190-coin annual mining output and $108,782 Bitcoin price suggest a 12-month timeline to reach its $20M target, though volatility poses risks. - Weekly transparency in Bitcoin/XRP holdings aligns with institutional trends, but 1385.3% debt-to-equity ratio and equity dilution risks challenge its leveraged strategy. - A $110,000+ Bitcoin price and Michi

Hyperscale Data’s digital asset strategy has positioned it as a unique player in the intersection of AI infrastructure and institutional-grade Bitcoin adoption. By allocating 60% of its $125 million At-the-Market (ATM) offering proceeds to Bitcoin and retaining all mined Bitcoin—approximately 190 coins annually—the company is building a treasury model reminiscent of MicroStrategy and Empery Digital [4][5]. As of August 31, 2025, its subsidiary Sentinum held 3.5966 Bitcoin, valued at $389,388.66, with plans to add $20 million in Bitcoin to its balance sheet [1][3]. This raises a critical question: Is Hyperscale Data’s dual-income model—a blend of Bitcoin appreciation and AI infrastructure growth—viable for reaching $20 million in Bitcoin holdings?

The Accumulation Playbook

Hyperscale Data’s approach combines organic mining with capital allocation. Its annual mining output of 190 Bitcoin [4] and 60% ATM allocation to Bitcoin [5] create a compounding effect. At a Bitcoin price of $108,782.0 (August 31, 2025) [2], the $20 million target would require approximately 184 additional Bitcoin. Given its current pace, this could be achieved in roughly 12 months, assuming stable mining yields and Bitcoin price. However, volatility remains a wildcard. Bitcoin’s August 2025 swing—from $124,290.93 to $108,782.0 [2]—highlights the risks of timing. A sustained price dip could delay the $20 million milestone, while a rally could accelerate it.

Transparency and Institutional Alignment

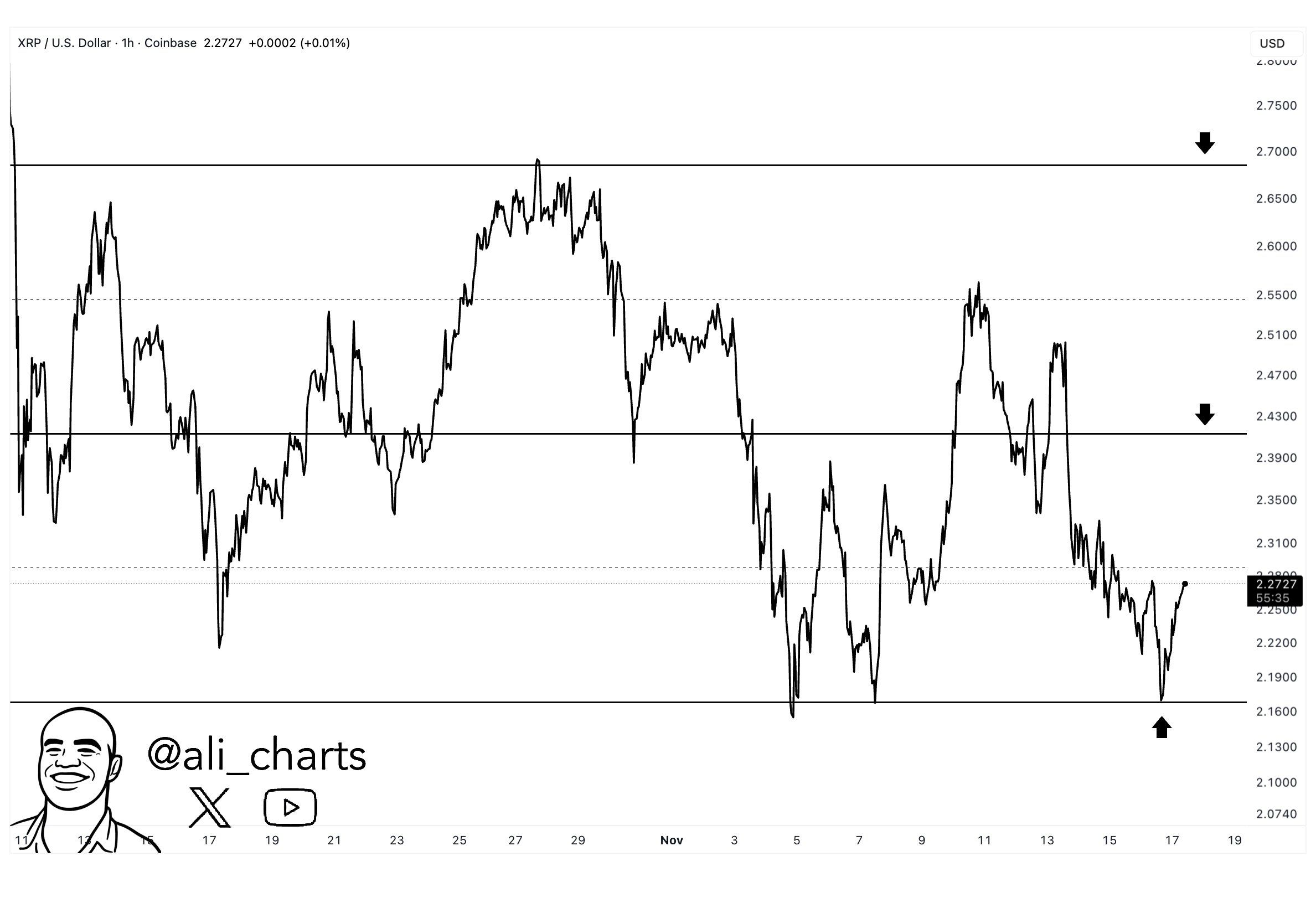

The company’s weekly reporting of Bitcoin and XRP holdings [1] mirrors institutional-grade transparency, a key differentiator in a sector plagued by opacity. This aligns with broader trends: 59% of institutional portfolios now include Bitcoin and real-world assets [1], and regulatory frameworks like the EU’s MiCAR and the U.S. GENIUS Act are normalizing corporate Bitcoin treasuries [1]. Hyperscale Data’s strategy also diversifies risk by allocating 10% of ATM proceeds to XRP [5], a move that could hedge against Bitcoin’s volatility while leveraging XRP’s utility in cross-border payments.

Risks and Leverage

Yet, the path is fraught with challenges. Hyperscale Data’s debt-to-equity ratio of 1385.3% [3] and a market cap of $15 million versus stated assets of $214 million [3] suggest significant leverage. The ATM offering, while funding Bitcoin accumulation, also risks equity dilution, compounded by anti-dilution clauses in financing agreements with Ault & Company [5]. These structural weaknesses could undermine confidence if Bitcoin’s price stagnates or declines.

The Long-Term Thesis

Despite these risks, Hyperscale Data’s dual-income model—Bitcoin appreciation and AI infrastructure growth—offers a compelling narrative. Its Michigan data center expansion [5] could generate recurring revenue, offsetting Bitcoin’s volatility. For investors, the key variables are Bitcoin’s price trajectory and the company’s ability to manage dilution. If Bitcoin stabilizes above $110,000—a level seen in early September 2025 [2]—the $20 million target becomes more feasible. However, success hinges on execution: Can Hyperscale Data maintain mining efficiency while scaling infrastructure?

In conclusion, Hyperscale Data’s strategy is a high-risk, high-reward bet. While the math suggests a plausible path to $20 million in Bitcoin holdings, the company’s leverage and market dynamics demand cautious optimism. For those aligned with Bitcoin’s long-term value proposition, this could be a speculative but strategic play.

Source:

[1] Hyperscale Data's Digital Asset Strategy: A Strategic Play

[2] Bitcoin Price (BTC) Stumbled in August

[3] Hyperscale Data's Strategic Capital Reallocation: A Dual-Pronged Play on Bitcoin and AI Infrastructure

[4] Hyperscale Data Issues Letter to Stockholders

[5] Bitcoin Treasury Strategy in Undervalued Tech Firms

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC price bull market lost? 5 things to know in Bitcoin this week

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand