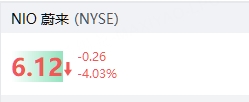

NIO drops over 4% after earnings, with a Q2 net loss of 4.995 billions yuan and vehicle gross margin down 1.9% year-on-year

On September 2, NIO shares fell more than 4% after earnings, with a net loss of 4.995 billion RMB in the second quarter and a vehicle gross margin of 10.3%, down 1.9 percentage points year-on-year.

News highlights:

NIO Inc. disclosed its unaudited financial results for the second quarter ended June 30, 2025, on September 2, 2025.

Revenue and Profit: Total revenue for the second quarter was 19.009 billion RMB (RMB19,008.7 million), up 9.0% year-on-year; gross profit was 1.898 billion RMB, up 12.4% year-on-year; gross margin was 10.0%, an increase of 0.3 percentage points year-on-year. GAAP loss per share (EPS) was 2.31 RMB, narrowing from 2.50 RMB in the same period last year; non-GAAP loss per share was 1.85 RMB, narrowing from 2.21 RMB in the same period last year. Net loss for the second quarter was 4.995 billion RMB, down 1.0% year-on-year; non-GAAP net loss was 4.127 billion RMB, down 9.0% year-on-year.

By Business Segment: Vehicle sales revenue was 16.136 billion RMB, up 2.9% year-on-year; other sales revenue was 2.873 billion RMB, up 62.6% year-on-year. Vehicle gross margin was 10.3%, down 1.9 percentage points year-on-year.

Operational Performance: 72,056 vehicles were delivered in the second quarter, up 25.6% year-on-year; among them, 47,132 vehicles under the NIO brand, 17,081 under the ONVO brand, and 7,843 under the FIREFLY brand. At the end of the period, cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits totaled 27.2 billion RMB.

Outlook for Next Quarter:

The company expects to deliver 87,000 to 91,000 vehicles in the third quarter of 2025, representing a year-on-year increase of 40.7% to 47.1%; total revenue is expected to be between 21.812 billion and 22.876 billion RMB (RMB21,812–22,876 million), up 16.8% to 22.5% year-on-year.

Executive Quotes:

William Bin Li (Founder, Chairman, and CEO) stated that deliveries in the second quarter increased by 25.6% year-on-year, and the market response to the ONVO L90 and the new ES8 reinforced sales momentum; based on demand performance, the company expects third-quarter deliveries to reach 87,000 to 91,000, a record high. His view points to incremental demand driven by new product ramp-up and multi-brand coverage.

William Bin Li also noted that the product experience of the ONVO L90 and the new ES8 has been recognized by users. Coupled with the long-term strategic advantages of battery swapping and charging networks, as well as the multi-brand strategy, there is potential to reshape the competitive landscape in the large three-row SUV segment and drive BEV penetration. This statement echoes the multi-brand contribution in the second quarter delivery structure and the sequential improvement in gross margin.

Stanley Yu Qu (Chief Financial Officer) stated that cost reduction and efficiency improvement measures implemented since the second quarter have shown results, with non-GAAP operating loss improving by over 30% quarter-on-quarter after excluding organizational optimization expenses. He emphasized that the company is approaching a financial inflection point, with operational performance showing positive momentum. This assessment is consistent with the 32.1% quarter-on-quarter narrowing of non-GAAP operating loss in the second quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto KOL's Personal Account: Our Era Has Ended

In the next cycle, just talking is not enough; KOLs must actually take action.